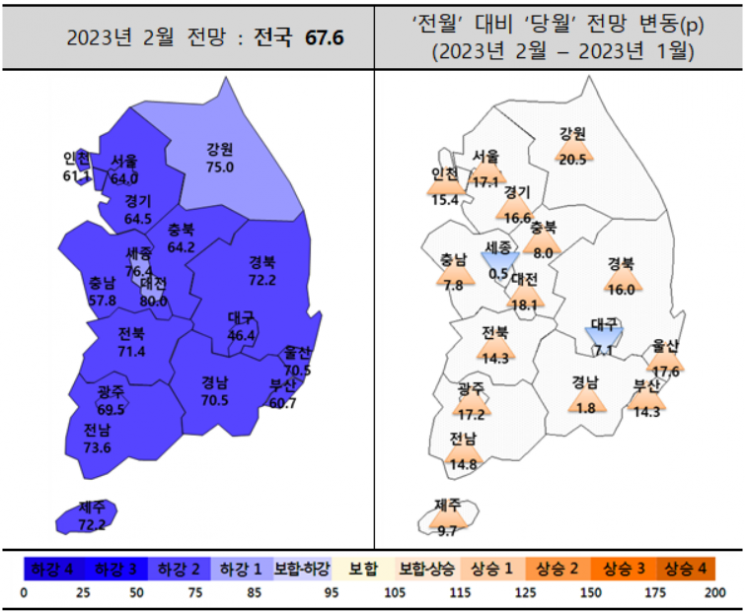

Housing Business Sentiment Index for February at 67.6, Turning Upward

Improvement in Seoul Metropolitan Area Amid Regulatory Easing Expectations, but Decline in Daegu

Funding and Material Supply Conditions Show Improvement Compared to Previous Month

[Asia Economy Reporter Kwak Min-jae] It has been revealed that the housing business market has rebounded due to expectations for the government's real estate soft landing measures. However, the decline in this region was prominent following Daegu City's announcement last month that it would suspend approval for new housing construction projects.

According to a survey conducted on housing developers by the Housing Industry Research Institute on the 15th, the housing business outlook index for this month was 67.6, rebounding 11.8 points from the previous month (55.8). This marks a turnaround after falling from 59.3 in December last year to 55.8 in January. A figure above 100 indicates a higher proportion of companies expecting the market to improve, while below 100 indicates the opposite.

In the metropolitan area, the index rose by 16.4 points overall compared to the previous month. This was the result of increases of 17.1 points (64.0) in Seoul, 15.4 points (61.1) in Incheon, and 16.6 points (64.5) in Gyeonggi Province. The Housing Industry Research Institute analyzed, “The housing business outlook index rose significantly due to expectations for the real estate soft landing measures, including the lifting of regulation zones, removal of the price ceiling system in the 1·3 real estate measures, abolition of mid-term loan guarantee price and special supply price standards, and expansion of HUG PF loan guarantees.”

The housing business outlook index in provincial areas also rose by an average of 10.9 points. However, Daegu recorded a decline of 7.1 points from the previous month to 46.4, showing a notable downward trend. This is interpreted as concerns that the announcement by Daegu City on January 31 to suspend approval for new housing construction projects would hinder future project execution. Currently, Daegu has the highest number of unsold units nationwide, with 13,445 units as of the end of last year. Although Sejong City fell by 0.5 points compared to the previous month, it is analyzed that this is not a significant figure due to the base effect of continuous rises from December last year through January this year.

The funding procurement index for February rose by 22.9 points (from 50.0 to 72.9). This is believed to be due to increased expectations following measures to ease real estate financial tightening, such as expanded funding support and PF loan guarantees included in the November 10 and January 3 measures, as well as the real estate market soft landing measures announced in last year's economic management plan.

However, the Housing Industry Research Institute stated, “The U.S. Federal Reserve (FED) raised the benchmark interest rate again to 4.75% on the 1st (local time). Although the rate hike magnitude has decreased, the upward trend in interest rates continues, so it is expected to take considerable time before rates return to previous levels.” They added, “The resolution of current issues such as short-term financial instability, weakened investment sentiment, and real estate market stagnation is expected to occur gradually.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.