Own shares accounting for 32.6% of total equity are an undervaluation factor

Plan to respond by selling own shares through a 100 billion KRW public tender offer

Private equity firm IMM Private Equity (IMM PE), which manages a portfolio company Hanssem, has pulled out the card of selling treasury shares of Hanssem while conducting a tender offer.

According to the investment banking (IB) industry on the 14th, IMM PE plans to respond to the tender offer by selling part of the 7,678,487 treasury shares (32.6% of the total stake) held by Hanssem. It is considering selling up to 100 billion KRW worth of shares.

A senior official from the IB industry said, "One of the factors contributing to Hanssem's undervaluation is the excessive holding of treasury shares," adding, "By responding to the tender offer with treasury shares, they can catch 'two rabbits'?the success of the tender offer and the sale of treasury shares."

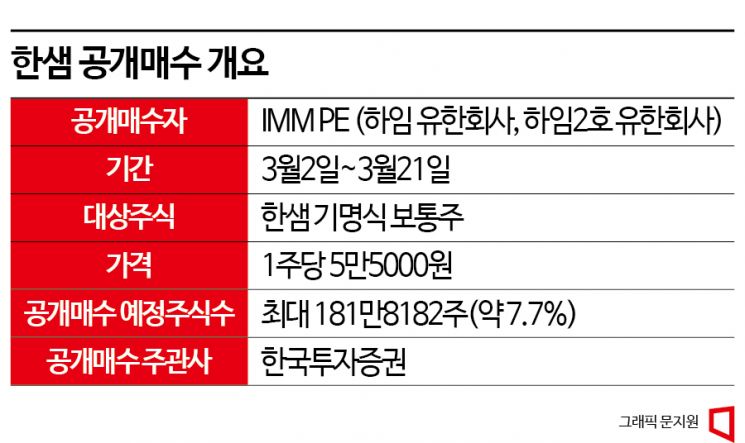

Earlier, IMM PE announced that from the 2nd to the 21st of this month, it would conduct a tender offer for 1,818,182 Hanssem shares (7.7%) at 55,000 KRW per share. This tender offer is being conducted through Haim LLC and Haim No. 2 LLC, which IMM PE established for the acquisition of Hanssem, acquiring 1,038,182 shares and 780,000 shares respectively.

If the number of shares tendered falls short of the planned purchase amount, all will be purchased; if exceeded, shares will be bought proportionally. If the tender offer succeeds, IMM PE's stake in Hanssem is expected to increase to 36%.

IMM PE acquired 27.7% of shares from former Hanssem Chairman Cho Chang-geol and related parties for a total of 1.4513 trillion KRW in early last year. A significant management premium was applied, setting the price at 221,000 KRW per share, about twice the stock price at the time. Of the total investment, 855 billion KRW was raised through acquisition financing from major lenders including Shinhan Bank and Korea Investment & Securities. Since then, Hanssem's stock price has declined, causing the loan-to-value ratio (LTV) of the shares used as collateral to soar. Consequently, at the end of last year, IMM PE agreed with the lenders to acquire additional shares. Among the additional investment options IMM PE could choose were tender offers, rights offerings, and on-market purchases. The limited partners (LPs) of IMM PE responded positively to these options as they commonly allowed for additional acquisition of undervalued Hanssem shares.

The reason IMM PE chose the tender offer among various options is primarily to enhance shareholder value. While rights offerings have the advantage of injecting new funds into Hanssem, dilution of share value due to an increase in the number of shares is inevitable. Considering that the proportion of minority shareholders in Hanssem reached 35.44% (as of the end of Q3 2022), third-party allotment rights offerings could provoke significant opposition. However, the tender offer, conversely, serves to raise market value and can be a means to gain support from minority shareholders.

The rise in Hanssem's stock price also benefits IMM PE. On the 2nd of this month, when the tender offer was announced, Hanssem's stock closed at 53,700 KRW, up 19.73% from the previous trading day. As of the closing price on the 13th, it recorded 52,900 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)