Hana Financial Group, 2023 Financial Consumer Trend Analysis

Worsening Household Conditions, Saving Small Change with Jupjup Investment Strategies

[Asia Economy Reporter Bu Aeri] This year, the trend of 'defense investment'?financial consumers strengthening efforts to protect asset value?is expected to continue.

Hana Financial Management Research Institute released the '2023 Financial Consumer Trends and Financial Opportunities Report' on the 22nd, stating, "Due to the economic slowdown, a safe and frugal financial management attitude is expected to spread throughout financial life." However, spending on self-development and consumption of luxury and small luxury goods are still expected to continue.

The institute presented this year's financial consumer trends as 'defense investment,' 'collecting small change,' 'spread of investment money,' 'focus on oneself,' 'green consumption,' 'one-on-one micro-customized management,' 'Phygital (Physical+Digital),' 'evolution of digital payments,' and 'rise of the Alpha generation.'

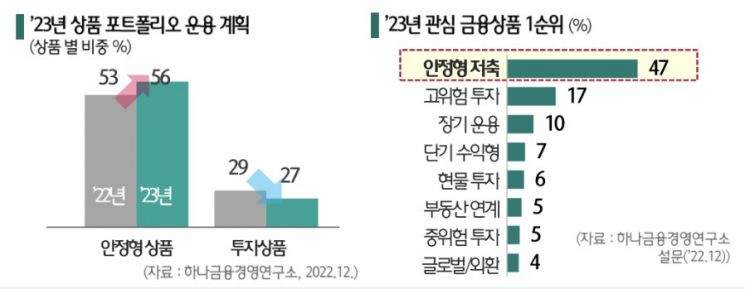

According to a survey conducted by the institute targeting 1,000 financial consumers aged 20 to 64, 43% expected household financial conditions to worsen this year compared to last year, which is four times higher than the 12% who expected improvement. Because of this, surplus funds are predicted to move toward stable products such as bonds rather than high-risk, high-return products, and awareness of long-term asset management like pensions will be strengthened as an extension of asset defense, the institute predicted.

With the unstable economic situation, demand for managing even small amounts of money frugally is increasing, strengthening the preference for small-amount investment. 71% of consumers expressed willingness to use small-amount investment services for financial management this year, and 61% chose 'saving' as the top strategy to achieve their financial management goals.

The institute expects 'Phygital,' a combination of physical space and digital, to become mainstream this year. Phygital refers to the integration of offline stores and convenient digital services and is emerging mainly in the distribution industry. Financial companies' branch spaces are also expected to develop into spaces emphasizing cultural and brand experiences and innovative digital services.

This year, competition among banks to capture the 'Alpha generation,' born after 2010, is predicted to intensify in the financial sector. The Alpha generation is a generation born into a low birthrate and aging society with abundance and has even received allowance management education, known as the 'Naedonnaegwan (I manage my own money)' generation. Currently, major commercial banks and internet-only banks operate services for minors, and Hana Bank targets even those under 14 years old.

Shin Sanghee, senior researcher at Hana Financial Management Research Institute, said, "This year, financial companies' efforts to diversify branch space utilization through digital technology, or 'Phygitalization,' will strengthen. As consumers begin to fully feel the economic slowdown, safe-oriented asset management and small-amount investment are likely to spread."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.