View of apartment complexes in downtown Seoul from Lotte World Tower Seoul Sky in Songpa-gu, Seoul

View of apartment complexes in downtown Seoul from Lotte World Tower Seoul Sky in Songpa-gu, Seoul[Photo by Yonhap News]

Despite comprehensive deregulation measures and a trend of lowering loan interest rates at commercial banks, both sales and jeonse prices continued to weaken. In Seoul, inventory accumulation is ongoing mainly in large complexes, and in the first-generation new towns, the decline widened centered on older complexes in Sanbon, Ilsan, and Jungdong, which showed slight weakness last week.

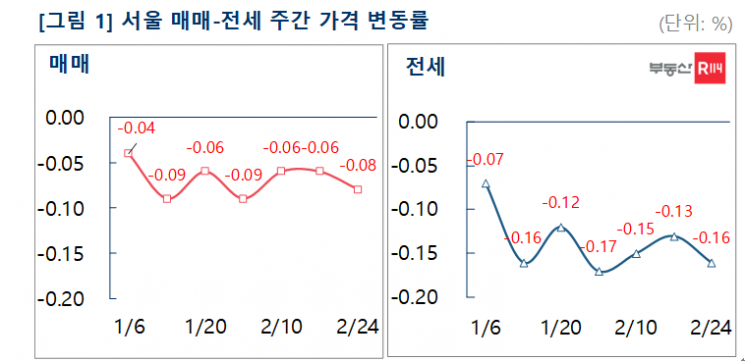

According to Real Estate R114 on the 26th, the apartment price change rate in Seoul for the last week of February fell by 0.08%, a larger drop than the previous week (-0.06%). Reconstruction prices fell by 0.07%, and general apartments decreased by 0.08%. New towns and Gyeonggi·Incheon fell by 0.08% and 0.10%, respectively.

In Seoul, transactions continued mainly for urgent sales in large complexes, and the number of districts falling more than 0.10% increased from 7 to 9 last week. By region, the declines were in the order of ▲Gangbuk (-0.25%) ▲Dongdaemun (-0.25%) ▲Guro (-0.19%) ▲Gangnam (-0.17%) ▲Seodaemun (-0.17%) ▲Geumcheon (-0.15%) ▲Gangseo (-0.12%) ▲Gangdong (-0.11%) ▲Yangcheon (-0.10%) ▲Yongsan (-0.06%).

In new towns, the decline in first-generation new towns (-0.05% → -0.11%) more than doubled compared to the previous week. The downward trend continued mainly in large-sized units. By region, the declines were in ▲Sanbon (-0.25%) ▲Ilsan (-0.16%) ▲Jungdong (-0.13%) ▲Gwanggyo (-0.13%) ▲Bundang (-0.09%) ▲Pangyo (-0.06%) ▲Dongtan (-0.04%) ▲Pyeongchon (-0.01%).

In Gyeonggi·Incheon, the declines were in the order of ▲Gunpo (-0.35%) ▲Suwon (-0.22%) ▲Goyang (-0.21%) ▲Hwaseong (-0.16%) ▲Incheon (-0.13%) ▲Siheung (-0.12%) ▲Bucheon (-0.11%) ▲Yongin (-0.11%).

The jeonse market saw an increased decline due to the impact of February move-in volumes and rising demand to switch to adjusted lower prices. Seoul and new towns each fell by 0.16%, and Gyeonggi·Incheon fell by 0.14%.

In Seoul, the decline was larger mainly in large complexes in Gangnam-gu with high jeonse prices due to new move-in volumes such as Gaepo Xi Residence. By region, the declines were ▲Gangnam (-0.45%) ▲Seodaemun (-0.31%) ▲Dongdaemun (-0.30%) ▲Geumcheon (-0.27%) ▲Gangbuk (-0.26%) ▲Yangcheon (-0.24%) ▲Guro (-0.21%) ▲Seongbuk (-0.20%).

In new towns, the declines were in the order of ▲Ilsan (-0.45%) ▲Gwanggyo (-0.35%) ▲Sanbon (-0.30%) ▲Jungdong (-0.22%) ▲Bundang (-0.15%) ▲Pangyo (-0.15%) ▲Dongtan (-0.09%) ▲Pyeongchon (-0.07%). In Gyeonggi·Incheon, the declines were ▲Goyang (-0.41%) ▲Suwon (-0.26%) ▲Incheon (-0.22%) ▲Hwaseong (-0.18%) ▲Siheung (-0.17%) ▲Yongin (-0.14%) ▲Bucheon (-0.11%) ▲Namyangju (-0.08%).

Baek Saerom, lead researcher at Real Estate R114, said, "Although the base interest rate hikes that continued for 1 year and 5 months since August 2021 have stopped, the possibility of additional rate hikes cannot be ruled out." She added, "Given the market uncertainties such as high inflation and prolonged economic recession concerns, it is expected to take a considerable time until a trend reversal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.