Financial Supervisory Service Issues Consumer Alert on Driver Insurance

Unlike Auto Insurance, Not Mandatory

Covers Only Expenses, Not Coverage Limits

Excludes Coverage for Drunk Driving and Hit-and-Run Cases

[Asia Economy Reporter Minwoo Lee] The Financial Supervisory Service (FSS) recently urged that driver insurance, which has been gaining popularity, should be carefully reviewed and subscribed to since it is not a mandatory insurance. They emphasized that only the actual expenses incurred are covered rather than the entire coverage limit, and that no coverage is provided in cases of drunk driving, unlicensed driving, or hit-and-run incidents.

On the 23rd, the FSS issued a consumer alert regarding driver insurance for these reasons. Since there are usually more than 100 optional riders available and the coverage details are diverse, it can be difficult for consumers to fully understand the product.

Driver insurance is a product that covers injury or financial losses related to criminal or administrative liabilities arising from car accidents. Recently, non-life insurance companies have been fiercely competing by increasing coverage for lawyer fees related to car accidents, injury insurance payments for minor injuries, and criminal settlement fees. The number of new driver insurance contracts increased from 396,000 in July last year to 603,000 in November of the same year.

"Driver insurance is not mandatory insurance"

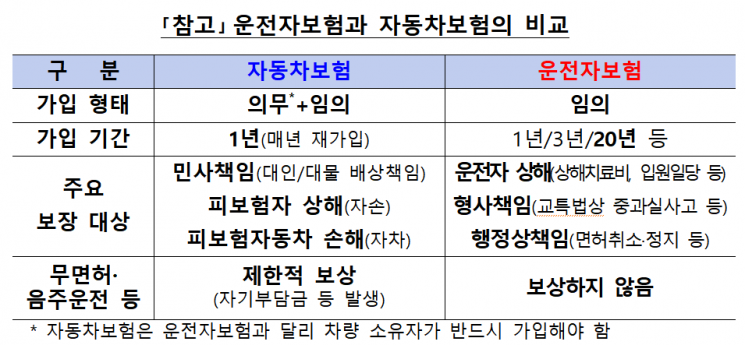

First, it is important to understand that driver insurance is not mandatory, unlike automobile insurance. It differs from automobile insurance, which mainly covers civil liabilities (bodily injury and property damage compensation) arising from car accidents, so there is no absolute need to subscribe.

Recently, the special rider for lawyer fees, which has expanded coverage up to the police investigation stage, is only limitedly covered in cases of death or serious violation of laws resulting in injury, such as police investigations. In the past, lawyer fees were only covered when the insured was detained or prosecuted for causing bodily injury to others. Recently, the coverage scope of this rider has been expanding to include police investigations (non-prosecution), non-indictment, and summary indictment. However, since this is only paid in very limited cases such as fatal accidents or serious legal violations (signal and instruction violations, crossing the center line, etc.) causing injury, it is necessary to carefully check the insurance payment conditions.

"Only actual expenses are covered for financial losses... Drunk driving and hit-and-run are excluded"

Coverage related to financial losses only reimburses the actual expenses incurred, not the full coverage limit. Special riders related to lawyer fees, fines, and other financial losses (actual expenses) will not be paid redundantly even if the same rider is subscribed to more than once. Compensation is proportional to the actual expenses incurred, not the full coverage limit.

Generally, driver insurance covers injuries and financial losses caused by traffic accidents while driving a car, but insurance accidents occurring during unlicensed driving, drunk driving, driving under the influence of drugs, or hit-and-run (fleeing the scene) are not covered.

"Check additional coverage first... Carefully review detailed terms"

If you want to expand the coverage scope or subscription amount of your existing driver insurance, it is necessary to first check whether you can add related riders rather than subscribing to a new driver insurance policy. Some insurers operate special riders for existing subscribers that allow increasing the limit of fine coverage or expanding the coverage scope of lawyer fees.

Also, to subscribe to driver insurance more affordably, you can choose a pure protection insurance product that has no maturity refund and only provides coverage functions.

Above all, it is essential to thoroughly check the product itself. Since driver insurance typically has more than 100 optional riders, it can be difficult for consumers to fully understand all the rider details. Even riders with similar names may have different coverage contents depending on the company, or riders with the same coverage may have different names. Therefore, you should carefully review the coverage details through the terms and conditions and product brochures before subscribing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)