Korea Venture Investment Announces First Regular Application Status

Requests 787.5 Billion KRW for MOTIE Fund

After Review, 247.5 Billion KRW Invested... Announcement in May

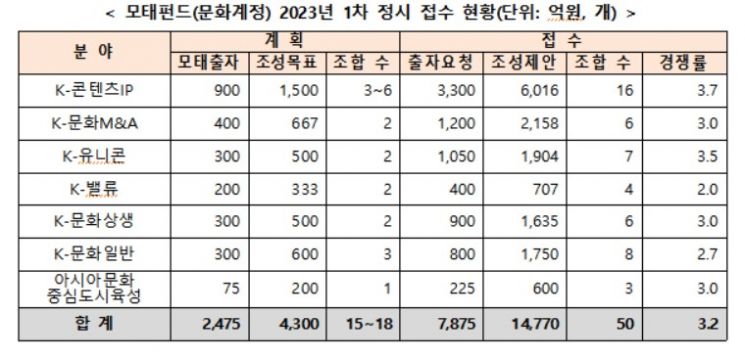

As a result of the application process for the mother fund (cultural account) investment project under Korea Venture Investment, a subsidiary of the Ministry of SMEs and Startups, 50 associations applied for an investment of 787.5 billion KRW. The K-Content IP sector showed the highest competition rate at 3.7 to 1.

Korea Venture Investment announced the results of the first regular investment project for the mother fund under the Ministry of Culture, Sports and Tourism in 2023 on the 6th. According to the status of cultural account investment applications, 50 associations applied for an investment of 787.5 billion KRW in the mother fund. Including the funds that the management companies pledged to raise from the private sector, the total fund formation amount reaches 1.477 trillion KRW.

The competition rate based on the investment application amount was 3.2 to 1. Among them, the K-Content IP sector, which mainly invests in small and venture companies related to cultural content intellectual property (IP), showed the highest competition rate at 3.7 to 1.

Other sectors include the K-Unicorn sector investing in cultural content youth companies with a competition rate of 3.5 to 1, the K-Culture M&A sector aimed at revitalizing cultural industry M&A with a competition rate of 3 to 1, and the K-Culture Win-Win sector investing in marginalized genres and under-invested areas, also with a competition rate of 3 to 1.

The Asia Culture Center City Development sector, which invests in small and venture companies located in Gwangju, also saw 3 associations apply, showing a competition rate of 3 to 1.

Korea Venture Investment plans to invest a total of 247.5 billion KRW across 7 sectors through this investment project, aiming to form venture funds exceeding 430 billion KRW including private capital. Through evaluation, 15 to 18 management companies will be selected and announced in May.

Woo-ung Hwan, CEO of Korea Venture Investment, said, "This cultural account investment project was carefully planned to diversify investment sectors and meet the diverse capital demands of the market," adding, "We will do our utmost to ensure that excellent management companies that can contribute to revitalizing investment in the cultural industry are selected through the investment project."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.