Statistics Korea, February Consumer Price Trends

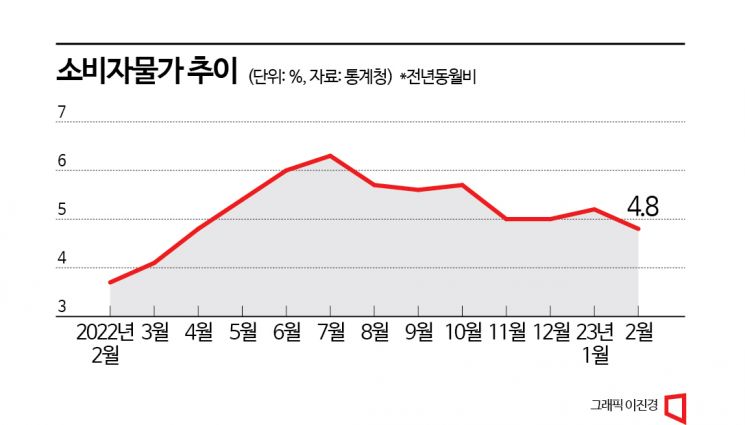

February Prices Up 4.8%...4% Range After 10 Months

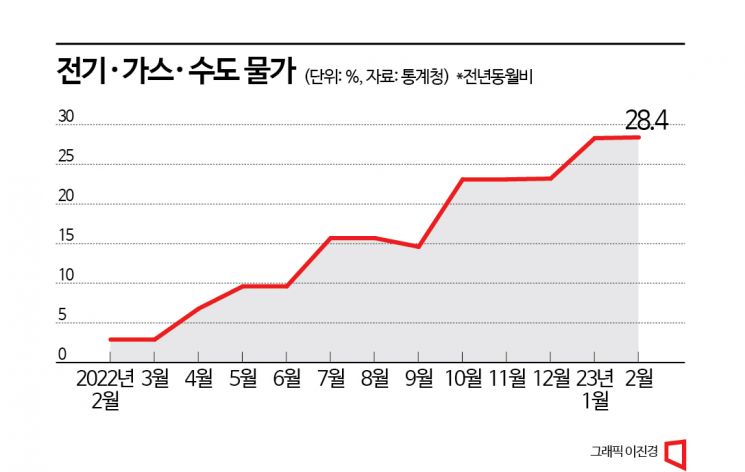

Electricity, Gas, and Water Soar 28.4%, Record High Increase

The consumer price inflation rate in February this year recorded a 4% level for the first time in 10 months. The government's 'price suppression' efforts, including pressure to restrain price increases on alcoholic beverages and food products, have proven effective. However, despite the public utility rates freeze card for the first half of the year, prices for major public utilities such as electricity, gas, and water recorded the highest increase ever. The factors driving public utility rate hikes have not disappeared but have simply been postponed, meaning there is still a high possibility that public utility rates will fuel inflation.

According to the 'February Consumer Price Trends' released by Statistics Korea on the 6th, the consumer price index rose 4.8% year-on-year, marking a 4% level for the first time in 10 months since April last year (4.8%). The increase rate was 0.4 percentage points lower than the previous month (5.2%).

Kim Bo-kyung, Director of Economic Trend Statistics at Statistics Korea, said, "The inflation rate for personal services such as dining out slightly slowed in February, showing a deceleration in inflation since the second half of last year," adding, "On the other hand, with the reopening of China's economic activities, there are signs of rising international raw material prices, so (future inflation) remains highly uncertain."

The slowdown in inflation in February was largely influenced by declines in petroleum products and livestock prices. Among manufactured products, petroleum products fell 1.1% year-on-year. This is the first time in two years since February 2021 (-6.3%) that petroleum prices have been lower than the previous year.

Among agricultural, livestock, and fishery products, livestock prices also fell by 2.0%. This was due to domestic beef and imported beef prices dropping 6.1% and 5.2%, respectively, compared to the same month last year. It is the first time in 3 years and 5 months since September 2019 (-0.7%) that livestock prices have fallen year-on-year. However, fresh food excluding livestock among agricultural, livestock, and fishery products rose 3.6% year-on-year. Although fresh fruits fell 3.2%, fish and shellfish rose 8.1%, and vegetables increased 7.4%. In particular, the rise in green chili peppers (34.2%), green onions (29.7%), onions (33.9%), and mackerel (13.5%) was steep.

Although the consumer price inflation rate dropped to the 4% range, the soaring increase rates for electricity, gas, and water due to previous public utility rate hikes continued. Electricity, gas, and water prices jumped 28.4% year-on-year, marking the highest increase since related statistics began in 2010. Electricity charges (29.5%), city gas charges (36.2%), and district heating costs (34.0%) rose significantly.

The problem is that despite the government's policy to suppress utility rates, public utility prices recorded the highest increase ever in February this year. At the end of last year, when the gas price hike coincided with a cold wave, sparking controversy over a 'heating bill bomb,' the government decided to freeze public utility rates for the first half of the year. President Yoon Seok-yeol announced at the 13th Emergency Economic and Livelihood Meeting on the 15th of last month that "public utility rates managed by the central government, such as roads, railways, and postal services, will be operated with a maximum freeze policy for the first half of the year." The government did not raise gas prices in the first quarter, and electricity charges that were decided to increase in the first quarter were frozen for households using 313 kWh or less per month. Additionally, the scheduled fare increases for Seoul subway and bus public transportation were postponed to the second half of the year.

At the Emergency Economic Ministerial Meeting held at the Government Seoul Office on the same day, Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho, considering concerns about inflation caused by public utility rates, reiterated, "Public utility rates are being managed as stably as possible under the freeze policy for the first half of the year."

However, the possibility of rate hikes in the second half of the year remains high. Korea Electric Power Corporation (KEPCO) and Korea Gas Corporation (KOGAS), which supply electricity and gas, are facing increasing deficits and unpaid amounts as they have not reflected international prices. In particular, KOGAS's unpaid amounts increased from 1.8 trillion won in 2021 to 8.6 trillion won, and are expected to approach 12 trillion won in the first quarter of this year. Minister of Trade, Industry and Energy Lee Chang-yang also hinted at the possibility of a price increase at a press conference on the 20th of last month, stating, "Gradual price normalization is necessary."

Ultimately, there are concerns that the inflationary pressures suppressed by the government in the first half of the year may return as a boomerang in the second half. The Bank of Korea stated in its 'BOK Issue Note' on the 2nd that "the expected additional increase in electricity and city gas charges within the year is also acting as an upward pressure on inflation," adding, "Since public utility rate hikes directly and indirectly raise the consumer price inflation rate, the impact on inflation can vary significantly depending on the magnitude and timing of the increase." It also suggested that a 'secondary ripple effect' could occur. The secondary ripple effect refers to the phenomenon where increases in core items such as energy and public utility rates raise corporate costs, leading to higher prices for goods and services. The Bank of Korea expressed concern that with China's economic reopening (reopening) increasing crude oil demand and the prolonged Russia-Ukraine war causing supply disruptions, international oil prices, which had relatively calmed down, could rise again.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.