Samsung SDI, Joint Venture with GM... Mass Production from 2026

LG Energy Solution, 4680 Mass Production Visible in Second Half of This Year

L&F Also Supplies Cylindrical Cathode Materials to Tesla

Korean battery companies have officially started producing cylindrical batteries for electric vehicles. Cylindrical batteries, a ‘form factor’ advantageous for large-scale mass production, are becoming the mainstream.

On the 8th (local time), Samsung SDI will hold a memorandum of understanding signing ceremony for the establishment of a joint factory with GM in Michigan, USA. Samsung SDI President Choi Yoon-ho and GM CEO Mary Barra will attend to formalize the establishment of the first joint factory between the two companies. The two companies will invest 3 to 5 trillion KRW to build a joint factory with a capacity of 30 to 50 GWh by 2026. This factory will produce cylindrical and prismatic batteries to supply GM’s electric vehicle plants.

The Samsung and GM factory will be the second North American cylindrical battery factory managed by a Korean company. LG Energy Solution announced last year plans to build a standalone factory producing cylindrical batteries in Arizona, USA, with production scheduled to start in 2024.

Samsung SDI has accumulated know-how in cylindrical batteries from small batteries used in laptops and other devices. They plan to pour this long-standing expertise into mass production of cylindrical batteries for electric vehicles. Samsung SDI is currently establishing a next-generation cylindrical battery pilot line at its Cheonan plant. Additionally, it is investing about 1.7 trillion KRW to build a cylindrical battery factory in Seremban, Malaysia.

LG Energy Solution will begin mass production of Tesla’s '4680 (46mm diameter, 80mm length)' batteries in the second half of this year. LG Energy Solution is investing 580 billion KRW to build new facilities at the ‘Ochang Energy Plant 2’ in Cheongju, Chungbuk. It also plans to invest 150 billion KRW in the first plant to expand the existing 4 GWh scale '2170 (21mm diameter, 70mm length)' cylindrical battery line. The 4680 battery is a medium-to-large cylindrical battery first introduced by Tesla CEO Elon Musk at the 2020 ‘Battery Day’. It has five times the capacity and six times the output of the 2170 battery currently used in Tesla electric vehicles.

Battery material company L&F has agreed to supply cathode materials to Tesla, which plans to produce cylindrical batteries independently. The supply volume is 77,000 tons of cathode materials over two years starting in 2024. This amount is enough to produce 780,000 electric vehicles. The contract value exceeds 3.8 trillion KRW. Large companies supply finished products, while small and medium enterprises supply core materials to the global cylindrical battery market. Because LG Energy Solution, Samsung SDI, and others have long produced small cylindrical batteries, Korea has been able to establish a cylindrical battery ecosystem.

Cylindrical batteries are the traditional battery shape commonly used in daily life. However, until now, electric vehicles mainly used prismatic and pouch-type batteries. This is because placing multiple cylindrical batteries inevitably creates empty spaces between them. To maximize energy density and space utilization, prismatic and pouch-type batteries, which can be tightly packed, have been used. The largest player in the cylindrical battery market so far has been Japan’s Panasonic.

However, as numerous automakers have rushed to produce electric vehicles, the situation has changed. Cylindrical batteries have advantages that outweigh their disadvantages.

Prismatic and pouch-type batteries vary in size and specifications depending on brand and vehicle model. In contrast, cylindrical batteries have standardized specifications. For example, the '4680' and '2170' batteries have fixed diameters and lengths. Standardized specifications are advantageous for stabilizing and optimizing large-scale manufacturing processes. Battery manufacturing yield rates vary due to small differences in process technology and equipment layout. Moreover, because each factory produces batteries of different shapes and specifications, it typically takes 2 to 3 years on average to reach the ‘process normalization’ stage with a yield rate above 90%. Cylindrical batteries reduce this time. Additionally, the produced batteries can be supplied to multiple companies rather than a single specific company.

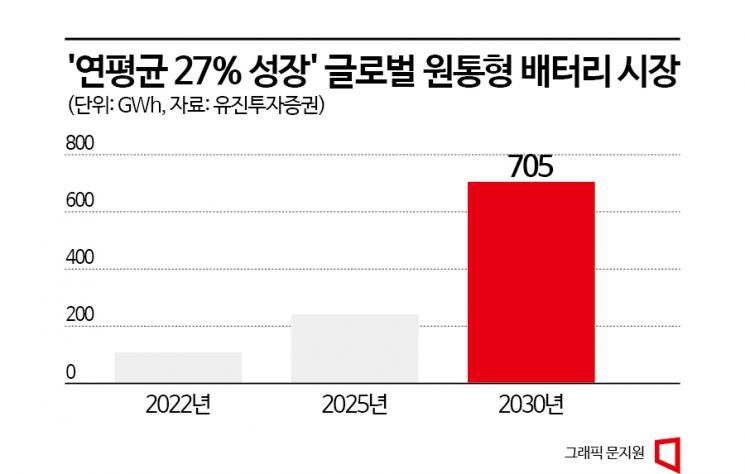

The global cylindrical battery market size is estimated to grow from about 108 GWh last year to 241 GWh in 2025 and 705 GWh in 2030 (Eugene Investment & Securities). The compound annual growth rate reaches 27%, exceeding the estimated 19% annual growth rate of the global electric vehicle market. Currently, most products are for Tesla, but BMW, GM, Stellantis, and others plan to expand their adoption of cylindrical batteries. Sales of commercial electric trucks equipped with cylindrical batteries are also expected to start growing after 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)