Increase in Basic Construction Costs

Rising Sale Prices Inevitable This Year

Concerns Over Growing Unsold Inventory

[Asia Economy Reporter Minyoung Kim] As private apartment sale prices rise nationwide, including in Seoul, concerns are emerging that the subscription market sentiment may further deteriorate. Amid the deepening slump in the sale market due to high interest rates and fears of further housing price declines, the added burden of high sale prices could further shrink subscription demand. Since price increases in construction costs and raw materials are inevitable due to inflation, construction companies are expected to adopt strategies to attract buyers, such as postponing sale schedules or offering free options and interest-free interim payments.

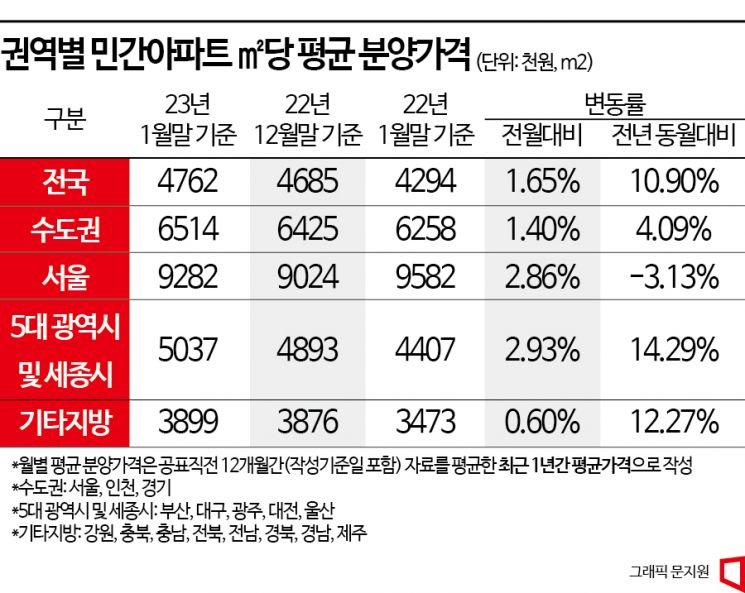

According to the private apartment sale price trends as of the end of January this year, released by the Housing and Urban Guarantee Corporation (HUG) on the 16th, the average sale price of private apartments in Seoul was 9,282,000 KRW per square meter, which converts to 30,636,000 KRW per 3.3 square meters. This is a 2.86% (25,800 KRW) increase from the previous month (9,024,000 KRW per square meter). In terms of 3.3 square meters, the price rose from 29,779,200 KRW back into the 30 million KRW range. However, compared to January last year (9,582,000 KRW per square meter), it decreased by 3.13%.

The sale price per 3.3 square meters of private apartments in Seoul fell into the 20 million KRW range starting from May last year (28,215,000 KRW) and remained below 30 million KRW for eight consecutive months until December last year. The nationwide average sale price per 3.3 square meters of private apartments was 15,714,600 KRW, up 10.90% year-on-year and 1.65% month-on-month. The metropolitan area recorded 21,496,200 KRW, up 4.09% year-on-year and 1.40% month-on-month.

The five major metropolitan cities and Sejong saw prices rise to 16,622,100 KRW, a 14.29% increase compared to January last year. Compared to December last year, it rose by 2.93%. Other provinces also increased by 12.27% over the year to 12,866,700 KRW.

This is interpreted as partly due to increased pressure on sale prices caused by the rise in basic construction costs and raw material prices. The Ministry of Land, Infrastructure and Transport raised the basic construction cost by a total of 6.7% last year, reflecting price increases in major materials such as high-strength rebar, ready-mixed concrete, and window glass. From this month, the basic construction cost was further increased to reflect the recent surge in ready-mixed concrete prices. Accordingly, from February, the basic construction cost applied to complexes under the price ceiling system will be 1.1% higher than the previous notice (September last year), at 1,925,000 KRW. Financial costs and labor costs have also risen, fueling the increase in sale prices.

The problem is that such increases in sale prices could deepen the slump in the sale market. Due to high interest rates, housing price decline forecasts, and economic recession, the current sale market is accumulating unsold units. According to the Ministry of Land, Infrastructure and Transport, as of December last year, the nationwide unsold housing stock was 68,107 units, a 17.1% (10,080 units) increase from the previous month. With over 10,000 units scheduled to be supplied nationwide this month, the unsold inventory is expected to accumulate further.

The market expects construction companies to postpone sale schedules or offer various sale benefits to attract buyers in order to avoid unsold units. Kyunghee Yeo, senior researcher at Real Estate R114, said, "Considering the sale market sentiment, companies have no choice but to reasonably adjust sale prices rather than freely raising them. Construction companies may also try to offset the increase in sale prices by adjusting schedules or providing benefits such as interest-free interim payments and free options instead of recklessly raising prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)