Toyota and Lexus Fail to Recover Sales After No Japan Movement

Slow Response to Rapid EV Transition in Korean Market

Increased Competition from Domestic and Imported Hybrid Models

Hyundai Knocks on Japanese Market Door with EVs for First Time in 13 Years

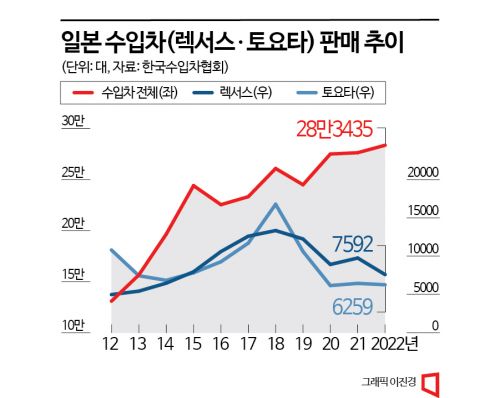

[Asia Economy Reporter Su-yeon Woo] In 2020, sales of Lexus and Toyota, representative Japanese car brands, plummeted to around 15,000 units, less than half of their past figures. This was the aftermath of the 2019 boycott of Japanese products. At the time, many in the industry considered it a temporary phenomenon, believing that once the so-called 'No Japan (NO JAPAN)' sentiment subsided, Japanese car sales would increase again. However, few now see the decline of Japanese cars as temporary.

Last year, when the boycott atmosphere had virtually disappeared, Lexus and Toyota sales were 13,851 units?actually lower than during the height of the NO JAPAN movement. This was because they failed to properly respond to the rapidly electrifying Korean market. On the other hand, perceptions of Korean cars in Japan are changing. As the global automotive market paradigm shifts from internal combustion engine vehicles to electric vehicles, Korean cars, once latecomers, are beginning to gain recognition even in Japan.

Global Sales Leader Toyota Struggles in Korea

Before the NO JAPAN movement, Japanese cars enjoyed steady popularity in Korea. Lexus’s flagship model, the ES300h, ranked among the top 3 best-selling cars for four consecutive years starting in 2016. This was thanks to the unique quietness of Japanese cars and the excellent fuel efficiency of their hybrid (HEV) engines. Until 2018, the consensus was that it was still too early to adopt electric vehicles domestically. Hybrid Japanese cars, which have characteristics between electric and internal combustion vehicles, were an attractive choice.

From the second half of 2019, as the NO JAPAN movement intensified, domestic sales of Lexus and Toyota sharply declined. Meanwhile, competing German car brands quickly expanded their eco-friendly lineups focusing on plug-in hybrids (PHEV) and battery electric vehicles (BEV). Hyundai and Kia, direct competitors of Toyota, also expanded their hybrid lineups. Currently, Hyundai and Kia offer more than 10 hybrid models in the domestic market.

Additionally, Toyota underestimated the rapid pace of electric vehicle adoption and infrastructure development in Korea. According to SNE Research data, 162,987 electric vehicles were sold in Korea last year, a 61% increase compared to the previous year. This ranks Korea fourth globally in electric vehicle sales, after China, Europe, and the United States.

Last year, electric vehicles accounted for 9.9% of all new cars sold worldwide. The proportion of electric vehicle registrations relative to new car registrations in Korea was also 9.8%. This indicates that major global automotive markets, excluding Japan, are rapidly electrifying.

Recently, Toyota has begun to recognize the rapid growth of the electric vehicle market. On the 16th, Koji Sato, the new president of Toyota headquarters, announced plans to launch a new Lexus electric vehicle in 2026 based on a dedicated electric vehicle platform. Toyota Korea is also accelerating its electrification strategy in line with headquarters’ policies. First, Lexus will release its second pure electric SUV, the RZ, in Korea this year. Toyota will introduce the first model of its new pure electric brand BZ, the bZ4X.

Manabu Konyama, president of Toyota Korea, said, "I will emphasize to headquarters how important it is for global Toyota to receive good evaluations from Korean consumers," adding, "We fully understand Toyota headquarters’ direction and product development and will provide products suitable for the Korean market."

Paradigm Shift to Electric Vehicles... Korean Cars’ Changed Status in Japan

Last year, Hyundai re-entered the Japanese passenger car market after 13 years since its withdrawal in 2009. The Japanese market, known for its strong loyalty to domestic cars, is like a fortress with tightly locked doors. This time, Hyundai plans to use eco-friendly vehicles as the key to open the Japanese market.

While it is difficult to catch up with Japan, a traditional powerhouse in internal combustion engines, Hyundai believes it has a good chance in the electric vehicle sector. From 2011 through last year, Hyundai and Kia have sold over one million electric vehicles worldwide.

As global sales have increased, the perception of Korean cars in Japan has also changed. At the end of last year, the Hyundai Ioniq 5 was selected as the 'Imported Car of the Year' in Japan. This is the first time a Korean car has been included in Japan’s Car of the Year award list in Korean automotive history.

Hyundai changed its Japanese subsidiary’s name to 'Hyundai Mobility Japan' and sells vehicles online. In July last year, it signed a contract to supply the Ioniq 5 to MK Taxi in Japan. To promote its vehicles, Hyundai established key stores in major areas such as Tokyo, Yokohama, Nagoya, Fukuoka, and Kyoto.

Ho-jung Lee, senior researcher at the Korea Automotive Technology Institute, said, "Considering all conditions, the consumption pattern in the Japanese market, which prioritizes economic efficiency, will not change significantly, but if the total cost of ownership (TCO) of electric vehicles becomes more economical in the future, the situation could change."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)