Net Profit Decline... Increased Costs from Savings Insurance Sales

Contrasting with Non-Life Insurers' 'Record-Breaking' Performance

Future Outlook Uncertain... "Must Prepare Thoroughly"

[Asia Economy Reporter Minwoo Lee] Life insurance companies are consecutively announcing poor performance results for last year. This is due to increased costs from expanding savings-type insurance to secure liquidity, combined with investment losses such as a decline in the value of held bonds amid a market downturn. This contrasts with the atmosphere of non-life insurance companies, which achieved 'record-breaking performance' through improved loss ratios.

From the Big 3 to Small and Medium Life Insurers: 'Gloomy'

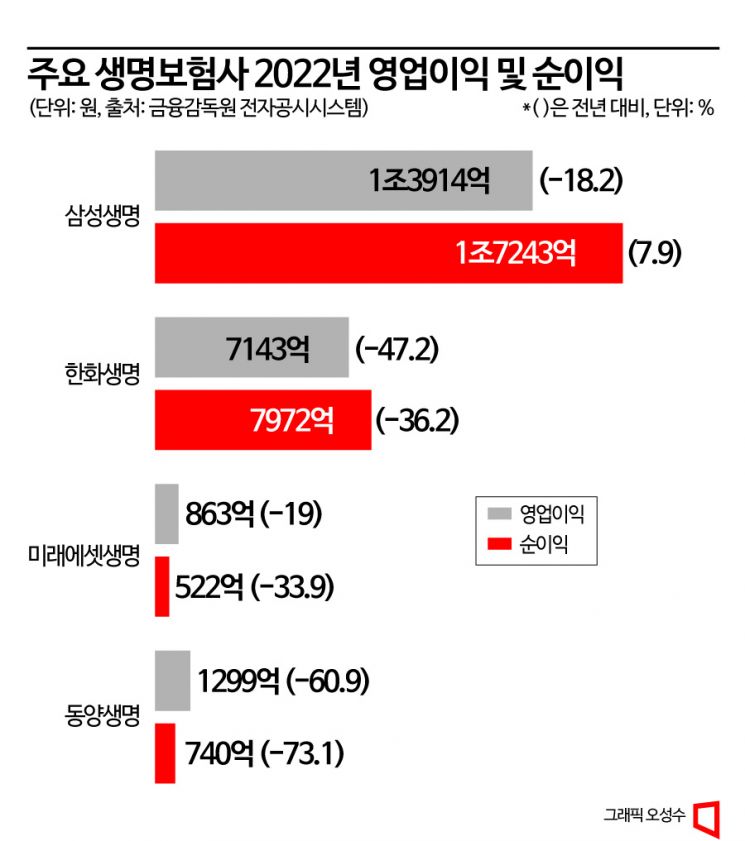

According to the Financial Supervisory Service's electronic disclosure system on the 16th, Dongyang Life Insurance recorded consolidated sales of 10.2796 trillion KRW and operating profit of 129.9 billion KRW last year. Sales increased by 62.0% compared to the previous year, but operating profit decreased by 60.9%. Net profit also dropped by 73.1% during the same period, totaling 74 billion KRW. Despite an increase in premium income, various investment yields declined, resulting in poor performance.

In particular, it is estimated that the sharp decline in non-interest profit (profits arising from the difference between expected and actual business expenses) was largely due to relatively high sales of savings-type insurance. During a high-interest rate period, as various funds flowed into bank deposits and savings, the company aggressively increased savings-type insurance to prevent liquidity depletion, which became a burden. In fact, Dongyang Life Insurance is estimated to have sold nearly 2 trillion KRW worth of single-premium savings insurance in the fourth quarter of last year. This exceeds the sales volume of savings-type insurance by Samsung Life Insurance, the industry leader, which was 1.5 trillion KRW. Additionally, the decline in various investment yields contributed to the continued poor performance.

The large companies known as the 'Big 3' also showed similarly gloomy results. Samsung Life Insurance recorded consolidated sales of 40.331 trillion KRW last year, a 15% increase from the previous year. However, operating profit decreased by 18.2% to 1.3914 trillion KRW during the same period. Samsung Life explained this was due to the base effect of Samsung Electronics' special dividend and increased financial market volatility. Net profit was recorded at 1.7243 trillion KRW, a 7.9% increase from the previous year, but this is not a satisfactory result. This is because 400 billion KRW in reduced corporate tax expenses due to this year's corporate tax law revision was classified as non-recurring income. Excluding this, net profit falls to around 1.3 trillion KRW, a decrease of more than 15% from 1.5977 trillion KRW the previous year.

Hanwha Life Insurance also saw operating profit and net profit decline by 47.2% and 36.2%, respectively, to 714.3 billion KRW and 797.2 billion KRW on a consolidated basis last year. The inclusion of Hanwha Securities, a subsidiary, in the consolidated financial statements had boosted 2021 performance indicators, but last year Hanwha Securities' operating profit sharply declined, negating that effect. Kyobo Life Insurance, which has yet to announce its results, is also expected to face deteriorating performance last year. Mirae Asset Life Insurance's net profit also fell 33.9% to 52.2 billion KRW last year compared to the previous year.

Contrasting with Smiling Non-Life Insurers... Challenges Ahead

The atmosphere contrasts with non-life insurers, which achieved record-breaking results. Due to reduced loss ratios in major products such as automobile insurance amid COVID-19, Hyundai Marine & Fire Insurance saw operating profit and net profit increase by 26.4% and 32.8%, respectively, compared to the previous year. Samsung Fire & Marine Insurance (14.1%) and DB Insurance (14.2%) also showed double-digit growth rates in net profit.

The reasons for the poor performance of life insurers include reduced non-interest profit due to sales of savings-type insurance and deteriorated investment performance caused by financial market volatility. Heeyeon Lim, a researcher at Shinhan Investment Corp., explained, "With rising interest rates, maturity refunds increased and surrender rates also rose, leading to increased sales of fixed-rate single-premium savings insurance in the high 5% range, which increased the burden of non-interest profit." Since long-term investments are mainly bond-centered, bond market tightening also affected yields.

Although profit size could increase if the rising interest rate trend reverses and more profitable long-term protection products are expanded in preparation for the new accounting standard (IFRS 17), it is still difficult to be complacent. A researcher at Yuanta Securities said, "Sales of repurchase agreements (RP) by life insurers have not turned to a declining trend this year, indicating an increase in recession-type surrenders. Therefore, if favorable contract service margin (CSM) under IFRS 17 is not maintained, competition to expand new contract CSM may intensify, worsening profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.