Franklin Templeton, Columbia Threadneedle CEOs Visit Korea in Succession

Valenbergi Family's Private Equity Fund EQT Partners Opens Korea Office

Attracts Investment from Domestic Pension Funds, Aims to Invest in Korean Companies and Assets

Global financial companies are increasingly entering the Korean market, and CEOs are visiting Korea one after another. This trend is interpreted as a result of the subsiding COVID-19 pandemic and the easing of the strong dollar phenomenon, which has increased interest in emerging markets, leading to more attempts to tap into the Korean market. These moves aim to attract funds from domestic pension funds and others or to seek opportunities for mergers and acquisitions (M&A) of prime companies or assets in the domestic market.

According to the investment banking (IB) industry, following the visit of Jenny Johnson, Chairwoman and CEO of Franklin Templeton, in January, global leaders of the UK-based asset management firm Columbia Threadneedle are visiting Korea this month. An IB industry official said, "Since October last year, global CEOs have been flocking to Korea," and predicted, "This trend will strengthen further this year."

The reason global leaders of Columbia Threadneedle, which manages assets worth approximately 750 trillion won, are visiting Korea is to meet major institutions such as the National Pension Service and Korea Investment Corporation (KIC). The visit is expected to last a short 1 night and 2 days.

Jenny Johnson’s visit in January was also aimed at attracting investments from domestic pension funds such as the National Pension Service. Franklin Templeton plans to open a liaison office in Jeonju, Jeollabuk-do, where the headquarters of the National Pension Service is located, during the first half of this year. Celebrating its 75th anniversary this year, Franklin Templeton is a global asset manager with over 1,300 professionals in 30 countries managing $1.4 trillion (approximately 1,744 trillion won).

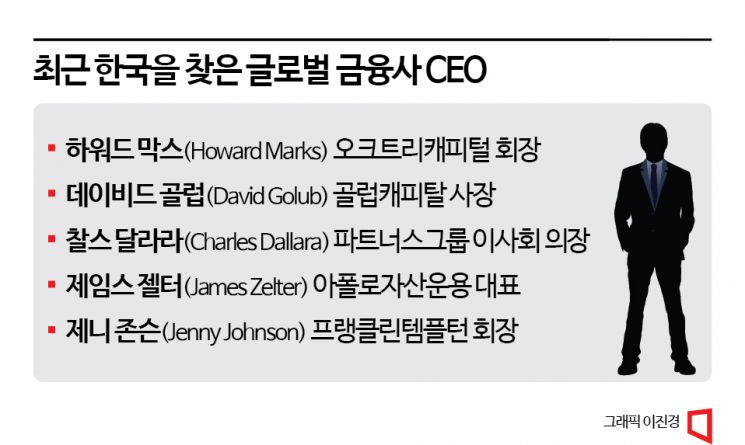

They are not alone. Since last fall, Howard Marks, Chairman of Oaktree Capital; David Golub, President of Golub Capital; Charles Dallara, Chairman of Partners Group Board; and James Zelter, CEO of Apollo Asset Management, have visited Korea and held meetings with major domestic institutions.

The establishment of Korean offices by global investment firms has also noticeably increased. Recently, EQT Partners, a private equity fund affiliated with the European Wallenberg family, opened an office in Korea and is pursuing a "big deal." EQT is a private equity fund (PEF) manager with assets under management (AUM) of 113 billion euros (approximately 157 trillion won). It has offices in 24 countries across Europe, Asia-Pacific, and the Americas. Recently, it opened its Korean office and announced the acquisition of SK Shieldus, a security specialist company under SK Group, and is currently finalizing the deal.

Since COVID-19, various American financial firms have entered the Korean market besides Blackstone, Apollo, EQT, and Franklin Templeton. American firms such as Pretium Partners, Neuberger Berman Asset Management, and Orchard, as well as UK financial firms like Man Group and Coller Capital, have recently established a presence in Korea. Brookfield Asset Management (Canada), IMC Securities (Netherlands), and Nordic Capital (Norway) have also been entering the domestic market one after another.

Foreign investment firms consider the current time, when global tightening has worsened funding conditions, as an opportune moment to invest in prime domestic companies or assets. Firms already operating in the Korean market, such as Kohlberg Kravis Roberts (KKR), Carlyle, TPG, Bain Capital, CVC, Baring Private Equity Asia, and Affinity Equity Partners, are increasing their hiring of Korean investment professionals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)