Sales index falls 0.26%... Largest drop since statistics began

Large areas that withstood real estate slump also decline

Lease market tightens, making price drop inevitable

[Asia Economy Reporter Onyu Lim] Due to the real estate market slump, the Seoul officetel sales price index recorded the largest decline ever, falling for five consecutive months. Even the large officetels in the downtown area, which had been holding firm, are struggling due to the easing of apartment regulations, a substitute product. To make matters worse, the rental market has tightened, leading to pre-sale rights with negative premiums, suggesting that the officetel market's sluggishness is likely to continue for the time being.

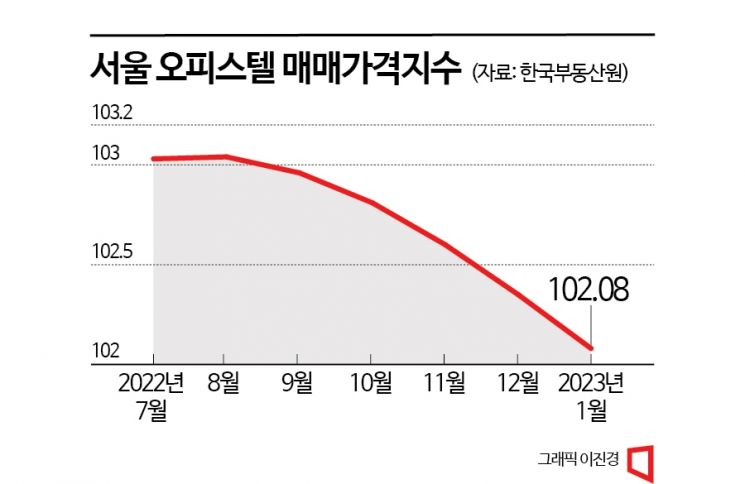

According to the Korea Real Estate Board on the 17th, the Seoul officetel sales price index in January was 102.08, down 0.26% from the previous month. This is the largest decline in five years since the Korea Real Estate Board began compiling this statistic in January 2018. As a result, the Seoul officetel sales price index has been falling for five consecutive months, increasing its decline from September last year (-0.08%) to October (-0.15%), November (-0.2%), December (-0.24%), and January this year.

Seoul officetels had held firm until the second half of last year despite the real estate market slump caused by high interest rates. While Seoul apartment prices began to fall from February last year and local officetel prices declined from January last year, Seoul officetel prices continued to rise until August last year. In particular, large officetels with an exclusive area of 85㎡ or more in downtown Seoul showed an upward trend until November last year, supported by solid demand.

However, with continued interest rate hikes and an overall tightening of the real estate market, even Seoul officetels have contracted. Especially, the government's 1·3 measures, which lifted regulations on all areas of Seoul except Gangnam, Seocho, Songpa, and Yongsan districts, appear to have dealt a heavy blow to the officetel market. The attractiveness of officetels, a substitute for apartments, has significantly diminished as various loans, taxes, and subscription regulations on apartments were eased. In fact, the number of officetel sales transactions in Seoul in January was 434, a 54% decrease from 939 in the previous month, while Seoul apartment sales transactions increased by 49%, from 837 to 1,246.

The sluggishness of the Seoul officetel market is expected to continue for the time being. Officetels are often used as investment tools for rental income, but with the rental market tightening, landlords who find it difficult to secure tenants are putting officetels on the market at low prices. Recently, pre-sale rights with negative premiums have been appearing one after another. A 44.77㎡ pre-sale right for Hillstate Cheongnyangni Station (954 households) in Dongdaemun-gu, Seoul, is listed at 560 million KRW, which is 10% lower than the pre-sale price of 622.2 million KRW. This officetel is located near Cheongnyangni Station, a transfer station for GTX B and C lines, and recorded a highest competition rate of 9.54 to 1 at the time of pre-sale in 2020.

Yeokyung Hee, senior researcher at Real Estate R114, explained, "Large and medium-sized officetels especially enjoyed a windfall during the real estate boom due to strengthened apartment regulations, but recently, as prices of small apartments, a substitute, have fallen, demand has decreased, leading to price drops." She added, "Officetels are income-generating real estate, but the tightening of the rental market has made it difficult to secure tenants, which also affected the price decline."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)