Possibility of Strong Economic Stimulus Measures

Limited Reflexive Benefits Amid US-China Conflict

As China’s largest political event, the Two Sessions (National People's Congress and Chinese People's Political Consultative Conference) opened, industries related to reopening (resumption of economic activities) are gaining momentum. In particular, sectors sensitive to economic trends such as steel, materials, and machinery equipment are experiencing rapid rises, as strong economic stimulus measures are expected after the Two Sessions. However, with nationalism intensifying amid US-China tensions and South Korea’s exports to China declining for nine consecutive months, there is cautious skepticism about whether the expected rebound will materialize following this year’s Two Sessions.

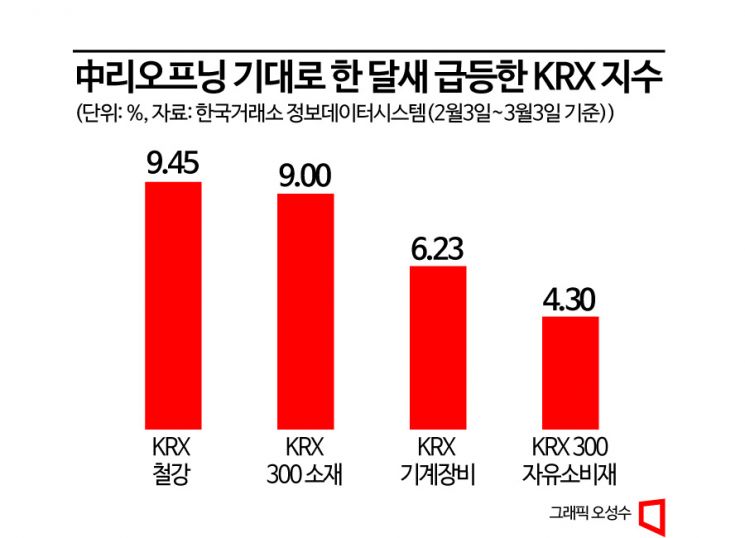

According to the Korea Exchange on the 6th, the KRX Steel Index surged 9.45% over the past month (based on closing prices from February 3 to March 3). This is the largest increase among the more than 30 KRX sector indices compiled by the Korea Exchange. The KRX sector indices consist of representative stocks from various industrial groups listed on the domestic stock market, reflecting the stock price trends of specific industries.

Looking at steel-related stocks, Hyundai Steel closed at 38,100 KRW on the 3rd, rising 11.89% in one month. Related stocks such as POSCO Holdings (9.39%), KG Steel (9.27%), and Dongkuk Steel (8.09%) also rose in unison. Alongside steel, the KRX 300 Materials Index, another representative cyclical sector, increased by 9% during the same period.

The sharp rise in steel and materials stocks is interpreted as reflecting expectations that the Chinese government will focus on real estate stimulus and strengthening infrastructure investment following the Two Sessions. As China’s economic activities fully resume, the pace of economic recovery is expected to accelerate. In fact, the manufacturing Purchasing Managers’ Index (PMI) announced by Chinese authorities earlier this month recorded 52.6, up 2.5 points from the previous month (50.1), marking the highest level in about 11 years. A PMI above 50 indicates economic expansion compared to the previous month, while below 50 indicates contraction. The recovery of China’s manufacturing sector is generally seen as positive news for domestic companies exporting related materials.

The securities industry is also paying attention to the recent rise in the Baltic Dry Index (BDI), which reflects global bulk shipping rates. This is highly correlated with China’s coal and iron ore imports. Jin-young Kim, a researcher at Kiwoom Securities, explained, “Following confirmation of the peak of COVID-19 spread in China, expectations for economic normalization have increased, leading the freight index to shift to an upward trend since February. Full-scale economic recovery and expectations for easing of China’s real estate regulations could further drive the BDI index higher.” However, he cautioned, “In this case, rising raw material prices originating from China and global inflation concerns could re-emerge as market risk factors. It is necessary to closely monitor changes in international raw material prices, export prices of Chinese products, and the number of Chinese overseas travelers.”

This year’s Chinese Two Sessions carry greater symbolic significance as they complete President Xi Jinping’s third term. Accordingly, there are expectations that the Chinese government, which failed to meet economic growth targets during the COVID-19 period, will present more aggressive economic stimulus measures.

However, cautious views are raised that such moves may not have the expected impact on the domestic market amid US-China tensions. The research team at Shinhan Bank S&T Center specializing in materials said, “Externally, political slogans aimed at countering the US, especially around semiconductors and resources, could be a point of caution for us. Considering the Biden administration’s focus on securing technological leadership through production internalization and security, the US economy’s increase in employment driven by service consumption rather than durable goods, and the reality that even if Chinese consumption rises due to reopening, the majority of our exports to China are intermediate goods, it is difficult to expect visible trickle-down effects.” He added, “The rebound in China’s manufacturing PMI in February is reflected in the fact that average daily exports decreased by 16% year-on-year in February.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)