KPMG Publishes '2022 Fintech Trends Report'

Fintech Investment Slumps... Only Asia-Pacific Region Rises

Fintech Investment Outlook This Year Lowered "Interest and Policy Are Key"

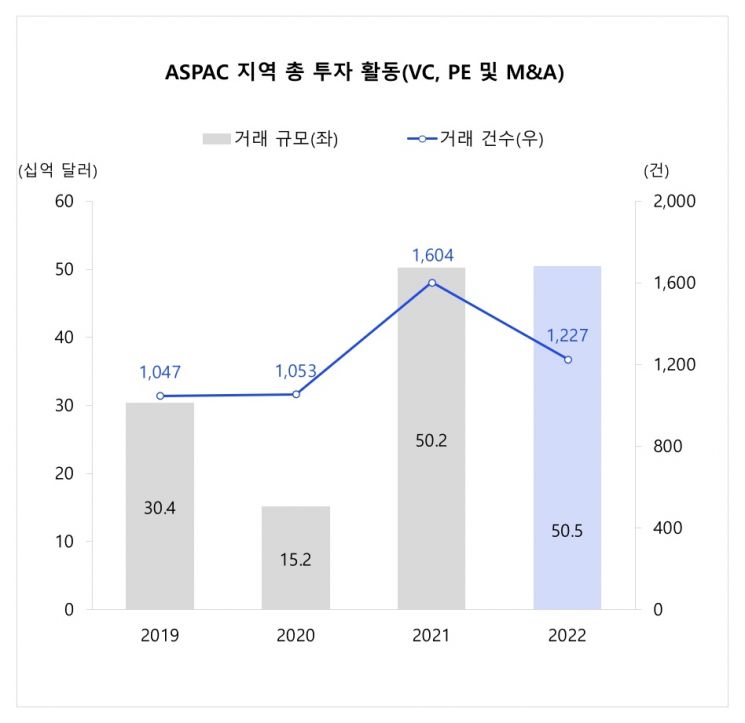

[Asia Economy Reporter Lee Seon-ae] Although global fintech investment is shrinking, fintech investment in the Asia-Pacific region alone reached an all-time high last year.

According to the report (Pulse of Fintech H2'22) published on the 22nd by global accounting and consulting firm KPMG, fintech investment in the Asia-Pacific region slightly increased from $50.2 billion in 2021 to $50.5 billion in 2022, breaking the previous year's record.

In particular, fintech-related mergers and acquisitions (M&A) in the Asia-Pacific region increased by 45.5%, from $23.3 billion in 2021 to $33.9 billion in 2022. This was driven by a mega deal where Block acquired Afterpay, Australia's largest Buy Now Pay Later (BNPL) company, for $27.9 billion.

Major venture capital (VC) investments in the Asia-Pacific region included South Korea's financial fintech company Toss raising $405 million, Indonesia's Xendit, and Singapore's Amber and Bolttech each successfully raising $300 million.

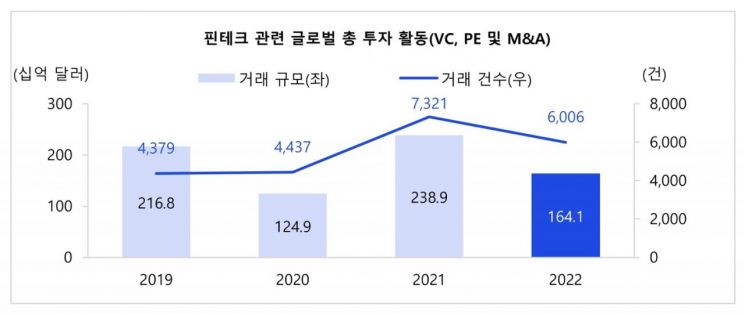

Global fintech investment across M&A, private equity (PE), and VC in 2022 amounted to 6,006 deals totaling $164.1 billion, showing a slight decrease in both deal count and volume compared to the record high of the previous year (7,321 deals, $238.9 billion). However, PE investment ($9.7 billion) and VC investment ($80.5 billion) remained strong, marking the second highest levels following the record year of 2021. Global fintech-related M&A declined from $105.1 billion in 2021 to $73.9 billion in 2022.

By region, the Americas attracted $68.6 billion in fintech investment in 2022, down about 40% from the record high of $108.9 billion in 2021, while Europe, the Middle East, and Africa (EMEA) raised $44.9 billion, a decrease of approximately 43% from $79 billion the previous year. Nevertheless, investments in fintech were evenly distributed across various emerging financial hubs including South Korea, Italy, Malaysia, and the UAE, in addition to established financial centers like the United States and the United Kingdom.

Investment in Regtech surged 57.6%, from $11.8 billion in 2021 to $18.6 billion in 2022, making it the most prominent area of interest last year. The report analyzed that “as companies increasingly comply with complex regulatory obligations while seeking cost reductions, investment in Regtech is rapidly increasing.”

The payments sector raised $53.1 billion last year, slightly down from $57.1 billion in 2021. Investment in cryptocurrency and blockchain fell by about 23%, from $30 billion in 2021 to $23.1 billion last year, with the decline particularly pronounced in the second half of the year due to the Luna incident and FTX bankruptcy.

Global fintech investment this year is expected to be relatively subdued compared to last year. In particular, while M&A activity is anticipated to recover, deal sizes are expected to be much smaller as investors wait for valuations of late-stage startups to stabilize. However, considering the rapid global transformation of financial services and the increasing convergence of financial and non-financial services, the long-term outlook for fintech investment remains quite positive.

Joa Jae-bak, Vice President and Fintech Leader at Samjong KPMG, analyzed, “Although fintech investment decreased overall last year due to the global recession, the share of fintech investment in the Asia-Pacific region has risen from less than 3% of the global total in 2010 to over 30% in 2022, positioning Asia, including South Korea, as a main stage.” He added, “Considering the current fintech market status and investment trends, fintech companies need to focus on discovering differentiated business models and profitability in areas such as business-to-business (B2B), business-to-business-to-consumer (B2B2C), embedded finance from the perspective of financial and non-financial convergence, and ESG (environmental, social, and governance). Continuous attention and policy support to promote fintech scale-up, investment, and collaboration are also important.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.