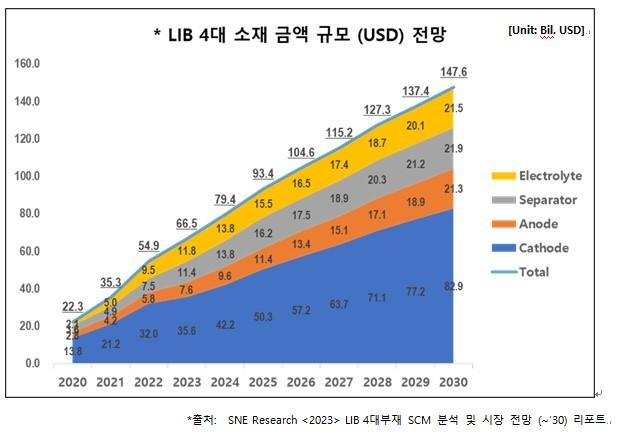

The battery materials market is projected to grow more than fourfold by 2030.

Energy-focused market research firm SNE Research reported that last year, the market size for the four major lithium-ion battery materials was estimated at $54.9 billion (70 trillion KRW).

SNE Research forecasted that, driven by the explosive growth of the electric vehicle market, the four major materials market will expand to $93.4 billion (121 trillion KRW) by 2025 and $147.6 billion (192 trillion KRW) by 2030.

The four major materials?cathode, anode, electrolyte, and separator?account for 70% of the entire battery market, with cathode materials alone making up more than 60% of the four-material market. This is because the cost of cathode materials reflects the prices of raw materials such as lithium, cobalt, and nickel. Cathode materials are the core battery components that determine electric vehicle performance factors such as driving range and output.

In last year’s ternary NCM (Nickel-Cobalt-Manganese) cathode material market, South Korea’s EcoPro BM ranked first in shipment volume. It was followed by Umicore (Belgium), XTC (China), LG Chem (South Korea), and Longbai (China). In the LFP (Lithium Iron Phosphate) market, Chinese companies occupied the top five positions.

Anode materials store and release lithium ions coming from the cathode, allowing current to flow through the external circuit, and they influence battery charging speed and lifespan. SNE Research highlighted the remarkable progress of South Korean company POSCO Chemical in the anode materials market.

Electrolytes are substances that transport lithium ions between the cathode and anode. Separators act as walls preventing direct contact between the cathode and anode while serving as pathways for lithium ions to pass through.

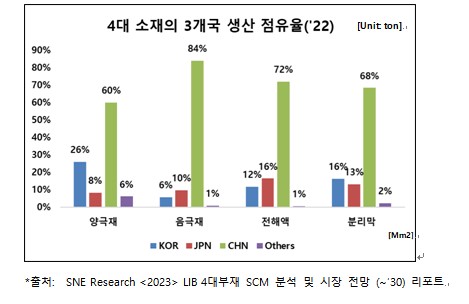

The share of production volume held by South Korea, China, and Japan in these four major materials is absolute, with a particularly high dependence on Chinese companies.

Last year, the production share held by Chinese companies was 60% for cathode materials, 84% for anode materials, 72% for electrolytes, and 68% for separators. Meanwhile, SNE Research expects the K-battery materials market to grow as well, spurred by the implementation of the U.S. Inflation Reduction Act (IRA) and other factors.

SNE Research stated, "Along with battery companies entering local markets in the U.S. and Europe, material suppliers are increasingly entering these markets simultaneously. Material suppliers who secure a leading position in these markets will reshape the industry structure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.