10-Year Bond Surpasses 0.5% for 2 Consecutive Days

BOJ Executes Unexpected Government Bond Purchases

Market Bets on New Governor Abandoning YCC Policy

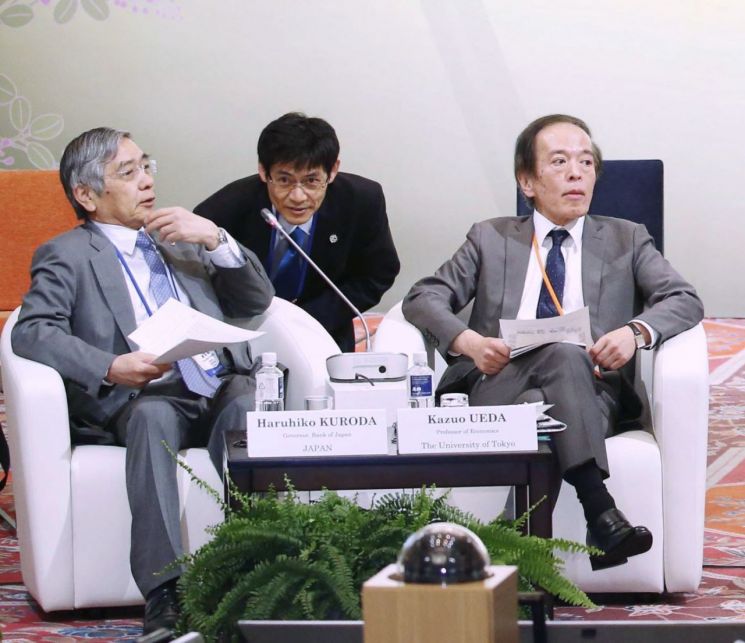

Current Governor of the Bank of Japan Haruhiko Kuroda (left in the photo) and newly appointed Governor Kazuo Ueda (right in the photo) [Image source=Yonhap News]

Current Governor of the Bank of Japan Haruhiko Kuroda (left in the photo) and newly appointed Governor Kazuo Ueda (right in the photo) [Image source=Yonhap News]

[Asia Economy Reporter Lee Ji-eun] Japan's 10-year government bond yield exceeded the Bank of Japan (BOJ)'s upper limit of 0.5% for the second consecutive day on the 22nd. This is analyzed as a result of growing expectations for a shift to a tightening monetary policy ahead of the inauguration of Kazuo Ueda, the designated BOJ Governor, scheduled for April.

According to Bloomberg, on the 22nd, Japan's 10-year government bond yield closed at 0.502%, surpassing 0.5% for two consecutive days. After hitting 0.5% on the 13th, the 10-year bond yield even rose to 0.507% intraday on the 17th. In response, the BOJ announced an unscheduled emergency bond purchase at 10 a.m. on the 22nd to defend the yield.

As market expectations strengthened that the newly appointed BOJ Governor would shift monetary policy toward a tightening stance, bond selling intensified. Previously, when the BOJ announced in December last year that it would raise the long-term yield fluctuation range, investors sold a massive amount of government bonds worth 4.8623 trillion yen (46.7685 trillion won) over a week starting from the 18th. This was the largest scale since statistics began in 2005.

Bloomberg reported, "Market participants expect the BOJ to abandon the YCC (Yield Curve Control) policy," adding, "They are trying to gauge whether the new Governor-designate Ueda leans more toward dovish or hawkish." The YCC policy refers to the central bank's unlimited purchase of government bonds to keep long-term interest rates at a certain level. Currently, the BOJ adjusts long-term rates to move within ±0.5%.

According to local foreign media, the Japanese financial sector views the new Governor-designate Ueda not as hawkish or dovish but as a pragmatist. Ueda served as a policy board member of the BOJ from 1998 to 2005, providing the theoretical background for Japan's quantitative easing introduction, but he reportedly voted against the BOJ's zero interest rate policy. He is also known for cautioning against the 'monetary policy omnipotence theory,' which assumes monetary policy can solve everything. Ueda has emphasized that in a negative interest rate environment, monetary easing alone has limits in reviving the economy and that raising potential growth rates should precede.

Accordingly, some view that the likelihood of Governor-designate Ueda rapidly and strongly pursuing hawkish policies, as the market expects, is low. Nihon Keizai Shimbun forecasted, "His first task will be to verify the side effects of long-term easing policies and promote a smooth policy transition," adding, "He will not simply continue the two-dimensional (quantitative and qualitative) easing pursued by Governor Kuroda."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.