Concerns Over Fed Rate Hike... Treasury and Corporate Bond Yields Rebound

Bank of Korea Rate Expected to Hold Steady... "Bond Yield Volatility to Increase"

[Asia Economy Reporter Minji Lee] The rapidly falling government bond yields are showing an upward trend again. Although the Bank of Korea's Monetary Policy Committee meeting on the 23rd is expected to keep the base rate unchanged, bond yield volatility is expected to increase for the time being due to ongoing concerns about interest rate hikes by the U.S. Federal Reserve (Fed).

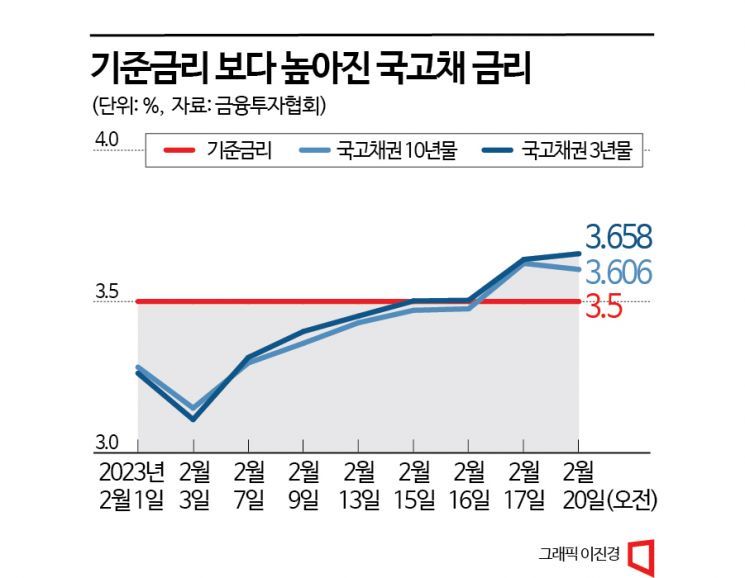

3-Year Government Bond Yield Rises 40bp in One Month

According to the bond industry, as of the morning of the 20th, the 3-year government bond yield stood at 3.658%. The 3-year government bond yield, which recorded 3.263% at the beginning of this month, rose by 39.5bp (1bp=0.01 percentage point) in less than 20 days. Compared to this month's lowest level (3.110%), it increased by about 55bp. Long-term government bond yields, which were below the base rate (3.5%), also showed an upward trend again. The 10-year and 30-year government bond yields recorded 3.626% and 3.483%, respectively, rising about 48bp and 30bp from this month's lowest levels. Corporate bond yields also showed a slight upward trend influenced by government bond yields. The 3-year unsecured corporate bond (AA-) yield was 4.345%, higher than the early-month level of 4.268%.

The rise in domestic government bond yields is driven by strong U.S. economic indicators and inflation concerns. After the Federal Open Market Committee (FOMC) meeting in February, expectations that the Fed's rate hikes would end after one more increase gained traction, but the market sentiment changed following employment data that exceeded expectations and the January Consumer Price Index (CPI) release. Concerns have emerged that interest rate hikes could continue throughout the first half of the year as the 'disinflation' expectation mentioned by Fed Chair Jerome Powell has retreated.

Excessive expectations for rate cuts also played a role. As no factors emerged to trigger rate cuts, the rate cut expectations that were anticipated for the second half of the year quickly faded. With China's reopening driving commodity prices upward again and increases in public utility fees such as electricity and gas, the domestic CPI forecast (3.1%) is expected to rise more than anticipated. Kim Gi-myeong, a researcher at Korea Investment & Securities, said, "An environment where uncertainty about inflation trends can increase is unfolding," adding, "The Bank of Korea may try to instill caution in the market, which is viewing the timing of entering a rate cut cycle too early."

Experts Confident in February MPC 'Hold'... Buy When Rates Rise

Experts expect the Bank of Korea's Monetary Policy Committee to keep the base rate unchanged in February. Furthermore, this hold stance is expected to continue until the end of the year. Considering weak economic indicators such as exports dropping more than 16% year-on-year last month, the economic growth forecast is expected to be slightly revised downward. However, despite weak economic indicators, the pace of rate cuts is not expected to accelerate.

Bond yield volatility is expected to increase further for the time being. If investors missed the opportunity due to the sudden drop in bond yields since last year, it is advisable to respond by buying whenever bond yield volatility increases. Kim Ji-man, a researcher at Samsung Securities, analyzed, "As recent rate rebounds show, rate cut expectations are being adjusted, so yields may rebound somewhat," adding, "From a mid- to long-term perspective, buying bonds is effective."

For corporate bonds, a selective approach is necessary. Although warmth is spreading from high-grade to lower-grade bonds, as credit spreads?a gauge of bond investor sentiment?shrank significantly from about 100bp at the beginning of this month to 70bp, concerns about corporate credit risk are also growing. Jung Hye-jin, a researcher at Shinhan Investment Corp., explained, "In a situation where government bond yield volatility has increased amid uncertainties about domestic and international economic outlooks, the possibility of rating downgrades due to deteriorating corporate earnings must also be considered," adding, "From a yield attractiveness perspective, investing in non-investment grade bonds below A rating might be attractive, but consideration of corporate fundamentals is also necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)