SMR Market Still in Early Stages

Projected to Reach 620 Trillion KRW by 2035

Diverse Participating Companies Including Holding and Construction Firms

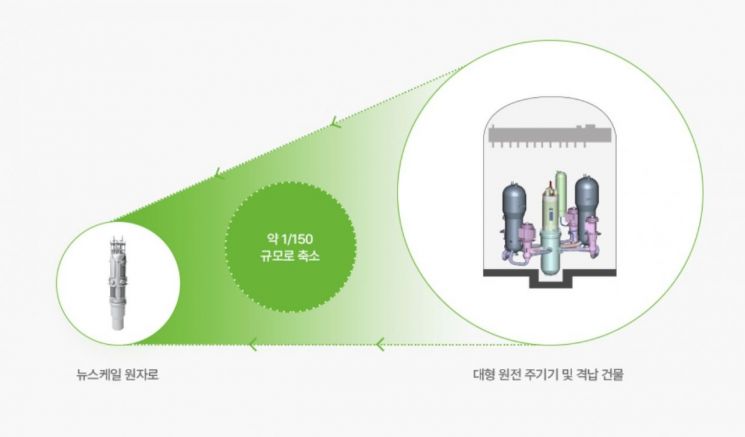

Doosan Enerbility has set a goal to become the Korean version of TSMC. Like Taiwan's TSMC, the world's number one foundry (semiconductor contract manufacturing) company, Doosan Enerbility aims to become a manufacturer of main equipment for Small Modular Reactors (SMRs) even without original design technology. SMR main equipment refers to reactors, steam generators, and pressurizers that are scaled down to about 1/150th the size of conventional large nuclear power plants.

A Doosan Enerbility official said on the 2nd, "The global SMR leader, U.S.-based NuScale Power, is currently in the final stages of SMR design certification." He added, "Even after completing the design, only companies in Korea, Russia, China, France, and Spain can manufacture SMR main equipment."

Doosan Enerbility calculates that since Russia and China are likely to be excluded by Western countries, there are very few places that can reliably manufacture the equipment. The company explained, "We judged that we have competitiveness as the only domestic company capable of making the main equipment, so we entered the SMR business." The target order amount for SMRs in 2027 is 1.4 trillion won.

In April last year, (from left) Nagiyong, Vice President of Doosan Enerbility, John Hopkins, President of NuScale Power in the United States, Heo Yong-su, CEO of GS Energy, and Lee Byung-soo, Vice President of Samsung C&T, are posing for a commemorative photo after signing a Memorandum of Understanding (MOU) for the joint promotion of SMR power plant business development.

In April last year, (from left) Nagiyong, Vice President of Doosan Enerbility, John Hopkins, President of NuScale Power in the United States, Heo Yong-su, CEO of GS Energy, and Lee Byung-soo, Vice President of Samsung C&T, are posing for a commemorative photo after signing a Memorandum of Understanding (MOU) for the joint promotion of SMR power plant business development. [Photo by GS Energy]

Doosan is not the only domestic company stepping into the still nascent SMR market. Various industries have joined, including holding company SK Inc., HD Hyundai, comprehensive energy specialists SK Innovation and GS Energy, construction companies Samsung C&T (construction division) and Hyundai Engineering, and DL E&C. They are determined to sow the seeds of growth early in the SMR market, which is expected to grow into the hundreds of trillions of won.

Earlier this year, construction company DL E&C invested $20 million (about 25 billion won) in X-energy, one of the top three SMR companies in the U.S., together with Doosan Enerbility. An industry insider said, "Only eight construction companies are qualified to build large nuclear power plants," adding, "DL E&C aims to play the role of a construction company when SMR power plants are built in the U.S. and elsewhere in the future."

Samsung C&T, which signed a memorandum of understanding (MOU) with NuScale Power, is in a similar position. Over the past two years, Samsung C&T has also made equity investments totaling $70 million (about 91.9 billion won) in NuScale Power. GS Energy, which signed an MOU with NuScale Power alongside Doosan Enerbility and Samsung C&T, has stepped forward to take on the role of power plant management and operation company based on its know-how as the top private power generation business in Korea.

SK is making its presence felt more as an investor than as a direct SMR construction business. In August last year, SK Inc. completed a $250 million (about 317.6 billion won) equity investment in TerraPower, founded by Microsoft (MS) co-founder Bill Gates, together with SK Innovation. This is one of the largest amounts invested by a single company. They are also aiming to discover business opportunities. Kim Muhwan, head of SK Inc.'s Green Investment Center, said at the time, "By linking TerraPower's innovative next-generation small nuclear reactor technology and therapeutic radioactive isotope production capabilities with SK's diverse energy and bio portfolio, a powerful synergy will be created." Korea Shipbuilding & Offshore Engineering, the intermediate holding company of HD Hyundai's shipbuilding division, also invested $30 million (about 37.5 billion won) in TerraPower.

The reason SMRs are gaining attention is closely linked to the global decarbonization trend. SMRs do not emit carbon during power generation. They can also compensate for the intermittency weaknesses of renewable energy. For example, wind power cannot generate electricity when there is no wind. Solar power is similar; electricity cannot be produced when it is cloudy or raining. However, SMRs generate electricity continuously under any circumstances.

Market research firm Allied Market Research predicted that the global SMR market, which was about $3.5 billion (approximately 4.6 trillion won) in 2021, will grow annually by 15.8% to reach $18.8 billion (about 24.7 trillion won) by 2030. It is expected to grow rapidly in the 2030s when coal phase-out accelerates. The UK National Nuclear Laboratory forecasted that the SMR market size will reach about 620 trillion won by 2035.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.