Japan's SoftBank is reportedly planning to temporarily halt the London Stock Exchange listing plan of the UK semiconductor fabless company ARM. The UK government's efforts to resume negotiations with SoftBank for ARM's listing have fallen through.

Bloomberg reported on the 1st (local time) that SoftBank has decided to exclude the London Stock Exchange listing from its IPO plans for the time being, focusing instead on a listing on the New York Stock Exchange.

So far, the UK government has put considerable effort into persuading SoftBank to pursue a dual listing of ARM on both the New York Stock Exchange and the London Stock Exchange. This is because, amid efforts to strengthen its domestic technology sector, there were concerns that the UK economy would suffer significant damage if ARM were to list only in New York. The relatively small number of tech stocks included in the FTSE 100 index is also cited as a reason for the UK government’s push for ARM’s listing.

ARM is a company that provides the most critical design IP for semiconductor production. It was once one of the UK's core technology companies, and most of its operations still remain in the UK. Currently, most mobile application processors (APs) produced by companies such as Samsung Electronics and Apple use ARM’s basic designs.

Former UK Prime Minister Boris Johnson tried to attract at least part of ARM’s initial public offering (IPO) to the UK capital market, but the listing discussions were halted amid political turmoil, including his resignation and the mass resignation of senior officials. Former Prime Minister Liz Truss also planned to resume negotiations with SoftBank in September last year, but the listing plan was again scrapped after she resigned just 45 days into her term.

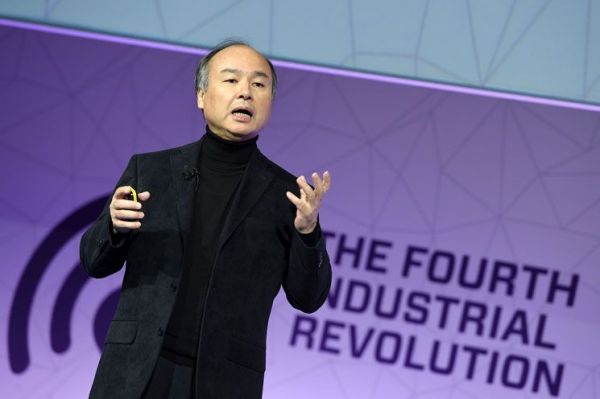

In response, her successor, Prime Minister Rishi Sunak, attempted to persuade SoftBank and resumed negotiations again in January. Prime Minister Sunak and UK Chancellor of the Exchequer Andrew Griffith held talks regarding ARM’s listing with ARM CEO Rene Haas and SoftBank Chairman Masayoshi Son. Julia Hoggett, CEO of the London Stock Exchange, also said in an interview with Bloomberg in July, "We propose everything we think is a convincing strategy and must fight," indicating that they have been continuously lobbying to change SoftBank’s mind.

However, Bloomberg reported that Chairman Son’s current focus is solely on the success of the US listing. SoftBank had attempted to sell ARM to US semiconductor company Nvidia for $40 billion in September 2020, but the deal was blocked by regulators, leading SoftBank to continuously pursue a New York Stock Exchange listing. Chairman Son is now seeking to raise funds through ARM’s US listing after SoftBank’s core investment project, the Vision Fund, incurred losses of about 60 trillion won last year. The market estimates ARM’s valuation to be as high as $60 billion.

Bloomberg stated, "Whether SoftBank’s investment activities can fully resume depends on the success of ARM’s IPO," adding, "Anonymous sources expect SoftBank to focus on a sole listing of ARM on the New York Stock Exchange by the end of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)