Stop Favoring Major Shareholder Companies... Demand for Corporate Governance Reform

Hailok Counters with Bylaw Amendment to Reduce Number of Directors and Auditors

Hailok Korea, a leading domestic manufacturer in the industrial fittings and valves sector, is facing a showdown between its major shareholder and the hedge fund Quad Asset Management at the March shareholders' meeting. Quad Asset Management has raised concerns about internal transactions involving Hailok's major shareholder and submitted shareholder proposals focusing on the appointment of auditors. In response, Hailok's board of directors has countered by putting forward agenda items aimed at nullifying these proposals. Quad Asset Management, in turn, is challenging the board’s agenda items and shows no sign of backing down.

In October last year, Quad Asset Management sent a shareholder letter titled "

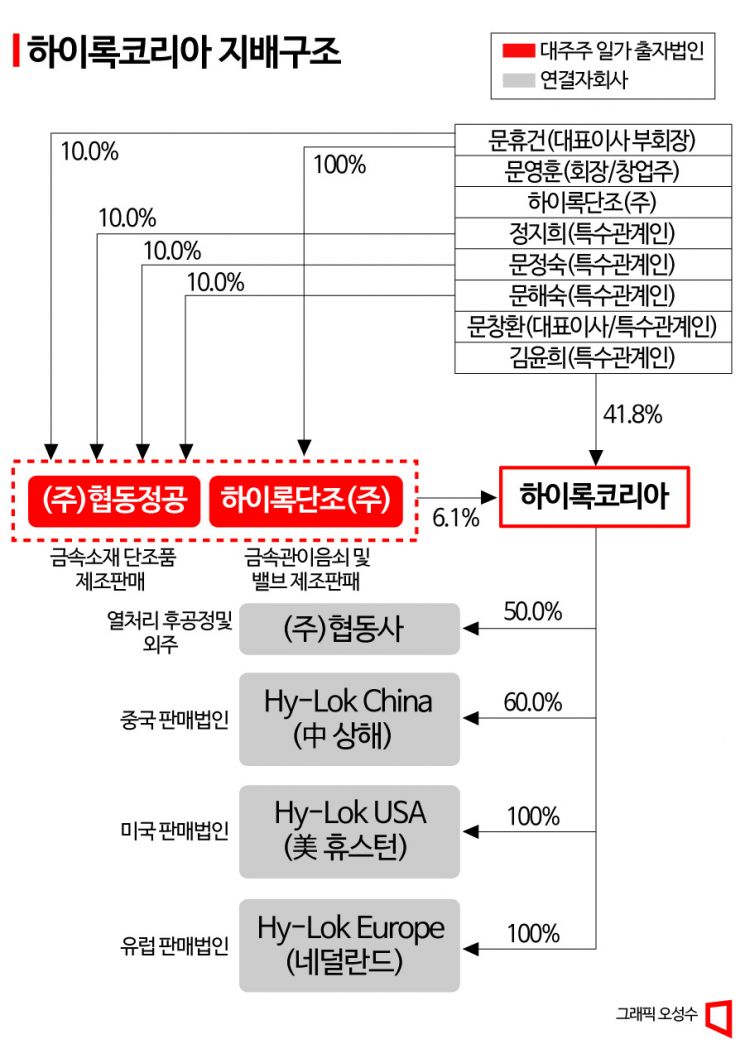

Quad Asset Management pointed out that 100% of the sales of the two companies come from internal transactions with Hailok, the group's core company. They also alleged that Hailok sold shares it held to the second-generation CEO Moon Hyu-geon at low prices multiple times, effectively favoring the second generation. They criticized that economic benefits accruing solely to the controlling shareholder and the undervaluation of the stock caused by controlling shareholder-centered management have excluded ordinary shareholders from economic gains.

They demanded the merger of Hyubdong Jeonggong, Hailok Forging, and Hyubdong, which are suspected of internal transactions, with Hailok to establish transparent governance. At the same time, they called for the cancellation of treasury shares equivalent to 5.4% of total issued shares, raising the dividend payout ratio to 50%, and introducing predictable shareholder return policies.

Only Accepts Treasury Share Buyback... Ignores Other Shareholder Proposals

However, Hailok only accepted the cancellation of treasury shares among the various shareholder proposals. It opposed implementing the other proposals. In response, Quad Asset Management launched a public campaign targeting other institutional investors and minority shareholders, emphasizing the need for further governance and shareholder return improvements.

They subsequently submitted a shareholder proposal under the Commercial Act to appoint two non-standing auditors. They pointed out that Hailok’s current standing auditor has served for 19 years, making it difficult to expect independence from the major shareholder. They also announced plans to actively pursue available legal measures to protect shareholder rights.

Hailok countered Quad Asset Management’s attack by proposing an amendment to the articles of incorporation to reduce the number of directors and auditors as an agenda item for the shareholders' meeting. At the same time, they nominated Lee Jun-hong, a representative tax accountant from Haein Tax Accounting Corporation, as a candidate for standing auditor. Quad interprets this as an attempt to block the shareholder proposal focused on appointing two auditors. A confrontation between the two sides at the March shareholders' meeting appears inevitable.

Quad Asset Management Secures Allies Among Domestic and Foreign Institutional Investors

Hailok’s major shareholder and related parties hold 42% of the shares, and affiliate Hailok Forging holds 6.07%. Quad Asset Management’s stake is only 4.8%, so the major shareholder side overwhelmingly dominates in terms of simple shareholding ratio.

However, the proposed amendment to reduce the number of directors and auditors requires a special resolution with two-thirds approval from shareholders attending the meeting. To block this, Quad Asset Management is reported to have secured allies including Fidelity Asset Management, which holds 8.37%, and other domestic and foreign institutional investors.

If the amendment is rejected, Quad will have an advantage in the auditor appointment agenda. Under the ‘3% rule,’ the major shareholder’s voting rights are limited to 3% for auditor appointments. A Quad Asset Management official expressed confidence, saying, "If the amendment is rejected and the auditor appointment passes, we will focus on issues such as internal transactions by the major shareholder and push through shareholder proposals like affiliate mergers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.