Coinone Trading Volume Share Higher Than Ethereum

Uncertainty Remains Over Other Exchanges' Support for WEMIX Trading

[Asia Economy Reporter Lee Jung-yoon] Coinone, a domestic virtual asset exchange, is reaping significant benefits from the re-listing of WEMIX. Among the traded virtual assets, WEMIX recorded the third highest trading volume and even rose to second place at one point. Additionally, Coinone's trading volume has shown an upward trend since the re-listing.

According to the virtual asset market relay site CoinGecko, as of 3:18 PM on the 22nd, WEMIX accounted for 11.5% of the trading volume on Coinone's KWR market, ranking third after the representative virtual assets Bitcoin (29.8%) and Klaytn (15.8%). Ethereum, the leading altcoin, recorded a lower share of 10.1%. Earlier that morning, WEMIX's trading share was even higher, exceeding 15% and ranking second only to Bitcoin.

On the 16th, Coinone announced support for KRW market trading of WEMIX. On November 24th last year, the Digital Asset Exchange Association (DAXA), which includes Upbit, Bithumb, Coinone, Korbit, and GOPAX, decided to delist WEMIX due to significant violations in circulation volume, inadequate or incorrect information provision, and errors and trust damage in materials submitted during the explanation period. However, Coinone decided to re-list WEMIX in just over two months, stating that "issues related to circulation volume violations, information provision, and trust damage that occurred during the previous trading support have been resolved."

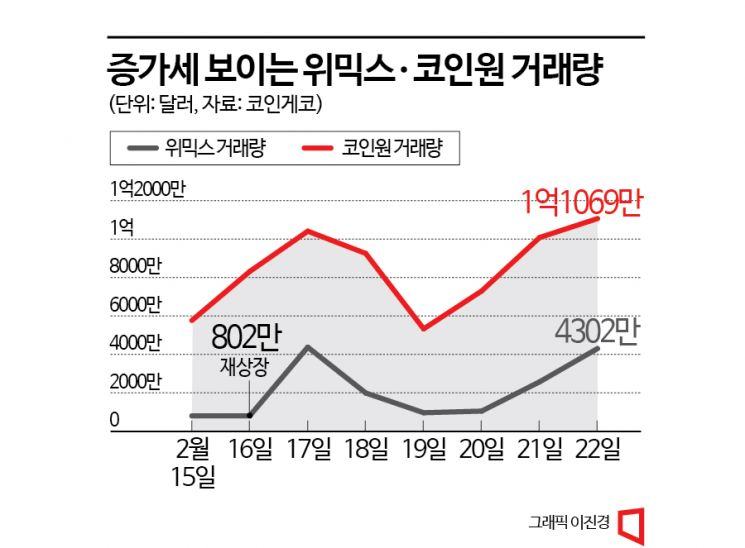

Since the re-listing, WEMIX's trading volume has increased significantly. Until the 15th of this month, it was recorded at $7.95 million, but on the 16th, the day of re-listing, it rose to $8.02 million. On the following day, the 17th, it surged to $43.74 million, more than 5.4 times the previous day. Although it showed a downward trend afterward, it was again recorded at over $43 million on this day. The price of WEMIX also surged about 90%, from $1.30 before the re-listing to $2.47 in the afternoon of this day.

As WEMIX's trading volume and price increased sharply, Coinone's daily trading volume also showed an upward trend. It rose from $57.63 million (approximately 75.2 billion KRW) on the 15th to $83.16 million the next day, and exceeded $100 million on the 17th. Although it declined afterward to $53.26 million on the 19th, it recorded over $100 million again on the previous day and this day. Among exchanges listing WEMIX, Coinone ranked first in daily trading volume, followed by Gate, XT.COM, KuCoin, and Bybit. Coinone's trading volume was 59.84% higher than Gate, which ranked second.

This effect was anticipated even on the day of re-listing, leading to predictions that other KRW market exchanges would soon support WEMIX trading. Wemade, the creator of WEMIX, also reinforced this speculation by submitting a withdrawal of three injunction appeals against Upbit, Bithumb Korea, Coinone, and Korbit at the Seoul Central District Court on the 16th, which sought to suspend the effect of their decisions to terminate trading support.

However, criticism has arisen against Coinone due to the aftermath of WEMIX's re-listing, and claims that DAXA has become ineffective have emerged, suggesting that it may be difficult to resume trading support easily. Although DAXA unanimously decided to delist WEMIX after consultation, Coinone reversed this agreement without prior consultation. It has been confirmed that Coinone did not discuss with DAXA before deciding to re-list.

An industry insider said, "It is true that the possibility of WEMIX being re-listed on other exchanges has increased since Wemade withdrew the injunction appeals," but added, "However, the period of just over two months after delisting is too short for re-listing, and with the current situation where the usefulness of DAXA is being questioned, it is uncertain whether additional trading support will resume in the near future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.