Turnover Rate of Multi-Unit Building Sales at 0.25%

Lowest Since 2010 Survey

"Some Urgent Sales Exhausted... Further Buying Restrictions Expected"

[Asia Economy Reporter Kwak Minjae] Despite the government's extensive deregulation efforts, the frozen real estate market shows little sign of thawing. As real estate transactions have sharply declined, the turnover rate, which indicates buying activity, has hit an all-time low. Due to high interest rates and economic contraction, buyer sentiment has weakened, and the frozen transaction situation is expected to continue for the time being.

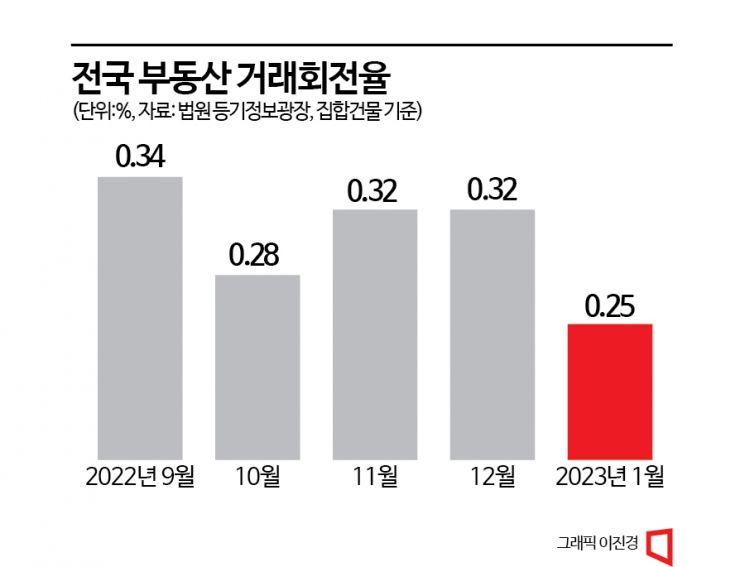

According to the Court Registry Information Plaza on the 10th, the turnover rate of collective buildings such as apartments nationwide last month was recorded at 0.25%. This is 0.07 percentage points lower than the previous month (0.32%), marking the lowest since the survey began in 2010.

The turnover rate of collective buildings is an indicator that reflects the vitality of the apartment, multi-family/row house, and officetel sales markets. It refers to the number of properties among collective buildings with transferable ownership for which ownership transfer registration has been completed. A lower turnover rate means fewer transactions compared to the total real estate properties. A 0.25% rate means that only 25 out of every 10,000 valid collective buildings were traded.

This index recorded a figure even lower than the all-time low of 0.28% in October last year. Notably, at that time, after a sharp drop, the market shifted back to an upward trend, which is quite different from the current atmosphere. However, after hitting the lowest point in October last year, the rate stayed in the 0.3% range in November and December, before dropping further in January this year.

In particular, the decline in Seoul and Ulsan stands out. As of January, the turnover rates in these regions were 0.14% and 0.17%, respectively, significantly lower than the national average of 0.25%. Especially in Seoul's Nowon-gu (0.05%), Songpa-gu (0.07%), Dongjak-gu (0.07%), Yangcheon-gu (0.08%), Dobong-gu (0.08%), and Dongdaemun-gu (0.09%), the rates remained in the two decimal places. This means that out of 10,000 transactions, fewer than 10 collective buildings were traded, indicating a severe slump.

Although some areas, such as reconstruction complexes, are seeing rapid sales depletion due to the effects of the 1st and 3rd real estate measures, experts predict that the sharp decline in transactions will continue for the time being. Yeokyunghee, Senior Researcher at Real Estate R114, said, "While rapid sales are being depleted mainly in some reconstruction complexes and price-down areas with good transportation and school districts, chasing purchases may be limited. Despite extensive deregulation, external variables such as the economy still seem to have a greater influence on buyer sentiment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)