WSJ "Reproducing the Great Depression Equation"

The world's largest e-commerce company, Amazon, halting the construction of its new headquarters following massive layoffs has been interpreted as a signal of a full-scale economic recession, according to warnings. During past global financial crises triggered by the 2001 IT bubble burst and the April 2007 subprime mortgage crisis, the tightening of the internet and telecommunications markets, as well as the housing market, respectively, spread externally, leading to widespread layoffs and an overall economic downturn. Such major recessions have unfolded as crises in one industry sector transferred to others, and this time, it is expected that the crisis starting in the technology and housing markets will spread throughout the industrial sector.

Big Tech Decline and Shaken Housing Market

U.S. big tech companies' earnings are plummeting one after another. The downward trend in earnings, which began in the second half of last year, is deepening. In the fourth quarter of last year, Amazon's net profit plunged by 98%, barely avoiding a transition to a loss. Microsoft (MS) recorded its lowest revenue growth rate in six years, and Alphabet experienced four consecutive quarters of net profit decline. Even Apple, the steadfast company with the highest market capitalization, could not avoid decreases in revenue and net profit compared to the previous year. As a result, the net profits of big tech companies included in the S&P 500 index fell by 8.4% year-over-year, marking the worst performance since 2009.

The harsh winter for big tech is expected to continue throughout this year. Amazon projected first-quarter sales between $121 billion and $126 billion, below market expectations. MS also set its revenue target at $50.5 billion to $51.5 billion, lower than the market forecast of $52 billion. Amazon Chief Financial Officer Brian Olsavsky said, "The most concerning part (for improving performance) is that everyone is cutting back on consumption and adjusting budget priorities."

Amid worsening earnings, big tech companies have resorted to additional layoffs and salary cuts to endure. Meta, which cut 11,000 employees at the end of last year, reportedly began laying off thousands more this week. Airbnb also reduced 30% of its recruitment staff this week. According to Layoffs.fyi, which tracks layoffs at global tech companies, 38 tech companies that went public during the pandemic have started layoffs to cut costs rather than expand their businesses.

The U.S. housing market is also significantly shaken. According to the U.S. Department of Commerce, U.S. housing construction has declined for seven consecutive quarters. Housing prices are also falling rapidly. The S&P CoreLogic Case-Shiller Home Price Index, which measures average home price trends in major U.S. cities, fell by 2.7% on a seasonally adjusted basis as of the end of December last year compared to the end of June.

Fed's Additional Tightening the Biggest Threat... Big Step Possible This Month

The Wall Street Journal (WSJ) forecasts that the equation "broad profit decline = recession," which appeared during past major recessions, will apply this year as well. According to financial information provider Refinitiv, earnings in nine sectors of the S&P 500 index declined in the fourth quarter of last year. Only energy and industrials, which benefited from the Ukraine war, experienced earnings growth last year. Refinitiv expects profit declines to continue in consumer goods, finance, retail, and healthcare sectors in the first and second quarters of this year.

The biggest threat is the Federal Reserve's (Fed) interest rate hikes. Fed Chair Jerome Powell, appearing at a Senate Banking Committee hearing to deliver the semiannual monetary policy report, stated, "The terminal rate could be higher than expected," signaling further tightening. The possibility of a 0.5 percentage point rate hike, a big step, at the Federal Open Market Committee (FOMC) meeting on the 21st-22nd has also increased.

The market expects the rate hike trend to continue this year. U.S. major investment bank Goldman Sachs has even presented a scenario where the terminal rate reaches 6%.

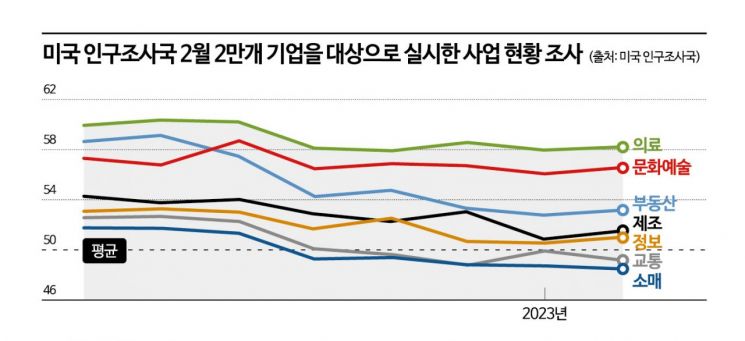

With expectations of continued high-intensity tightening, the intensity of recession predictions is also increasing. In a survey conducted last month by the U.S. Census Bureau of 20,000 companies across 19 industries nationwide, the number of companies reporting excellent or above-average business conditions has been declining since July last year. WSJ predicted that additional layoffs by companies responding to profit declines and reduced consumer spending could lead to a recession this year.

WSJ also pointed out that the increasing number of companies facing liquidity crises due to interest rate hikes is acting as a trigger for the U.S. economy. Credit rating agency Moody's warned that continuous interest rate hikes will make it difficult for companies across all industries to repay maturing debts over the next 12 to 18 months. Particularly, six sectors?retail, automotive, transportation, chemicals, mining, and forestry?are expected to be vulnerable. This is a significant deterioration in economic outlook compared to last year, when only one sector was expected to be vulnerable.

Moody's stated, "These six sectors have shown weaker performance than other sectors in economic recovery, and their credit fundamentals are deteriorating. As maturities come due, refinancing with new loans will be more costly and difficult to execute," warning that these sectors could face bankruptcy risks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)