February Apartment Move-in Outlook Index 72.1

January Apartment Occupancy Rate 66.6%, Down 5.1%p from Previous Month

"Strengthening Loan Support for Non-homeowners Needed to Improve Occupancy Rate"

[Asia Economy Reporter Kwak Minjae] Expectations for a soft landing in the housing market have been reflected, leading to a significant rise in the apartment move-in outlook for February. However, due to the increase in the base interest rate last month, the burden of loans has increased, resulting in a decline in the occupancy rate.

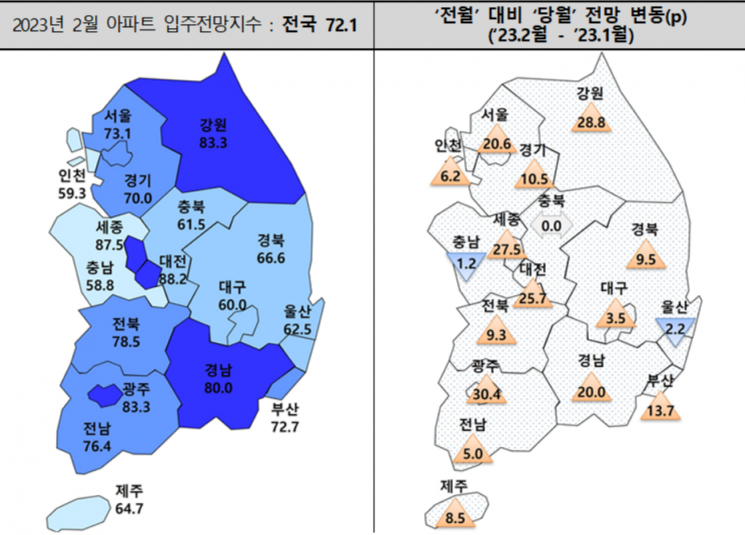

According to the Korea Housing Industry Research Institute (hereinafter KHIRI) on the 13th, the apartment move-in outlook index for February is expected to rise by 12.7 points to 72.1 compared to last month (59.4). The metropolitan area is expected to increase by 12.5 points (55.0→67.5), metropolitan cities by 16.5 points (59.2→75.7), and other regions by 10.0 points (61.2→71.2).

The apartment move-in outlook index was developed to proactively respond to changes in the housing supply market and is surveyed among members of the Korea Housing Association and the Korea Housing Builders Association.

KHIRI analyzed, “The significant rise in the move-in outlook index appears to reflect expectations for the soft landing measures in the housing market, such as the full lifting of regulations except for the three Gangnam districts in Seoul and Yongsan-gu announced in the January 3 real estate deregulation plan, easing of resale restrictions, relaxation of regulations on multi-homeowners, and easing of loan regulations for non-homeowners.”

Following expectations for the soft landing measures in the housing market, five cities and provinces including Gwangju (52.9→83.3), Gangwon (54.5→83.3), Sejong (60.0→87.5), Daejeon (62.5→88.2), and Gyeongnam (60.0→80.0) responded that the move-in outlook has greatly improved and will recover to the 80-point level. On the other hand, Ulsan is expected to decline by 2.2 points (64.7→62.5), which seems to have negatively affected the move-in outlook due to the regional economic downturn caused by the global shipbuilding industry recession.

However, KHIRI forecasted, “The occupancy rate is expected to gradually improve due to the recent decline in mortgage loan interest rates, active deregulation, expectations for economic recovery, and the announcement of redevelopment plans for first-generation new towns.”

The nationwide occupancy rate in January was 66.6%, down 5.1 percentage points from the previous month. Although the government announced a comprehensive plan including tax, finance, and deregulation measures to normalize the housing market, the occupancy rate declined due to increased loan costs following the 0.25% base interest rate hike on January 13.

The reasons for non-occupancy were delayed sale of existing homes (41.7%), failure to secure tenants (39.6%), and failure to secure balance loans (14.6%), in that order. KHIRI stated, “Although housing transactions have become easier due to the easing of resale restrictions, lifting of regulation areas, and abolition of the obligation to dispose of existing homes when applying for subscription, securing tenants has become more difficult due to the increased loan cost burden caused by the base interest rate hike,” adding, “To prevent a decline in occupancy rates, measures such as strengthening loan support for non-homeowners are necessary.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.