Significant Reduction in Goddess Activities

Annual 5% Increase in Mutual Finance Sector Deposit Balances

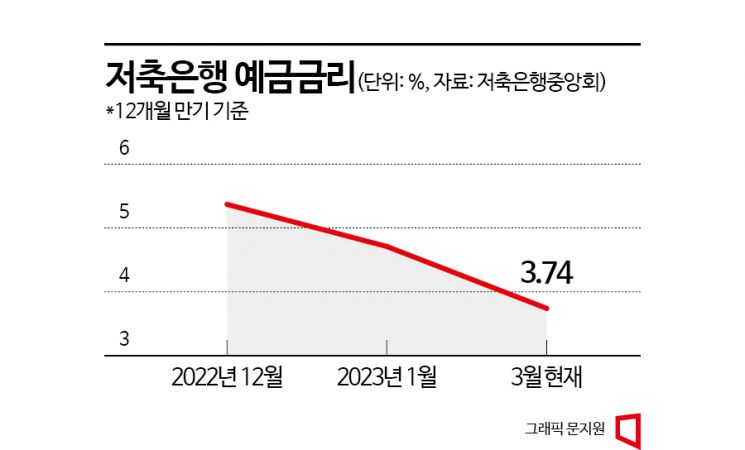

Savings bank deposit interest rates have been falling day after day. This is because the industry has reduced loan supply, eliminating the need to secure funds through competition in deposit interest rates. The downward trend is expected to continue for the time being, accelerating the outflow of funds from savings banks.

According to the Korea Federation of Savings Banks on the 13th, the average interest rate on fixed deposits at 79 savings banks was 3.74% (12-month maturity). This is a 1.63 percentage point drop from 5.37% at the end of last year. OK Savings Bank, one of the top five savings banks by asset size, lowered the interest rate on its ‘OK Fixed Deposit’ from 3.5% to 3.2% and the ‘OK Safe Fixed Deposit’ from 3.6% to 3.3% for 12-month maturities starting from the 6th. This came just two weeks after a 0.2 to 0.5 percentage point cut on the 20th of last month. Industry leader SBI Savings Bank has also lowered fixed deposit rates five times this year. SangSangIn and Joeun Savings Banks have joined the trend of falling deposit interest rates.

Interest rates on parking accounts, which pay interest even if deposited for just one day, are also declining. Although they were popular last year with rates reaching up to 5% annually, they have recently fallen to the low 3% range. OK Savings Bank’s ‘OK Eutbaekman Account II’ offered a 3.3% interest rate on amounts exceeding 5 million KRW up to 50 million KRW, but the rate was lowered to 3.0% and the upper limit was adjusted to 20 million KRW.

The decline in deposit interest rates is interpreted as a result of savings banks not actively engaging in lending. Concerned about the economic downturn and borrowers’ declining repayment ability, savings banks have reduced loan operations as part of risk management, removing the need to quickly raise funds through deposits and savings. Another factor is that they secured liquidity last year and now have surplus capacity.

Funds are leaving savings banks faster due to their lower interest rate competitiveness compared to other sectors. As of the end of December last year, the deposit balance at savings banks was 120.2384 trillion KRW, down by more than 1 trillion KRW from the previous month. Meanwhile, deposit balances in mutual finance institutions, which still offer interest rates in the low 5% range, are increasing. As of the end of December last year, credit unions increased by 2.8953 trillion KRW and Saemaeul Geumgo by 6.8184 trillion KRW compared to the previous month. Since the interest rate gap between mutual finance institutions and savings banks reaches 2 percentage points, this trend is expected to become more pronounced. A savings bank official said, “With the base interest rate increase slowing down and commercial banks also lowering deposit interest rates, savings bank deposit interest rates are likely to fall further.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.