Commercial Banks Lower Loan Interest Rates

Savings Banks Without Capacity See Rates Rise Instead

Loans Become Harder and Interest Burden Increases

Following President Yoon Suk-yeol's 'money party' remark, while major commercial banks have recently shown movements to lower loan interest rates, the interest rates at savings banks, which are frequented by low-credit borrowers, have remained unchanged. Excluded from the financial authorities' interest rate reduction targets, the interest rates in the secondary financial sector such as savings banks continue to soar, making it difficult for vulnerable borrowers to cross the loan threshold.

Loan Interest Rates Higher in February than in January

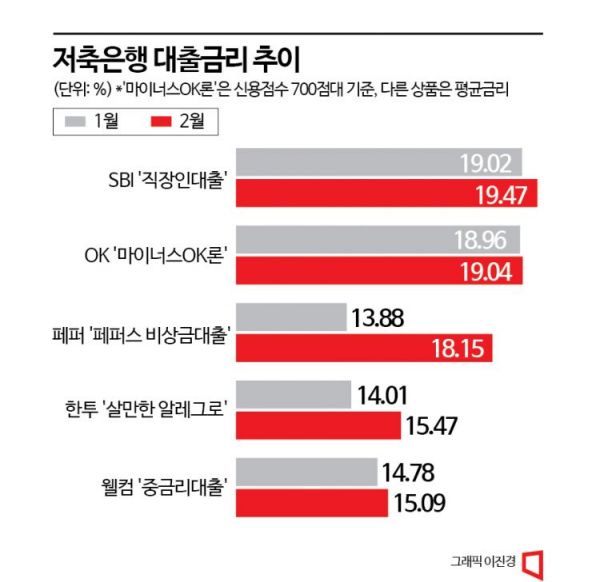

According to the Consumer Portal of the Korea Federation of Savings Banks, the average interest rates on unsecured loans at the five major savings banks in February either remained the same or increased compared to the previous month. SBI Savings Bank's 'Employee Loan' rose slightly to 19.47% in February from 19.02% in January. The 'Mid-interest Loan' product also increased somewhat to 15.93% from 15.42% the previous month. OK Savings Bank's 'Minus OK Loan' applied an interest rate of 19.04% in February for borrowers with credit scores in the 700s, who are the primary users of this product, which is also higher than January's 18.96%.

Pepper Savings Bank's 'Peppers Emergency Loan' average interest rate jumped from 13.88% (January) to 18.15% (February), and Korea Investment Savings Bank's 'Salmanhan Allegro' also rose from 14.01% to 15.47% during the same period. Welcome Savings Bank's 'Mid-interest Loan' similarly increased from 14.78% to 15.09%.

This contrasts with the five major commercial banks lowering interest rates on mortgage and unsecured loans starting last month. A senior official from the financial authorities said, "Savings banks' high interest rates make it difficult for vulnerable borrowers with low credit scores to obtain loans, and even if they do, the interest burden is significant. Since the political focus is mainly on commercial banks used by the majority of the public, vulnerable borrowers are relatively neglected."

The reason savings banks find it difficult to lower interest rates is that their loan funding mainly comes from deposits and savings. Commercial banks raise loan funds through both bond issuance and deposits/savings. Recently, as bond yields have fallen, commercial banks have had room to reduce loan interest rates accordingly, but savings banks have not.

Savings Banks Lack Room to Lower Interest Rates... More Conservative Lending Expected

Riding the base rate hike last year, savings banks pushed deposit and savings interest rates up to as high as 7%. Although the funding cost for loans increased this way, the legal maximum interest rate caps loan interest rates at 20%, making losses inevitable for savings banks. This is also why savings banks' performance has deteriorated. Another savings bank official said, "Unlike commercial banks, we currently lack the capacity to lower loan interest rates."

The rising delinquency rate at savings banks is also an obstacle to lowering interest rates. When delinquency rates increase, banks must manage risks and tend to adopt a conservative approach by reducing lending. According to the Korea Deposit Insurance Corporation, the average delinquency rate of 79 savings banks nationwide was 3.0% in the third quarter of last year, up 0.4 percentage points from the previous quarter.

Kwok Soo-yeon, a researcher at Korea Ratings' Financial Research Division 1, said, "About 50% of savings bank household loan borrowers are low-credit borrowers (bottom 20% or lower based on credit scores), representing the highest proportion of borrowers with low repayment ability across all sectors. Due to inflation, rising interest rates, and falling asset prices, household debt burdens are increasing, and delinquency rates are expected to rise further."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.