President Yoon and FSC "Need to Increase Loan Loss Provisions to Prepare for Risks"

Loan Loss Provisions of Four Major Banks Total 6.3 Trillion Won

"Currently Solid Level"... Likely to Accumulate More to Prepare for Rising Delinquency Rates

[Asia Economy Reporter Sim Nayoung] As President Yoon Seok-yeol and Financial Supervisory Service (FSS) Governor Lee Bok-hyun continue to strongly criticize banks, it appears inevitable that banks will have to make additional provisions for loan loss reserves, which represent their loss absorption capacity. Despite posting record-high profits last year through interest income, banks have become public enemies due to paying high performance bonuses to executives and employees instead of preparing for future financial risks.

One of the key demands from President Yoon and the authorities is for commercial banks to increase their loan loss reserves. Loan loss reserves are "costs set aside by banks to cover losses in case they cannot recover the money they lent." This means preparing in advance for an increase in borrowers who may default as the economy worsens. Following the president’s directive, the FSS has been closely examining banks’ loss absorption capacity through on-site audits of financial statements starting from the 13th.

Under Pressure from Authorities...Last Year’s Additional Loan Loss Reserves Increased at the Four Major Banks

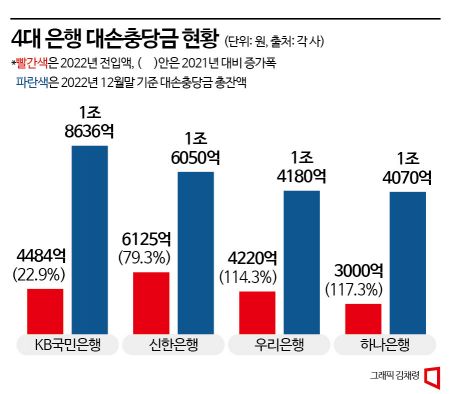

According to the financial sector on the 15th, the amount of loan loss reserves added by the four major banks (KB Kookmin, Shinhan, Hana, and Woori) last year increased significantly compared to 2021. Shinhan Bank increased by 79.3% to 612.5 billion KRW from 341.6 billion KRW the previous year. KB Kookmin Bank added 448.4 billion KRW, up 22.9% from 364.6 billion KRW in 2021. Woori Bank set aside 422 billion KRW, soaring 114.3% from 197 billion KRW in 2021. Hana Bank added 300 billion KRW, a 117.3% increase from 138 billion KRW the previous year.

The total loan loss reserves of the four major banks amount to approximately 6.3 trillion KRW. By bank, KB Kookmin Bank leads with 1.8638 trillion KRW, followed by Shinhan Bank with 1.605 trillion KRW, Woori Bank with 1.418 trillion KRW, and Hana Bank with 1.407 trillion KRW. A representative from a commercial bank said, "Last year, the financial authorities pressured banks to build up loan loss reserves in preparation for defaults expected after COVID-19, which led to a significant increase."

Lee Bok-hyun, Governor of the Financial Supervisory Service, is delivering opening remarks at a meeting with bank presidents held on the 18th at the Bankers' Hall in Jung-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

Lee Bok-hyun, Governor of the Financial Supervisory Service, is delivering opening remarks at a meeting with bank presidents held on the 18th at the Bankers' Hall in Jung-gu, Seoul. Photo by Hyunmin Kim kimhyun81@

Loan Loss Reserve Coverage Ratio of Four Major Banks Exceeds 200%

As loan loss reserves increased, the NPL (Non-Performing Loan) coverage ratio also rose. The NPL coverage ratio refers to the amount of provisions set aside relative to non-performing loans (classified as substandard or below), indicating the bank’s buffer capacity.

As of the end of December last year, the NPL coverage ratios were 259.4% for KB Kookmin Bank (225.3% at the end of 2021), 256.7% for Woori Bank (205.5%), 212.1% for Hana Bank (163.9%), and 202% for Shinhan Bank (163%), showing an increase compared to the previous year. Another commercial bank official said, "An NPL coverage ratio above 150% is generally considered solid," adding, "All four major banks have exceeded 200%, indicating a healthy status."

Bankers Association Calls for Increasing Provisions...Financial Holding Stocks Decline

However, signs of risk are emerging as delinquency rates rise. The delinquency rates of the four major banks increased by 0.03 to 0.04 percentage points compared to the previous year. KB Kookmin Bank’s rate rose from 0.12% to 0.16%, Shinhan Bank from 0.19% to 0.22%, Hana Bank from 0.16% to 0.20%, and Woori Bank from 0.19% to 0.22%, triggering warning signals.

Kim Kwang-soo, chairman of the Bankers Association, stated, "Since bank interest rates jumped sharply in October last year, the public’s interest burden has increased, and signs of rising delinquency rates appeared in the first quarter. From the second quarter, delinquency rates are expected to rise much more sharply than now. Accordingly, banks will need to use the provisions they have accumulated so far, and therefore, banks should build up more provisions in advance."

A bank finance team official said, "While additional provisions can reduce risk, they also reduce banks’ net income, decrease dividends, and cause stock prices to fall," adding, "You can already see this from the decline in financial holding companies’ stock prices following President Yoon’s remarks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.