[Asia Economy Yeongnam Reporting Headquarters Reporter Hwang Du-yeol] Korea Housing Finance Corporation (HF) announced on the 24th that it will freeze the March interest rates for the long-term fixed-rate, installment repayment mortgage loan called the ‘Special Bogeumjari Loan.’

Starting in March, customers who are not familiar with non-face-to-face applications such as online applications will also receive a 0.1 percentage point reduction benefit when applying and submitting in person.

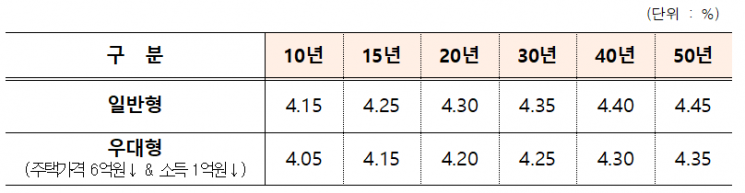

In this case, the interest rates for face-to-face and non-face-to-face (internet electronic contract) applications will be applied equally. For the general type, the rates range from 4.15% per annum (10 years) to 4.45% (50 years), and for the preferential type, from 4.05% per annum (10 years) to 4.35% (50 years), effectively providing a 0.1 percentage point reduction benefit.

The benefit will also apply to customers who have already applied for a loan, with the reduced interest rate applied at the time the loan is executed in March.

An HF Corporation official said, “Compared to early February, the 5-year government bond yield rose by more than 40 basis points (1bp = 0.01 percentage points), significantly increasing the corporation’s funding costs,” adding, “We decided to freeze the interest rates to reduce financial costs for low-income and real demand borrowers.”

To alleviate customer inconvenience, HF Corporation plans to expand the banks accepting face-to-face applications, currently limited to SC First Bank, to include Industrial Bank of Korea as early as the end of March, with further expansions planned.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)