[Change of Korea's Industrial Throne①] Cars Top Surplus Last Month

February Exports Up Over 50% YoY

Likely No.1 Export Item in Trade Balance After 10 Years

Exports Surpass Semiconductors, First-Time No.1 Spotlight

With strong automobile exports, it is expected to become the largest surplus export item this year. Following its position as the top trade surplus item for four consecutive months from October last year to January this year, exports this month surged by more than 50% compared to last year.

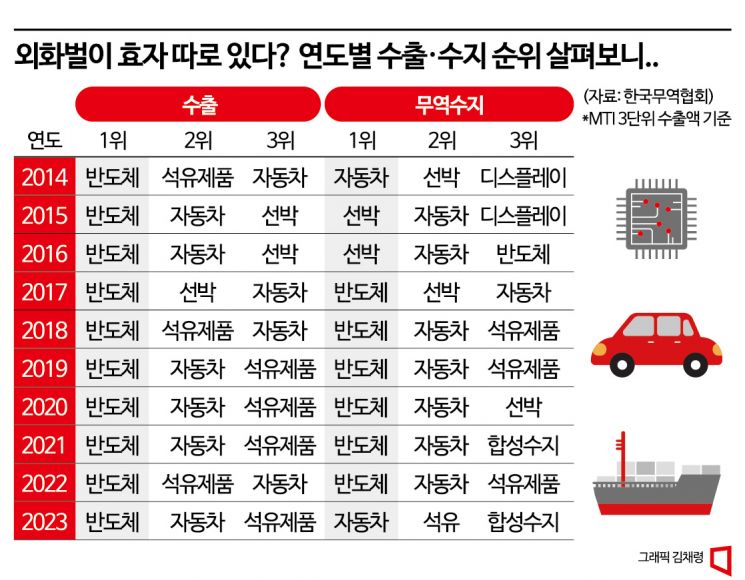

If it becomes the item with the largest annual surplus, it will be the first time in 10 years since 2014 to top the trade surplus rankings. The Korean economy has been criticized as a unicycle that runs on a single wheel, relying heavily on semiconductors. However, now automobiles have also started to play the role of a wheel driving the Korean economy. It is evaluated that the future Korean economy can run more stably with two wheels: semiconductors and automobiles.

Last month, the top export item in Korea's trade surplus (based on MTI 3-digit classification) was automobiles. About $5 billion worth of automobiles were exported and $1.4 billion worth imported, resulting in a $3.6 billion surplus. It far outpaced semiconductors ($857 million), whose export scale shrank due to sluggish market conditions, as well as the second-ranked petroleum products ($2.194 billion).

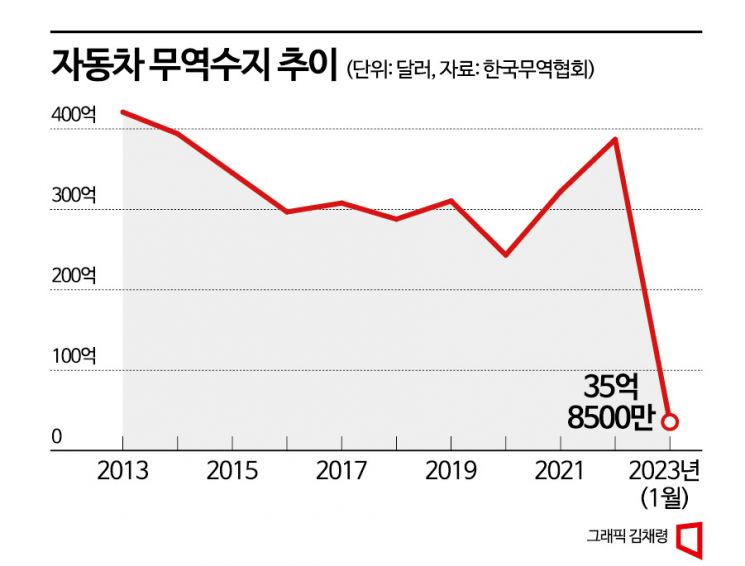

The surplus in automobile trade was the largest in over 10 years since January 2013, when it earned more than $3.7 billion. Also, the export amount was the highest ever recorded for January. Despite the slump in Korea's main export items such as semiconductors and displays, the automobile sector steadily increased overseas sales, emerging as a pillar for earning foreign currency.

According to export-import statistics from the Korea International Trade Association on the 27th, automobiles have held the top spot in monthly trade surplus since October last year, leading all items for four consecutive months through last month. Until now, semiconductors accounted for an overwhelmingly large share of Korea's exports, but as signs of demand slowdown became clear in the second half of last year, automobiles took over the number one position.

Automobile exports have been steadily rising. From July last year to January this year, they increased by double digits for seven consecutive months. Until last year, production disruptions occurred due to difficulties in parts supply, which prevented meeting both domestic and export demand properly. However, as parts supply gradually normalized, domestic and overseas sales volumes have increased. With the depreciation of the Korean won, major automakers have continued to focus more on exports than domestic sales this year.

It is more profitable to receive payment in dollars rather than won, even when selling the same car. The trend has been similar this month. According to export statistics compiled by the Korea Customs Service in ten-day increments, passenger car exports from the 1st to the 20th of this month amounted to $3.358 billion, a 57% increase compared to the same period last year.

Automobiles are considered one of Korea's main export items alongside semiconductors, petroleum products, and ships. However, until now, semiconductors have dominated Korea's exports. Although the trade surplus rankings have occasionally changed due to industry cycles, semiconductors have held the top spot in export volume for 10 consecutive years since 2013. While semiconductor exports are large, imports are also substantial, which somewhat disadvantages the trade surplus calculation. Nevertheless, semiconductors held the number one trade surplus position for seven consecutive years from 2017 to last year.

Some changes have been detected this year. Not only did automobiles take the top spot in surplus, but the gap in export amounts has also narrowed significantly. Last month, the export amount difference between semiconductors and automobiles narrowed to about $1 billion. Typically, during periods of semiconductor industry boom, export amounts were two to three times higher than automobiles, often tens of billions of dollars more. This year, semiconductors still maintain the top spot in export volume but have dropped to 8th place in trade surplus ($857 million), behind ships and displays.

The increase in automobile exports is largely due to the rise in shipments to the United States. The U.S. accounts for about 40% of Korea's automobile exports. Although Korea's largest automakers Hyundai Motor and Kia operate local plants in the U.S., local production alone cannot meet demand, so many vehicles are shipped from Korea. Especially, the recent rapid increase in demand for eco-friendly vehicles such as electric cars in the U.S. has driven export expansion.

Electric vehicles like the Ioniq 5 and EV6, which use dedicated platforms, as well as hybrids and plug-in hybrids, are mostly produced at Korean plants (Ulsan, Hwaseong, etc.) to meet local demand. Additionally, Korean GM and Renault Korea Motors, which have experienced ups and downs in the past, are gradually increasing export volumes centered on sport utility vehicles (SUVs) to their main markets in North America and Europe.

Although some markets show signs of demand slowdown due to rising prices and interest rates, the industry expects steady new car demand overall until the second half of this year. This is because accumulated waiting demand is substantial and the transition to eco-friendly vehicles is accelerating.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.