Unmarried Children Under 30 Considered One Household with Parents

A 26-year-old youth who purchased his first home in life has become a hot topic as the story of him paying 12 times the acquisition tax was revealed.

According to Yonhap News on the 11th, Mr. A (26), a public official who recently bought an apartment in Muan-gun, Jeollanam-do, was informed by the county office that a 12% acquisition tax rate would be applied under the multi-homeowner heavy taxation rule for 1 household owning 4 homes. Normally, the acquisition tax rate for a single-homeowner is 1%, but he has to pay acquisition tax 12 times higher. First-time homebuyers are exempted from acquisition tax up to 2 million won.

It was detected in the Muan-gun computer system that Mr. A’s mother, who divorced his father when he was 23 months old, owns three houses. When Mr. A acquired the apartment, his household became a 1 household 4 homes case under the Local Tax Act. The amendment to the Enforcement Decree of the Local Tax Act announced by the Ministry of the Interior and Safety on July 30, 2020, states that spouses and unmarried children under 30 years old are considered one household even if they live separately. This means that parental divorce and household separation are unrelated. Furthermore, even if an unmarried child under 30 years old is employed and has income, unless the child’s income is 40% or more of the median income according to Article 2, Clause 11 of the National Basic Living Security Act and the child separates their household, they are considered the same household.

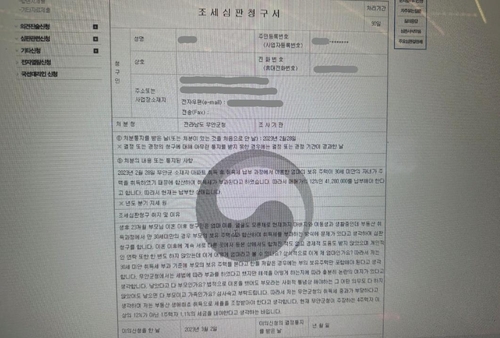

A young man who became a single household with four houses due to the house owned by his mother, who divorced his father, and paid 40 million won in acquisition tax, wrote a tax appeal petition.

A young man who became a single household with four houses due to the house owned by his mother, who divorced his father, and paid 40 million won in acquisition tax, wrote a tax appeal petition. [Photo by Yonhap News]

Also, according to the multi-homeowner rule of the Local Tax Act, unlike the acquisition tax rate of 1-3% for single-homeowners, acquisition tax is heavily imposed on multi-homeowners owning two or more homes. Corporations and owners of 4 or more homes are subject to a 12% acquisition tax rate regardless of region.

There is no provision excluding the number of houses owned by divorced parents, so Mr. A, who has lived with his father and younger sister since he was 23 months old, had to pay about 40 million won in acquisition tax due to his biological mother, whom he has never contacted or even seen.

The multi-homeowner rule of the Local Tax Act was newly created by the government in 2020 to stabilize housing prices during a period of rapid price increases, but cases like Mr. A’s seem to have been overlooked.

Filed a petition to the Tax Tribunal... Awaiting authoritative interpretation

Currently, Mr. A has submitted his case to the Tax Tribunal and is awaiting an authoritative interpretation.

Mr. A expressed that he has never received economic support such as child support or even emotional support, and that it is unfair to aggregate the houses owned by his divorced mother and impose heavy acquisition tax. He said, "Who would check the houses owned by divorced parents before buying a house?" and "The current 'household' criteria defined in the tax law need to be more detailed."

The Muan-gun office explained that when imposing acquisition tax, they identify the number of houses and family relationships and resident registration for household judgment, and that the tax was imposed on Mr. A according to the Local Tax Act and Acquisition Tax Act regulations. They stated that they will comply with the Tax Tribunal’s authoritative interpretation once it is issued.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.