Semiconductor Sales Share 33.7%→32.6%

Inventory Soars Due to Memory Sales Decline

Server Products Expected to Reverse Memory Trend

Samsung Electronics' semiconductor sales proportion decreased last year. Sales of its core memory semiconductor sector also declined. Samsung Electronics expects a business turnaround to overcome the semiconductor downturn in this situation. It anticipates increased demand for high-margin server-oriented Double Data Rate (DDR)5 DRAM and High Bandwidth Memory (HBM).

According to the business report disclosed by Samsung Electronics on the 9th, sales in the DS division, which handles the semiconductor business, slightly increased last year. It reached 98.4553 trillion KRW, up 4.56% from the previous year (94.1586 trillion KRW). However, the share of total sales decreased. It dropped by 1.1 percentage points from 33.7% in 2021 to 32.6% last year. Memory sales, a major business area within the DS division, also fell by 5.6% to 68.5349 trillion KRW last year from 72.6022 trillion KRW the previous year.

Last year, the semiconductor market froze due to economic downturn, causing performance to shrink from the second half. In fact, DS division inventory assets stood at 29.0576 trillion KRW at the end of last year, a 76.59% increase from 16.4551 trillion KRW at the end of the previous year. This indicates a large accumulation of products made but unsold due to reduced IT demand. As a result, DS division operating profit also decreased by 18.42% to 23.82 trillion KRW last year from 29.2 trillion KRW the previous year.

Samsung Electronics expects to generate profits in the memory business despite unfavorable market conditions. The expansion of the latest DRAM standard, DDR5, is a representative example. DDR5 DRAM is about three times more profitable than the existing DDR4 DRAM. In particular, server-oriented products have higher added value than mobile and PC products.

The semiconductor industry is paying attention to Intel's launch of Sapphire Rapids in January. Sapphire Rapids is a new server central processing unit (CPU) that supports DDR5. Once Sapphire Rapids is widely released in the market, the use of server DDR5 DRAM, which is used together, will inevitably increase.

No Geun-chang, a researcher at Hyundai Motor Securities, said, "From the third quarter, as demand for server DDR5 increases, the average selling price (ASP) of server DRAM will stop declining thanks to the high price premium," adding, "The key is how much the shipment ratio of server DDR5 can be increased."

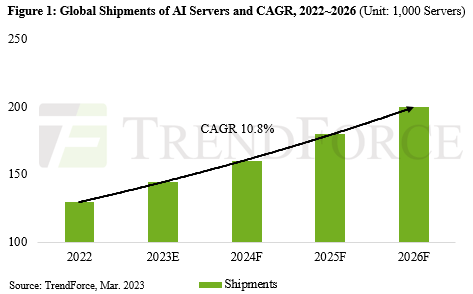

AI server shipments increasing at an average annual rate of 10.8% from 2022 to 2026 /

AI server shipments increasing at an average annual rate of 10.8% from 2022 to 2026 / [Image provided by TrendForce]

The expansion of artificial intelligence (AI) services driven by the ChatGPT effect is also a factor that raises expectations for high-performance memory demand. To support AI computations on servers, graphics processing units (GPU) together with HBM installation are essential. As many companies increase investments in AI servers, HBM usage is also rising. Market research firm TrendForce expects the HBM market to grow at an average annual rate of 40-45% or more from this year through 2025.

Regarding this, TrendForce explained, "HBM has very high entry barriers in terms of manufacturing technology," and "memory suppliers consider HBM a product with a high gross margin." It also forecasted that cloud service companies will invest more in AI servers, expecting AI server shipments to increase by 8% this year. Shipments are projected to grow at an average annual rate of 10.8% until 2026.

Financial information provider FnGuide estimated Samsung Electronics' first-quarter sales forecast at 64.4625 trillion KRW, down 17.12% from the same period last year. The operating profit forecast is 2.2662 trillion KRW, which could decrease by 83.95%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.