High Interest Rates and Economic Slowdown Reduce Purchase Demand

Real Estate Market Slowdown Worsens PF Profitability

Concerns Over Risk Recurrence in Q2

Despite last year's Legoland incident, concerns remain over instability in the bond market. There are calls for expanding the Bond Market Stabilization Fund and other measures.

On the 9th, the Korea Chamber of Commerce and Industry's SGI (Sustainable Growth Initiative) released a report titled "Current Status and Implications of the Bond Market and Short-term Financial Market," stating that the credit crisis that occurred last year has not been fully resolved, and there is a possibility of a recurrence of the bond market crisis at any time, urging appropriate responses.

The credit crunch in the bond market at the end of last year was triggered when Gangwon Province failed to fulfill its payment guarantee for the project financing asset-backed commercial paper (PF ABCP) of the Legoland project. PF ABCP refers to commercial paper issued based on project financing loans received by real estate development project operators from financial institutions.

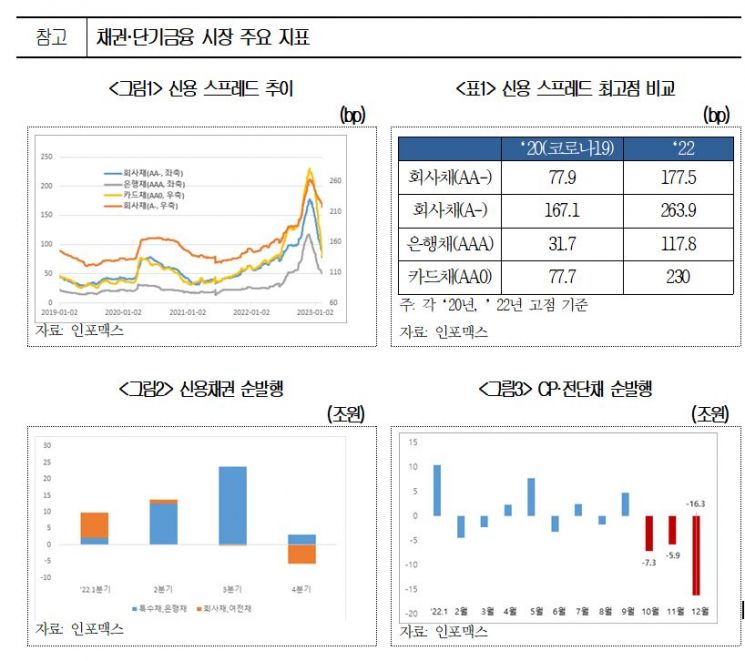

At that time, Gangwon Province did not fulfill the payment guarantee by the maturity date (September 29), causing credit bond yields to surge. As a result, the credit spread?the difference between AA- corporate bond yields and government bond yields?widened significantly from 60.7 basis points (bp) at the beginning of last year to 177.5 bp by the end of November. The larger the credit spread, the lower the bond price, increasing the cost for companies to raise funds through bond issuance. Moreover, ultra-high-grade bonds such as KEPCO bonds and bank bonds absorbed demand in the bond market, worsening supply and demand conditions for other credit bonds, including corporate bonds.

In response, the government announced market stabilization measures worth 50 trillion won plus alpha and purchased high-quality corporate bonds, commercial paper (CP), and construction company-guaranteed PF ABCP through a 20 trillion won Bond Market Stabilization Fund. Additionally, the purchase limits for corporate bonds and CP by the Korea Development Bank and Industrial Bank of Korea were doubled from 8 trillion won to 16 trillion won.

Corporate Bond Maturities of 48 Trillion Won by Year-End, Increase in Unsold Houses... Concerns Over Risk Re-spreading from Vulnerable Sectors

In fact, corporate bonds maturing from March to the end of this year amount to approximately 48.3 trillion won, with non-investment grade bonds rated A or below nearing 15.2 trillion won. Maturities of credit specialized financial bonds, including capital and card bonds totaling 65 trillion won, are also scheduled.

The bigger problem is that as the economy slows down significantly and high interest rates persist, demand for non-investment grade bonds is unlikely to improve. Furthermore, compared to bank bonds and high-credit rating corporate bonds, non-investment grade corporate bonds and credit specialized financial bonds have not recovered to past levels of net issuance, making refinancing difficult when maturities come due.

The short-term funding and real estate markets are also not optimistic. In the fourth quarter of last year, corporate commercial paper (CP) rates surged, and CP and electronic short-term bonds recorded a net negative issuance of about 29.5 trillion won. Additionally, due to interest rate hikes and the resulting real estate market contraction, the number of unsold houses nationwide reached approximately 75,000 in January this year, about 3.5 times higher than a year ago, and PF ABCP yields exceed 10%.

If the real estate downturn continues, project operators may find it difficult to repay PF loans through sales proceeds. Risks are expected to intensify for small and medium-sized construction companies that provided credit enhancements for non-investment grade PF ABCP, exacerbating liquidity shortages and other risks.

Expansion of Bond Market Stabilization Fund Purchase Scope, Increased Purchase of Construction Company-Guaranteed PF ABCP by KDB and IBK, Corporate Debt Restructuring Needed

The report emphasized the need for proactive measures to prevent risk recurrence, especially in vulnerable sectors during the economic slowdown.

First, it pointed out the necessity to expand the purchase targets of the Bond Market Stabilization Fund from the current AA- grade and above to include A-grade bonds to support the non-investment grade corporate bond and PF ABCP markets. If implemented, this measure would cover 8.4 trillion won of A-grade corporate bonds maturing by year-end.

Moreover, in January this year, the unsold portion of corporate bonds relative to the target issuance was 1.4% for AA grade, 36.4% for A grade, and 52.5% for BBB grade and below, indicating that issuance of non-investment grade bonds rated A or below remains sluggish. The expansion is expected to somewhat alleviate this issue.

Additionally, the report suggested increasing the execution level of the 1 trillion won purchase program for construction company-guaranteed PF ABCP by the Korea Development Bank and Industrial Bank of Korea from the current 100 billion won. It also recommended providing low-interest loans and guarantees to small and medium-sized construction companies facing liquidity difficulties.

The need for debt restructuring for small and medium-sized enterprises (SMEs) was also raised. As of January this year, the average interest rate on unsecured loans for SMEs with relatively weak collateral capacity was about 6.67%, and for low-credit companies rated 6 or below, it exceeded 9%, imposing a heavy burden. Therefore, the report mentioned that support measures such as loan interest rate adjustments and repayment deferrals should be provided to SMEs.

Min Kyung-hee, a research fellow at KCCI SGI, stated, "The instability in the bond and short-term funding markets triggered by the Gangwon Province PF issue resulted from the sudden collapse of trust in local government payment guarantees, which were previously considered safe, causing the market to suffer more damage than expected." She emphasized, "Policy support should be strengthened to prevent panic from spreading rapidly if risks recur, and companies facing liquidity shortages due to worsening domestic and external economic conditions should be selectively and actively supported."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.