42 Gap Investments in Seoul in January... 73% Decrease Year-on-Year

9 Districts Including Yongsan with Zero Cases

Price Gains Difficult and Jeonse-to-Price Ratio Falling Lead to Decline

[Asia Economy Reporter Onyu Lim] The number of ‘gap investments’?buying apartments in Seoul with jeonse deposits?has sharply declined. Once blamed as a major cause of soaring housing prices, gap investments have disappeared as it has become difficult to earn capital gains amid the real estate market downturn. Additionally, the increase in actual investment funds due to the decline in the jeonse-to-sale price ratio is also cited as a factor deterring gap investments. As one pillar of demand supporting housing prices collapses, forecasts suggest that the downward trend in sale prices will continue for the time being.

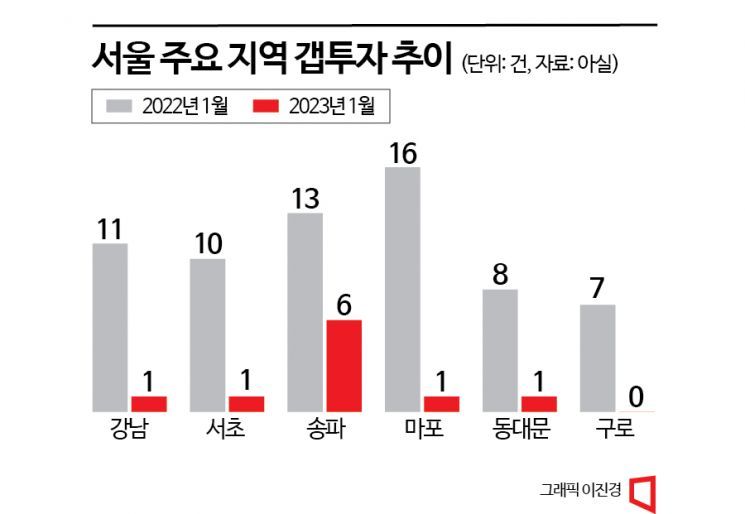

According to real estate big data firm Asil on the 14th, the number of apartments purchased through gap investments in Seoul in January was 42. This is a decrease of 113 cases (73%) compared to 155 cases in January 2022, one year earlier. Although about half a month remains for January real estate transaction reporting, no significant change in the trend is expected.

Among the 25 autonomous districts in Seoul, nine districts recorded zero gap investment cases. This means that in Gwanak, Gwangjin, Guro, Geumcheon, Seodaemun, Yangcheon, Yongsan, Jongno, and Jung districts, there were no sales involving jeonse deposits for a month. Eight districts including Gangnam, Gangbuk, Dongdaemun, Mapo, Seocho, Seongbuk, Yeongdeungpo, and Jungnang had only one gap investment case each. Mapo, which had the highest number of gap investments in Seoul with 16 cases a year ago, is included here. Four districts?Gangseo, Dongjak, Seongdong, and Eunpyeong?recorded two gap investment cases each.

Gap investments generally tend to increase during periods of rising housing prices because even a small amount of capital can yield capital gains from price appreciation. During the previous real estate boom, gap investments were blamed for further driving up apartment prices, leading the government to strengthen regulations on multi-homeowners.

However, with recent consecutive interest rate hikes causing housing prices to fall repeatedly, making it difficult to earn capital gains for the time being, demand for gap investments has sharply decreased. Since the possibility of future profits is low but monthly interest burdens have increased, the economic incentive for gap investments has weakened.

Moreover, the attractiveness of gap investments has significantly declined due to the drop in the jeonse-to-sale price ratio, which represents the ratio of jeonse price to sale price. When this ratio falls, the initial cost that buyers must pay when purchasing a home increases, making it difficult to decide to buy.

According to KB Real Estate, the jeonse-to-sale price ratio for apartments in Seoul in January was 52.0%. This is a 0.9 percentage point decrease from 52.9% in December last year and the lowest level in 10 years and 8 months since May 2012, when it recorded 51.9%. In particular, Seocho, Gangnam, Songpa, and Yongsan districts have already recorded ratios in the 40% range, and Yangcheon district also fell below the 50% mark to 49.84%.

The Bank of Korea recently analyzed in its financial and economic report, "When housing transactions freeze and sale listings convert to jeonse listings, jeonse prices fall, leading to a reduction in gap investments and consequently causing housing prices to drop," adding, "The recent chain reaction between sale and jeonse prices is intensifying the housing market downturn."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)