7 Consecutive Months of Decline... Nearly 800,000 Departures

Attractiveness Diminished Due to Falling House Prices and Rising Interest Rates

[Asia Economy Reporter Kim Hyemin] As the real estate market experiences a downturn, the popularity of subscription savings accounts for housing (Cheongyak Savings) is waning, leading to a decrease in the number of people maintaining these accounts. The trend of cancellations that began in the second half of last year continues this year, with nearly 150,000 accounts lost in just one month.

According to the Korea Real Estate Board's Cheongyak Home on the 16th, as of the end of January this year, the total number of Cheongyak Savings (Housing Subscription Comprehensive Savings) subscribers was 26,236,647, down by 144,648 from one month earlier (26,381,295). Currently, there are four types of Cheongyak Savings accounts: Housing Subscription Comprehensive Savings, Cheongyak Savings, Cheongyak Installment Savings, and Cheongyak Deposit Savings, but only the Housing Subscription Comprehensive Savings has been available for new subscriptions since 2015, when the system was unified.

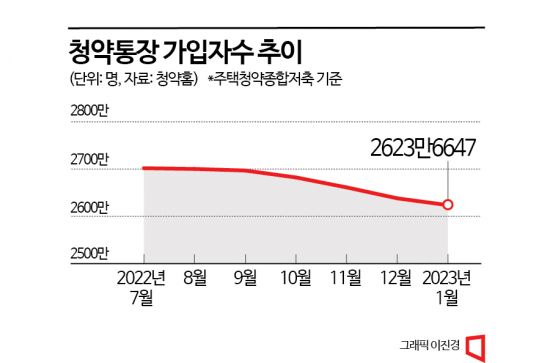

The number of Cheongyak Savings subscribers steadily increased until June last year but has been declining for seven consecutive months since then. The number, which reached 27,019,253 in July last year, fell to the 26.2 million range, resulting in a total loss of 795,264 accounts during this period. However, compared to the over 200,000 decrease for two consecutive months, the decline this month has slowed.

The decrease in Cheongyak Savings subscribers coincides with the real estate market slump. When housing prices surged rapidly, so-called "lottery subscriptions" attracted many subscribers because winning a subscription could yield several hundred million won in capital gains. However, as housing prices fell and construction costs caused relative increases in sale prices, the attractiveness diminished to the point that more people gave up even after winning subscriptions. The increase in unsold units available for sale without a Cheongyak Savings account also appears to have influenced this trend.

While various savings and deposit interest rates have been rising, the interest rate on Cheongyak Savings remains around 2% per annum, which is not very high, accelerating the departure of subscribers. With the base interest rate hike, more people are canceling their Cheongyak Savings accounts and depositing lump sums in commercial bank savings accounts, which has become more profitable. Additionally, some who have succeeded in purchasing their own homes are canceling their Cheongyak Savings accounts to repay increasing loan interest during the rising interest rate period.

An industry insider said, "Changes in the number of Cheongyak Savings subscribers are closely related to the real estate market sentiment. Since it has become difficult to expect affordable sale prices and housing purchase sentiment has not recovered, the downward trend is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.