Online-Offline Boundary Meaningless... Entire 600 Trillion Market Stage

Simple Sales Comparison Shows Lotte, Shinsegae, Coupang as 'Top 3'

Speed Gained Through Logistics and Differentiation by Securing Membership Customers

"The offline-centered distribution market still has high prices and limited products. Coupang's market share in the domestic distribution market is still only in the single digits. Over the next few years, Coupang will grow significantly in the domestic distribution market."

Kim Beom-seok, founder of Coupang, identified traditional offline retailers as Coupang's competitors during a conference call following the earnings announcement on the 1st, signaling the start of a major shift in the industry landscape. He expressed ambitions for Coupang to compete not only as an e-commerce company but across the entire distribution market, establishing itself as one of the 'top 3' distribution companies alongside Lotte and Shinsegae based on sales. Experts analyzed that the old framework of separating online and offline is no longer meaningful, and in the borderless era of infinite competition in the distribution industry, sharpening each company's unique differentiation weapons has become a task for all.

The boundary between online and offline is meaningless... The entire 600 trillion won market is the stage

According to the distribution industry on the 2nd, Coupang recorded sales of 26.5917 trillion won last year, achieving its highest-ever sales. Operating losses (144.7 billion won) were reduced to one-tenth of the previous year. Following the third quarter of last year, the fourth quarter (113.3 billion won) also posted operating profits in the 100 billion won range, raising expectations for an annual turnaround to profitability this year.

Coupang announced that it will expand its activities to the entire domestic distribution market this year and will not limit its competitors to e-commerce companies, challenging the two major distribution players, Lotte and Shinsegae. When simply comparing the distribution businesses of Lotte and Shinsegae that correspond to Coupang’s distribution business such as Rocket Delivery and Rocket Fresh based on sales, these three companies are already classified as the top 3 distribution companies. Shinsegae Group’s nine distribution business sectors (excluding five overseas and non-distribution subsidiaries such as Starbucks and property) recorded sales of 30.4602 trillion won and operating profit of 617.3 billion won. Lotte Shopping’s performance, including six distribution business sectors such as department stores, marts, and convenience stores (excluding Culture Works), was 15.007 trillion won.

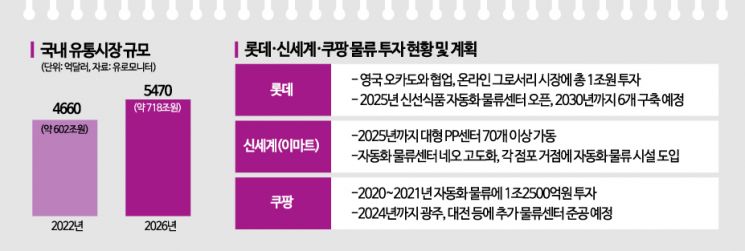

Including duty-free businesses that generate several trillion won in annual sales, the market dominance of traditional offline companies in domestic distribution remains very strong. Nevertheless, analysis shows that there is no absolute dominant player in the entire domestic distribution market. According to global market research firm Euromonitor, the size of the domestic distribution market last year was about $466 billion (approximately 602 trillion won). Euromonitor forecasts that the domestic distribution market will grow at an average annual rate of 4%, reaching $547 billion (approximately 718 trillion won) by 2026. Coupang’s share of the distribution market, with sales of 26 trillion won last year, is only about 4.4%. Shinsegae and Lotte also hold about 5.1% and 2.5%, respectively, when considering comparable distribution businesses.

Gaining speed through logistics and locking in loyal customers with membership

Industry insiders believe that in the era of distribution competition without boundaries between online and offline, quick access to shopping and customer lock-in effects that bring customers to the channel will be decisive differentiating factors. To this end, Coupang plans to expand its automated logistics infrastructure to improve delivery efficiency and increase consumer touchpoints. Coupang invested 1.25 trillion won in automated logistics from 2020 to 2021 and plans to build additional logistics centers in Gwangju and Daejeon by 2024, following the recently unveiled Daegu fulfillment center. Lotte is investing a total of 1 trillion won in the online grocery market through collaboration with the UK grocery platform company 'Ocado.' Starting with an automated fresh food logistics center in 2025, Lotte plans to build six automated logistics centers by 2030. By introducing automated logistics robots from receiving to shipping, the number of products that can be stored in logistics centers will double, and customers will be able to receive desired food items in one-hour increments. SSG.com plans to enhance productivity by upgrading its existing three online-only logistics centers, Neo, and the logistics system of Emart PP Center.

Membership competition to secure loyal customers is already fierce. Coupang announced that its Wow membership had 11 million members as of the end of last year. Shinsegae Group plans to launch a paid membership in the second half of this year that integrates benefits from six affiliates including Starbucks, Gmarket, and Shinsegae Duty Free. Lotte is expanding membership services through L.Point Members with 40 million members, strengthening benefits for Lotte Hotel membership rewards accumulation and usage, and the MZ generation-exclusive paid membership Y Club of Lotte Home Shopping.

Professor Seo Yong-gu of the Department of Business Administration at Sookmyung Women’s University said, "As e-commerce companies like Coupang rise, Lotte and Shinsegae are also investing in automated logistics and memberships based on their strong offline distribution power in department stores and large marts, so competition in the domestic distribution market will become more intense."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)