[Asia Economy Reporter Kwon Jae-hee] Hanwha Group's sponsor office REIT, Hanwha Trust Management Real Estate Investment Company (Hanwha REIT), is pursuing an initial public offering (IPO) aiming for listing on the KOSPI market.

On the 23rd, Hanwha REIT announced that the effectiveness of the securities registration statement submitted to the Financial Services Commission has taken effect, and it will begin the full-scale public offering and listing procedures aiming for a listing at the end of March. Previously, Hanwha REIT received business approval from the Ministry of Land, Infrastructure and Transport in September last year.

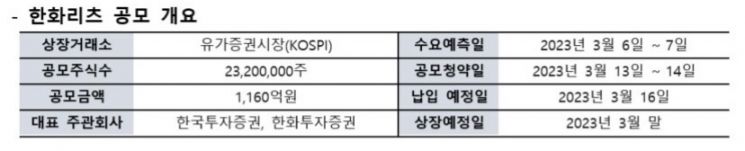

The total number of shares offered by Hanwha REIT is 23.2 million, with a single public offering price set at 5,000 KRW. The demand forecast for institutional investors will be conducted over two days from March 6 to 7, and the subscription for public offering shares for general investors will take place from the 13th to the 14th. The company plans to raise approximately 116 billion KRW through this offering, with Korea Investment & Securities and Hanwha Investment & Securities jointly serving as lead underwriters.

Hanwha REIT is a sponsor office REIT holding office assets owned by Hanwha Financial affiliates. The sponsor of Hanwha REIT is Hanwha Life Insurance, which will hold a 46% stake upon completion of the IPO. As a top-tier sponsor REIT with a large group affiliate as the major shareholder, it is evaluated to have secured high reliability and stability.

Hanwha REIT currently owns the Hanwha General Insurance Yeouido building and four Hanwha Life Insurance buildings. The included assets have long-term lease contracts of 5 to 7 years mainly with financial affiliates within the group, resulting in low volatility. The company aims for an annual dividend in the high 6% range based on stable assets.

Park Sung-soon, Head of the REIT Business Division at Hanwha Asset Management, said, "Sponsor REITs holding group assets can secure high stability in volatile market conditions like now," adding, "Hanwha REIT focuses on enhancing stability through relatively high annual dividend rates and a strategy of evenly distributed loan maturities, and based on this, it will lead the revitalization of the domestic REIT market after listing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)