Financial Authorities Pressure Banks to Lower Interest Rates

Household Loan Rates Cut First

Corporate Loans Relatively Overlooked

[Asia Economy Reporter Sim Nayoung] It has been revealed that the pace of interest rate cuts on corporate loans, including loans for self-employed individuals and small and medium-sized enterprises (SMEs), is much slower than that of household loans. Although financial authorities and banks are rolling out financial support measures for SMEs, they appear relatively neglected in terms of interest rates.

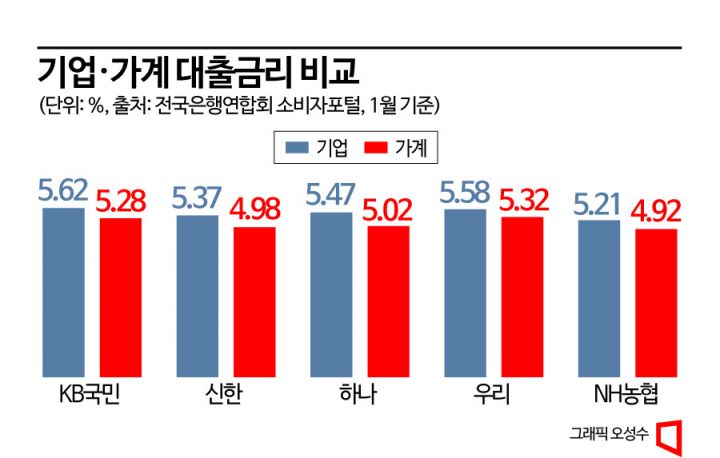

According to the consumer portal disclosure of the Korea Federation of Banks as of January 23, the interest rates on corporate loans at commercial banks were up to 0.4 percentage points higher than those on household loans. This is because, depending on the bank, the reduction in corporate loan interest rates was smaller than that of household loans, or the increase was more significant than that of household loans.

The Decline in Corporate Interest Rates is Half That of Households

Compared to December last year, in January this year, Woori Bank's household loan interest rate fell by 0.41 percentage points (from 5.73% to 5.32%), whereas the corporate loan interest rate dropped by only 0.21 percentage points (from 5.79% to 5.58%). At Hana Bank, household loans decreased by 0.33 percentage points (from 5.35% to 5.02%), but corporate loans fell by just 0.17 percentage points (from 5.64% to 5.47%). Shinhan Bank also saw a larger decline in household loans at 0.32 percentage points (from 5.30% to 4.98%) compared to corporate loans at 0.27 percentage points (from 5.64% to 5.37%).

NH Nonghyup Bank's loan interest rates increased during the same period. Household loans rose by 0.15 percentage points (from 4.77% to 4.92%), while corporate loans jumped by 0.35 percentage points (from 4.86% to 5.21%). Only Kookmin Bank saw corporate loan rates fall by 0.2 percentage points (from 5.82% to 5.62%) while household loan rates increased by 0.19 percentage points (from 5.09% to 5.28%), but in terms of corporate loan rates, it remained the highest among the five major banks.

Why are corporate loan interest rates higher than those for households? This is because financial authorities' pressure to lower rates is focused on households, and as the economy worsens, banks reflect the risk of loan defaults by charging relatively higher rates to corporations.

An official from a commercial bank explained, "For household loan interest rates, the rate is set by adding a bank margin (spread) to the base rate and then subtracting preferential rates. Recently, household loan rates have been falling by reducing this spread. However, for corporate loans, the situation varies greatly by industry, and as the economy deteriorates, banks have no choice but to raise the spread for industries with bleak prospects."

Self-Employed Facing Heavy Interest Burden, Loans Declining for 5 Consecutive Months

Banks are also building additional loan loss provisions to prepare for default risks under the direction of financial authorities, but this applies to corporate loans rather than household loans. Since mortgage loans are secured by collateral, the need for provisions is lower, but corporate loans, which have a smaller collateral ratio and a higher credit ratio than household loans, are different.

Another bank official said, "From the bank's perspective, they have to set aside a lot of provisions because of corporate loans, so it feels unfair if they cannot receive the proper interest rates. Financial authorities understand this and tell banks to support small business owners, but they do not demand a drastic cut in corporate loan interest rates like they do for households," he explained.

Loans to self-employed individuals, who face a heavy interest burden, have been declining for five consecutive months. As of the 20th, the outstanding balance of personal business loans at the five major banks was 312.7035 trillion won. This is 2.5644 trillion won less than the peak recorded in September last year (315.2679 trillion won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.