Base Rate Held Steady on the 23rd

Bank Deposit and Loan Interest Rates Are Falling

[Asia Economy Reporter Sim Nayoung] On the 23rd, although the Bank of Korea kept the base interest rate steady at 3.50%, commercial banks' interest rates have been on a downward trend. Despite no signs of the base rate falling, bank deposit and loan rates are moving independently. This week, KakaoBank and K Bank lowered their credit loan and overdraft interest rates by up to 0.7 percentage points. KB Kookmin Bank will also reduce its mortgage loan interest rates by 0.35 percentage points starting from the 28th. NH Nonghyup is also discussing lowering credit loan interest rates.

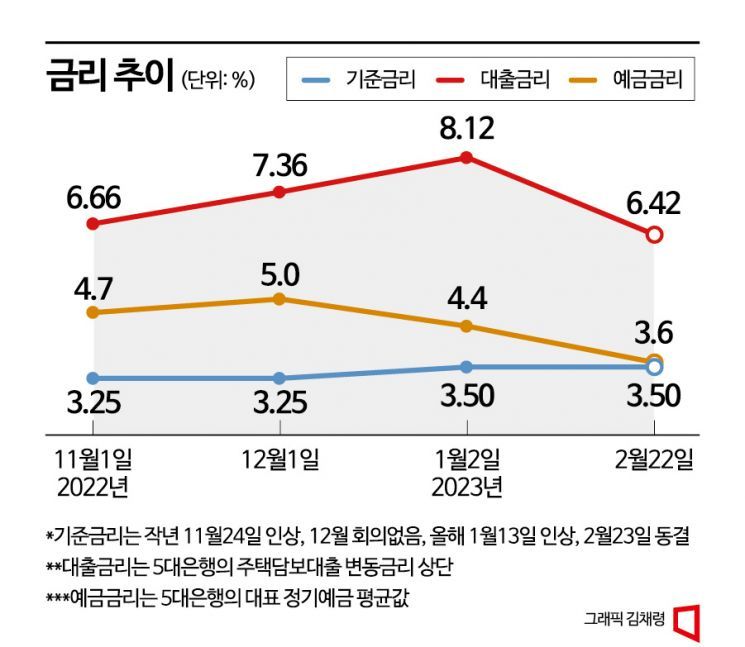

From November last year to February this year, the Bank of Korea raised the base rate twice (November 24 and January 13) and once held it steady (February 23) during monetary policy meetings. During this period, the variable mortgage loan rates of the five major banks (KB, Shinhan, Hana, Woori, NH Nonghyup) fluctuated like a rollercoaster: 'November 5.09~6.66% → December 5.77~7.36% → January 5.48~8.12% → February 4.35~6.42%'. Deposit rates also showed an early downward trend during the same period, moving from '4.7% → 5.0% → 4.4% → 3.6%'.

Dissonance with the Base Interest Rate

The main reason commercial bank interest rates are moving in a different direction is due to pressure from financial authorities. After President Yoon Seok-yeol warned banks, which enjoyed record profits last year from "interest business," about a "money feast," banks began to lower their rates one after another. Additionally, as the bond market stabilized and bank bond yields fell, this influenced the reduction of loan interest rates.

Regarding criticism that the base interest rate and bank interest rates are out of sync, financial authorities are cautious. At a press conference on the 14th, Lee Bok-hyun, Governor of the Financial Supervisory Service, stated, "Most citizens have already individually felt the effects of the rate hikes, and since the second half of last year the economy has been worsening due to reduced consumption, the authorities' position is that there is no need to worry about the rate hikes having no effect."

A senior official from the Financial Services Commission also analyzed that "the deposit and loan rates, which had 'overshot' compared to the base rate hike trend due to bond market volatility in the second half of last year, are returning to their proper levels."

Concerns from the Bank of Korea and Commercial Banks

The stance of financial authorities differs from that of the Bank of Korea and commercial banks. A senior Bank of Korea official said, "Although the base rate is held steady this time, with rising gas and electricity prices clearly pushing inflation up and the need to lower inflation expectations, the possibility of future rate hikes remains open. In this situation, if commercial banks lower their rates, there is a risk that monetary policy could be undermined."

There are also voices expressing concern about the government's artificial price controls. Besides urging banks to lower high loan interest rates, the authorities also told banks to raise deposit rates when money flowed into banks due to low deposit rates, then reversed course and told them to lower deposit rates again. As a result, recently, the fixed deposit rates of the five major banks have fallen to levels similar to the base interest rate.

An executive at a commercial bank expressed concern, saying, "If the government pursues livelihood policies through direct price controls without distinguishing between finance and welfare, it causes side effects that distort the effectiveness of monetary policy. It only prolongs the situation without offering fundamental solutions to vulnerable borrowers."

Banks are also under pressure. A commercial bank official who has not yet announced plans to lower rates said, "Since the beginning of the year, we have been continuously lowering loan interest rates under pressure from authorities, and after last year's earnings were announced, the pressure intensified. Internally, there is a sentiment that 'there is no more room to lower rates,' so we are considering the extent of further cuts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)