19,219 Households Moved In Nationwide in March

Seoul Metropolitan Area Down 51% Month-on-Month

Increase in Seoul Metropolitan Area Housing Supply Expected After May

Supply Impact Likely to Continue

Next month, 10,079 apartment units will be occupied in the Seoul metropolitan area, signaling a slowdown in supply. However, the number of apartment move-ins in the metropolitan area is expected to increase after May, likely causing both sale and rental prices to weaken due to the supply impact.

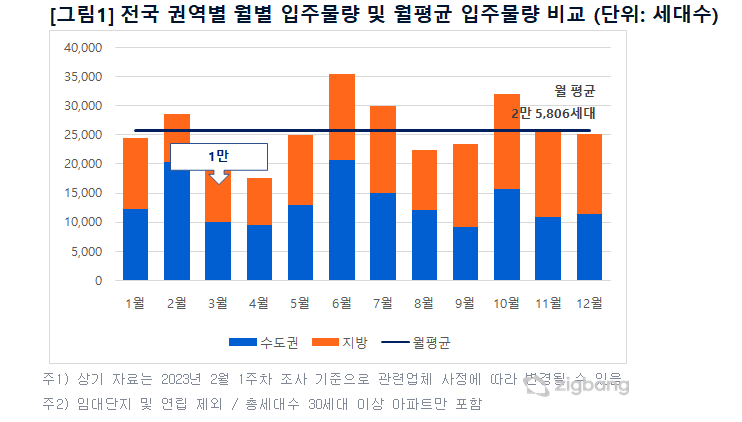

Comparison of Monthly Move-in Volume and Monthly Average Move-in Volume by Region Nationwide (Photo by Zigbang)

Comparison of Monthly Move-in Volume and Monthly Average Move-in Volume by Region Nationwide (Photo by Zigbang)

According to real estate platform Zigbang on the 27th, 19,219 apartment units nationwide will be occupied next month. This is 26% less than this year's monthly average move-in volume (25,806 units). In particular, the number of move-ins will decrease mainly in the metropolitan area, where the volume was concentrated in January and February. In March, the metropolitan area will see 10,079 units occupied, which is about 25% less than the monthly average volume (13,432 units) and 51% less than the previous month. In Seoul, only 239 units will be occupied, marking a 96% decrease compared to the previous month. There are no planned move-ins in Seoul for April either.

The number of apartment move-ins in provincial areas in March is 9,140 units, about 12% more than the previous month but approximately 26% less than this year's monthly average (12,374 units). △Daegu will have 4,085 units, △Chungnam 1,903 units, and △Gyeongnam 1,631 units scheduled for move-in.

For the metropolitan area, where move-ins are concentrated for the time being, rental prices are expected to continue weakening due to the supply volume. Seoul, where large-scale complexes were mainly occupied in January and February, will see a temporary lull in move-ins in March and April, but the volume is expected to increase again from May.

Ham Young-jin, head of Zigbang Big Data Lab, said, "In Gyeonggi Province, areas such as Yongin, Pyeongtaek, Siheung, and Hwaseong, where move-ins have recently been concentrated, still have a significant volume scheduled, so there will likely be a backlog of listings and price declines around these complexes."

Incheon is also expected to face strong downward pressure on rental prices due to many scheduled move-ins this year. A total of 42,723 units are planned to be supplied in Incheon this year, which is 10% more than last year's 38,840 units, when the move-in volume was high.

Amid oversupply, sale and rental prices are expected to continue declining. According to Real Estate R114, the apartment price change rate in Seoul for the last week of February was -0.08%, a larger drop than the previous week's -0.06%. In Seoul, transactions mainly involved urgent sales in large complexes, and the number of districts with price drops exceeding 0.10% increased from 7 to 9 last week. The largest declines were in Gangbuk (-0.25%), Dongdaemun (-0.25%), Guro (-0.19%), and Gangnam (-0.17%).

During the same period, the rental market saw increased demand for switching to lower-priced units due to the impact of move-in volumes and adjusted prices, which widened the decline. Both Seoul and new towns fell by 0.16%, while Gyeonggi and Incheon dropped by 0.14%. In particular, Seoul saw larger declines in rental prices in large complexes in Gangnam-gu, where rental prices are high, reflecting new move-in volumes such as Gaepo Xi Presidents.

Lab head Ham said, "There is growing interest in whether follow-up purchases will continue as urgent sales transactions occur in specific areas and complexes, and whether this will lead to price rebounds. However, in areas with concentrated move-in volumes, sale and rental prices are likely to weaken simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.