Japan Whisky Import Value $4.15 Million... 31% Increase YoY

Beer Also Recovering... $14.48 Million, 111% Increase YoY

Imports and sales of Japanese alcoholic beverages are rapidly increasing. The boycott movement against Japanese products, known as ‘No Japan,’ has been fading year by year, and amid the COVID-19 pandemic, the popularity of whiskey highballs among young consumers has surged, leading to a rapid increase in demand for related products.

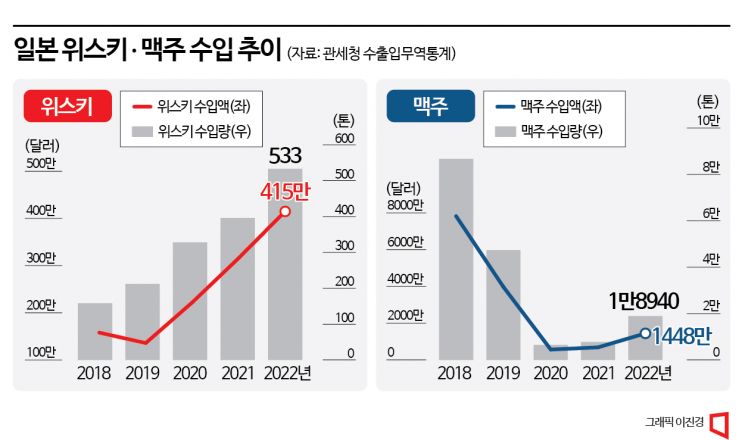

According to customs import-export trade statistics on the 27th, last year’s import value of Japanese whiskey was $4.148 million (approximately 5.4 billion KRW), a 31.4% ($991,000) increase compared to 2021’s $3.157 million. During the same period, the import volume also rose 34.6% from 396 tons to 533 tons. The import value of Japanese whiskey, which was around $1.58 million in 2018, decreased to about $1.36 million in 2019 when the boycott movement intensified, but it has been steadily increasing since the following year when the COVID-19 pandemic began spreading.

Japanese beer is also showing a clear recovery trend. Last year, the import value of Japanese beer was $14.484 million (approximately 18.8 billion KRW), a 110.7% increase compared to the previous year. The import value of Japanese beer, which reached $78.3 million (about 101.7 billion KRW) in 2018, dropped to half that amount at $39.756 million in 2019 and plummeted further to $5.668 million in 2020. However, it began to rebound in 2021 ($6.875 million), and last year the import volume more than doubled compared to the previous year.

Suntory Whiskey 'Gakubin'

Suntory Whiskey 'Gakubin'

The recent popularity of Japanese alcoholic beverages is led by whiskey brands represented by Suntory’s ‘Yamazaki’ and ‘Hibiki.’ Before the boycott movement, beer was the flagship product of Japanese alcoholic beverages, but with the rise of home drinking and solo drinking culture during the COVID-19 pandemic, more young consumers have been exposed to high-end whiskey, increasing interest. This interest naturally extended to Japanese whiskey, which has long been internationally recognized for its quality.

Japanese whiskey, in particular, stimulates consumer purchasing desire due to its rarity, which is often harder to obtain than many Scotch whiskies. Since the 1990s, Japan’s prolonged economic stagnation and recession have also affected the whiskey industry, leading to reduced production. Due to the long aging period characteristic of whiskey, future demand is difficult to predict, and the previously reduced production volume has recently resulted in supply shortages and price increases. This is why it is not easy to increase import volumes despite the recent whiskey boom in Korea.

The trend of drinking highballs?distilled spirits mixed with soda water?is also attracting attention as a reason for seeking Japanese whiskey, overpowering the ‘No Japan’ sentiment. Japan is one of the countries where whiskey highballs are most popular, and especially the highball made with Suntory’s ‘Kakubin’ is regarded as the standard for highballs domestically, enjoying high popularity. The relatively affordable price of Kakubin also encourages demand expansion, as young consumers can purchase it without much burden. The industry expects the popularity of highballs to continue for the time being.

The sales growth trend is also clear. According to a major supermarket, sales of Japanese whiskey and beer increased by 22.4% and 53.5%, respectively, compared to the previous year. Although sales of Japanese whiskey have decreased by 31.0% year-on-year as of the 22nd of this month, a company official explained, "This decline is due to supply shortages caused by supply-demand imbalance, not a lack of demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.