"Imported Car Market Share 18.5%... Highest Since Entering Domestic Market"

"160,000 Electric Cars Sold, Total Market Share 9.8%"

[Asia Economy Reporter Hyunseok Yoo] Although the number of new car registrations in South Korea decreased last year, the acquisition amount increased by nearly 6%. The increase in sales of electric vehicles and luxury cars had an impact.

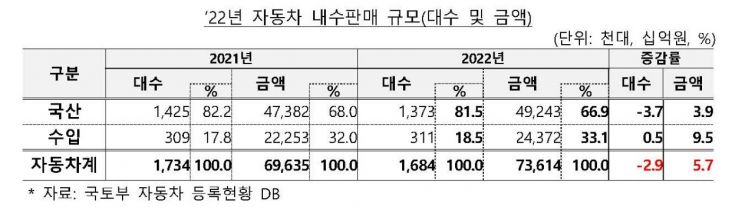

On the 9th, the Korea Automobile Manufacturers Association (KAMA) published the '2022 New Car Registration Status Analysis.' The number of new car registrations last year decreased by 2.9%, from 1.73 million units in 2021 to 1.68 million units in 2022. The acquisition amount recorded 73.6 trillion KRW, an increase of 5.7% from 69.6 trillion KRW.

Despite steady demand, the number of registrations was the lowest since 2014 due to delivery disruptions. However, the acquisition amount reached an all-time high, supported by increased preference for electric-powered vehicles and luxury cars.

Domestic cars recorded 1.372 million units, a 3.7% decrease compared to the previous year. The acquisition amount increased by 3.9%. Imported cars sold 311,000 units, a 0.5% increase from the previous year. In terms of volume, they accounted for 18.5%, and in terms of amount, 33.1% market share. This was the highest market share since entering the domestic market.

Among major brands, only German brands increased by 7.7% compared to the previous year. By major country of origin, German and Chinese imports increased by 7.8% and 154.5%, respectively. In particular, Chinese imported cars, mainly electric vehicles, increased by 603.5%. With the addition of electric commercial vehicles and European brands' electric passenger car models, the number increased by 154.5% compared to the previous year, surpassing 10,000 units for the first time and reaching 12,000 units.

In the domestic market, sales of eco-friendly vehicles increased significantly. Electric-powered vehicles, including hybrids (plug-in and mild HEV) and electric cars, sold 448,000 units, a 28.7% increase from the previous year, accounting for a 26.7% market share. Electric vehicles recorded 164,000 units, a 63.7% increase, reaching a market share of 9.8%. Hybrid vehicle sales also reached 274,000 units, accounting for 16.3% market share.

On the other hand, diesel vehicle sales decreased by 19.8% from the previous year to 333,000 units. For the first time, sales of electric-powered vehicles surpassed diesel vehicles, intensifying the contraction of the internal combustion engine vehicle market.

By purchaser type, new car purchases by corporations and businesses increased by 5.6%, with increases in both commercial use (taxis, rental cars, etc.) and private use (business use). By vehicle type, thanks to the popularity of sport utility vehicles (SUVs), new car effects were seen with mid-size SUVs and compact cars increasing by 12.4% and 38.8%, respectively, compared to the previous year.

However, from the second half of last year, signs of demand slowdown appeared as the waiting period for delivery shortened due to improved parts supply and the impact of rapid interest rate hikes, and the previously rising used car prices began to decline.

KAMA Chairman Gang Nam-hoon said, “Although automobile demand was steady, signs of demand slowdown are emerging due to increased purchase cancellations caused by rapid installment interest rate hikes and a shift to decreased used car transactions,” adding, “It is necessary to expand domestic demand stimulus measures such as support for replacing old vehicles to prepare for a sharp decline in demand.”

He emphasized, “As the transition from internal combustion engine vehicles such as diesel cars to electric-powered vehicles accelerates, the rapid increase in the proportion of Chinese-made vehicles raises concerns about the weakening of the domestic industrial base,” and added, “The enactment of a special law on future cars is urgent to revitalize electric vehicle investment, including expanding tax credits for investment in electric vehicle production facilities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)