The Most Urgent Task Now: 'Stabilizing Real Estate Prices'

Highly Concerned Policy: 'Eradicating Jeonse Fraud and Supporting Victims'

[Asia Economy Reporter Kim Min-young] This year, the most anticipated real estate policies were identified as multi-homeowners focusing on taxes related to multiple properties, while non-homeowners highlighted issues of jeonse fraud and mortgage loan products. Additionally, the most urgent task in the current real estate market was chosen as 'stabilizing real estate prices' by the highest number of respondents. The policy attracting the most attention this year was found to be 'eradication of jeonse fraud and support for victims.'

Real estate information platform Zigbang announced on the 20th that these results came from a mobile survey conducted in January with 615 application users.

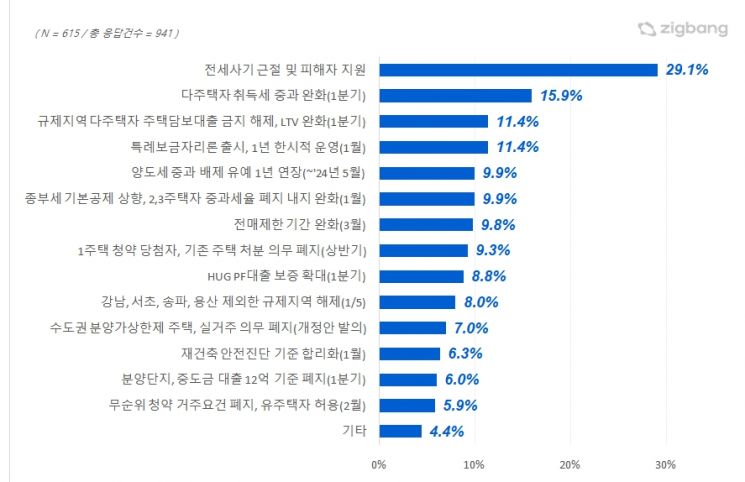

First, when asked which of the policies already implemented or being prepared this year attracted the most interest or expectations, 'eradication of jeonse fraud and support for victims' received the highest response at 29.1%. This was followed by △easing of acquisition tax surcharges on multi-homeowners (15.9%) △lifting the ban on mortgage loans for multi-homeowners in regulated areas △temporary one-year operation of eased loan-to-value (LTV) ratios and special Bogeumjari loan launch (11.4%) △one-year extension of capital gains tax surcharge exemption and raising the basic deduction for comprehensive real estate tax, abolition or easing of surcharge rates for second and third homes (9.9%) △relaxation of resale restriction periods (9.8%) △and abolition of the obligation for one-home subscription winners to dispose of existing homes, in that order.

However, these survey results varied depending on homeownership status. Homeowners most frequently selected 'easing of acquisition tax surcharges on multi-homeowners' (23.6%) as the policy of greatest interest, followed by raising the basic deduction for comprehensive real estate tax and abolition or easing of surcharge rates for second and third homes (15.7%).

In contrast, non-homeowners most frequently chose 'eradication of jeonse fraud and support for victims' (45.1%), followed by the special Bogeumjari loan launch with a one-year temporary operation (15.8%). Homeowners showed greater interest in real estate-related taxation, while non-homeowners were more concerned with jeonse fraud issues and mortgage loan products.

Regarding additional needs in the current real estate market, the highest number of respondents (22.9%) pointed to 'improvements in loan systems such as LTV and DSR.' This was followed by △policies to stabilize the jeonse and monthly rent market (12.8%) △housing stability for vulnerable groups and low-income households (12.5%) △eradication of real estate speculation and illegal activities (10.6%) △policies for balanced regional development (9.9%) △real estate tax system improvements (8.9%) △and expansion of housing supply (8.3%), in that order.

When asked what the most urgent task in the current real estate market is, 42% of the 615 respondents answered 'stabilizing real estate prices.' This was followed by △revitalizing real estate transactions (26.2%) △national land balanced development to resolve polarization between the metropolitan area and provinces (12.2%) △implementing welfare for housing vulnerable groups (11.5%) △and development of national land and transportation infrastructure such as transportation and infrastructure expansion (4.4%).

Ham Young-jin, head of Zigbang Big Data Lab, said, "As confirmed by the survey results, the most urgent task currently is stabilizing real estate prices through a soft landing of the recent sharp price declines after several years of rapid increases," adding, "The topic attracting the most interest this year was policies related to ‘jeonse fraud.’"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.