[Asia Economy Reporter Buaeri] Interest rates on fixed deposits at major commercial banks are falling one after another. With deposit rates dropping more than 1 percentage point compared to three months ago, recording in the low to mid 3% range, it seems that the money move of market funds flowing into the stock market is also starting.

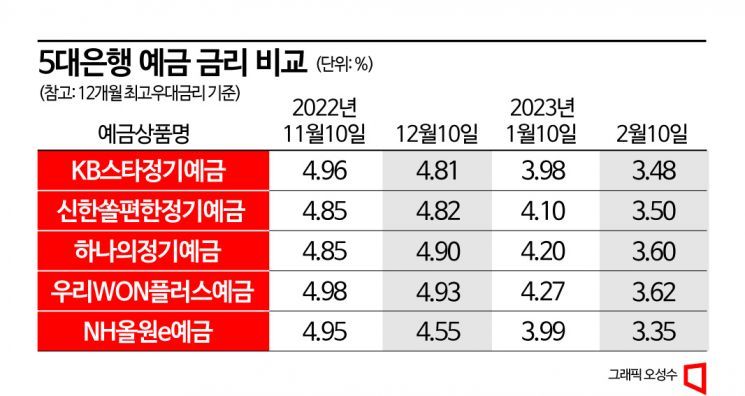

On the 13th, a comparison of the interest rates of major fixed deposit products at the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup (as of the 10th)?showed an average decrease of 1.41 percentage points compared to November 10 last year, three months ago.

The representative deposit products (12 months, as of the 10th) of the five major banks recorded interest rates of 3.35% to 3.62%. Just last month, the representative deposit products of the five major banks had interest rates around 3.99% to 4.2%, but now there are no deposit products with interest rates in the 4% range.

Looking at each bank, KB Kookmin Bank’s 'KB Star Fixed Deposit' offers a maximum annual interest rate of 3.48%. This product, which offered 4.96% interest on November 10 last year, dropped nearly 1.48 percentage points in just three months.

Shinhan Bank’s 'Sol Pyeonhan Fixed Deposit' fell 1.35 percentage points from a maximum of 4.85% to 3.5% during the same period. The situation at Hana and Woori Banks was similar. Hana Bank’s 'Hana Fixed Deposit' product dropped 1.25 percentage points from a maximum of 4.85% on November 10 last year to 3.6% as of the 10th, and Woori Bank’s 'WON Plus Deposit' fell 1.36 percentage points from 4.98% to 3.62% during the same period.

NH Nonghyup Bank experienced the largest drop. The 'NH All One e-Deposit,' which was 4.95% as of November 10 last year, offered an interest rate of 3.35% as of the 10th, dropping by 1.6 percentage points.

As the investment attractiveness of deposit and installment savings products declines, the 'reverse money move' phenomenon, where market funds flow into banks, is also slowing down.

The balance of fixed deposits at the five major banks stood at 812.25 trillion won as of the end of last month, down 6.1866 trillion won from the previous month. The deposit balance, which surged in the second half of last year, has been declining since December last year. The total deposit balance as of the end of last month was also recorded at 1,870.0581 trillion won, down 7.3862 trillion won from the previous month (1,877.4443 trillion won).

On the other hand, it seems that the money move into bonds and stocks is starting. According to the Korea Financial Investment Association, investor deposits, which were around 46.4 trillion won at the end of last year, increased to 51.5 trillion won as of the 1st. A financial industry official said, "Looking at recent trends in negative balance accounts, it seems that as deposit interest rates in the banking sector continue to fall, interest in stock market investment is reviving."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.