Ecopro BM Pushes Out Competitor Celltrion Healthcare

Acquisition Issues Propel SM and Osstem Implant into Top 10 Rankings

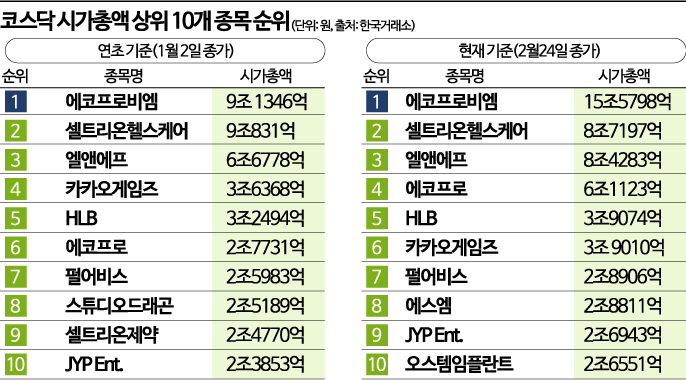

[Asia Economy Reporter Kwon Jae-hee] This year, the KOSDAQ market has recorded a rise of over 10%, causing a significant reshuffle in the rankings of the top 10 companies by market capitalization. SM Entertainment (SM), which is currently involved in a management dispute, has entered the top 10, while secondary battery stocks have drawn attention by securing places within the top 5.

According to the Korea Exchange on the 28th, the market capitalization of the top 10 KOSDAQ stocks was 57.7695 trillion KRW (as of the 26th). This represents a 29.7% increase compared to 44.5346 trillion KRW based on the closing price on January 2nd of this year.

EcoPro BM, which competed with Celltrion Healthcare for the top spot in KOSDAQ market capitalization last year, has firmly maintained its position. At the beginning of the year, both EcoPro BM and Celltrion Healthcare had market capitalizations in the 9 trillion KRW range, but currently, EcoPro BM’s market capitalization stands at 15.5798 trillion KRW, while Celltrion Healthcare’s is 8.7197 trillion KRW, widening the gap to about twice as much. This is due to the rapid surge in secondary battery stocks in a short period. EcoPro BM’s market capitalization has increased by nearly 6.5 trillion KRW since the start of the year, a rise of over 70% compared to the beginning of the year.

EcoPro, the holding company of EcoPro BM, has made its presence felt by entering the top 5 in KOSDAQ market capitalization. EcoPro’s market capitalization increased from 2.7731 trillion KRW to 6.1123 trillion KRW during this period, an increase of about 120%. This is the highest growth rate among the top 10 KOSDAQ stocks by market capitalization. Its KOSDAQ market capitalization ranking also jumped two places from 6th to 4th.

Additionally, SM, which is attracting attention due to its management dispute, entered the top 10, and Osstem Implant rose about 30% compared to the beginning of the year, reaching 10th place as Dentistry Investment pursued a public tender offer.

On the other hand, Studio Dragon and Celltrion Pharm were pushed out of the top 10 KOSDAQ stocks by market capitalization. Studio Dragon fell from 8th to 13th place, and Celltrion Pharm dropped from 9th to 14th place.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)