"Criticism of Recent Reports Focused Solely on 'Title Selling'

Difficult to Issue Sell Opinions Due to Sales and Investment Briefing Relationships"

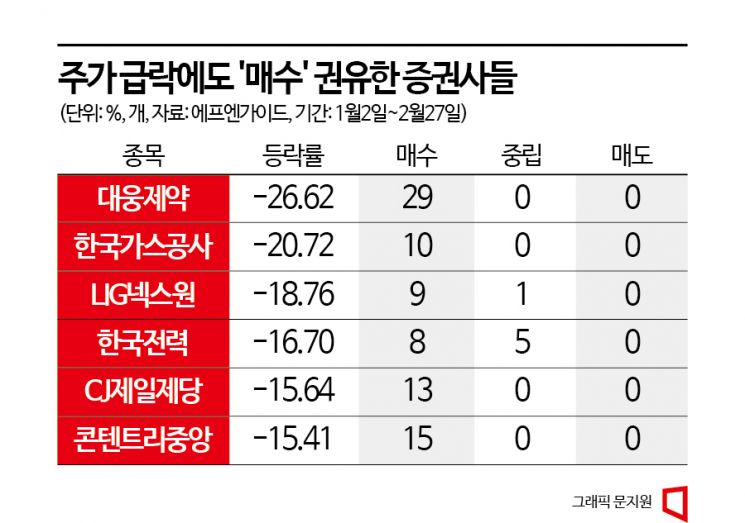

As stock market volatility increases, the number of stocks that have plummeted more than 20% compared to the beginning of the year has surged. However, the securities industry still issues 'buy more' investment opinions on these stocks, raising questions about the credibility of investment reports.

According to the Korea Exchange on the 28th, Daewoong Pharmaceutical's stock price fell from 158,500 won at the beginning of the year to 116,300 won as of the previous day's closing price. It dropped 26.62% in just two months. Even when the KOSPI was on a rising rally in January, Daewoong Pharmaceutical's stock price showed a sluggish pattern with repeated fluctuations. Then, on the 10th, when news broke that it lost the first trial in a civil lawsuit related to Botox against competitor Medytox, the stock price plunged nearly 20% in one day.

Despite this, domestic securities firms' research center reports on Daewoong Pharmaceutical are all 'buy' recommendations. Since the beginning of this year, all 29 investment reports related to Daewoong Pharmaceutical registered with the financial information provider FnGuide have issued a 'buy' opinion. There was not a single report that downgraded its investment opinion to 'neutral' or 'sell.' Although there was litigation risk and the fourth-quarter sales last year failed to meet market expectations, no securities firm sounded a warning to investors.

Instead, securities firms showed a pattern of gradually lowering Daewoong Pharmaceutical's target stock price. However, until January, they maintained target prices in the 200,000 won range, and only after the first trial loss and the sharp stock price drop did they belatedly lower the target prices one after another. On the other hand, some still maintain target prices in the 200,000 won range, more than twice the current stock price. SangSangIn Securities set the highest target price at 250,000 won (February 8). Other firms maintain 230,000 won at Daishin Securities (January 17), 230,000 won at Hanwha Investment & Securities (January 10), and 210,000 won at DB Financial Investment (February 13).

The situation is similar for other stocks that have plunged sharply. Korea Gas Corporation's stock price fell about 21% compared to the beginning of the year, but all 10 reports issued by securities firms recommended 'buy.' For LIG Nex1, whose stock price dropped about 19% this year, nine reports contained buy recommendations. In particular, Daol Investment & Securities issued 'Strong Buy' opinions twice on January 16 and February 13. Only one report contained a 'neutral' opinion. CJ CheilJedang and Contentsree Central, which fell about 15% compared to the beginning of the year, also only released buy reports, 13 and 15 respectively, with zero neutral or sell opinions. Even for Korea Electric Power Corporation, which recorded the worst deficit in history last year, there are numerous buy reports.

In the case of Hanwha Solutions, which announced its earnings on the 16th, 12 domestic securities firms simultaneously issued investment reports the next day, the 17th. Without exception, all were 'buy' opinions, and IBK Investment & Securities especially recommended 'strong buy.' However, after these buy reports flooded the market, on the next trading day, the 20th, Hanwha Solutions' stock price fell more than 7% in one day due to a no-dividend issue.

Although this has been a recurring issue, dissatisfaction is emerging even within the securities industry that research center reports cannot be trusted. A representative of a domestic investment management firm said, "Looking at securities reports these days, they focus only on 'headline grabbing,' and it is hard to find reports with in-depth analysis. Institutions often do not look at them at all or selectively review them depending on the author, so it must be even harder for individual investors to filter out reports useful for investment."

Considering the internal and external dynamics of researchers belonging to securities research centers, there is also a complaint that it is realistically difficult to honestly write 'sell reports.' A securities firm official explained, "If an analyst issues a 'sell' opinion on a company they cover, they are immediately excluded from various events such as the company's investor relations (IR), making it practically impossible to issue sell reports." Another securities firm official said, "When the research center issues a sell opinion, the sales department within the same securities firm sometimes protests, saying 'How are we supposed to do business?'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)