84 Participants Including Celebrities, SNS-RICH, Platform Operators, and Local Community Entrepreneurs

Luxury Goods and Housing Rent Processed as Corporate Expenses

One-Person Agency Established to Falsely Pay Wages to Family Members

Overseas Prize Money Also Not Reported

[Asia Economy Sejong=Reporter Joo Sang-don] The National Tax Service (NTS) has launched a rigorous tax investigation after confirming tax evasion suspicions by YouTubers and others who failed to report income that surged due to the spread of social networking services (SNS) such as sponsorships and advertising revenue.

The NTS announced on the 9th that it has started tax investigations on 84 business operators who enjoy stable high income based on their popular and social influence but fail to fulfill their constitutional tax obligations.

The subjects of the tax investigation include ▲26 SNS-rich (RICH) individuals such as YouTubers, influencers, and shopping mall operators ▲18 personal service providers such as celebrities, athletes, and webtoon artists ▲19 platform operators and online investment information service providers ▲21 local community-based business operators who conduct business based on local influence.

An NTS official said, "There are cases where the expected amount of additional tax collection among the suspected tax evaders reaches 10 billion KRW. However, it is difficult to disclose specific details about the types of tax evasion and fields of activity."

They are suspected of evading income tax while enjoying stable high income based on their public recognition. Cases were also confirmed where supercars and luxury goods used privately were purchased with corporate credit cards or wages were paid to relatives who did not actually work.

First, some YouTubers failed to report sponsorship money and advertising revenue received from subscribers and received false tax invoices without actual transactions. In particular, YouTuber A, who specializes in stocks, received tens of billions of won from video lecture sales on the website through nominee accounts or cryptocurrency and failed to report it. The NTS also views that A made a disguised gift by transferring the YouTube channel and paid subscribers free of charge to a corporation where a minor child is the sole shareholder.

There were also influencers who evaded taxes by processing high-priced luxury goods purchase costs and housing rent as corporate expenses, and shopping mall operators who failed to report income from cosmetics, food, and clothing sales and falsely paid wages to relatives.

One celebrity was found to have evaded income by establishing a one-person agency under a family member's name to disperse income and falsely paying wages to relatives who did not actually work. Gamers and athletes who did not report prize money received from overseas competitions were also caught.

Also, a webtoon artist included in this investigation artificially established a corporation and transferred personal copyrights free of charge to disperse income and evade taxes as online content popularity surged and income rapidly increased.

Platform operators providing financial and lifestyle information and online investment information service providers offering stock, coin, and real estate investment information were also included in this tax investigation. Platform operators evaded taxes by failing to report platform commission income and improperly deducting system development costs. One investment information service provider is suspected of receiving income from stock (coin) investment-related publishing and lectures and investment advisory fees into nominee accounts under employees' names and failing to report them.

Local community-based business operators, who exert influence in their communities with government construction and public institution supply as major sources of business income, are also suspected of tax evasion. They registered corporate development trademarks under the owner's name, then transferred them to the corporation to improperly divert corporate funds, or established overseas paper companies and diverted corporate funds to pay for the owner's children's overseas study expenses.

Oh Ho-seon, Director of the NTS Investigation Bureau, said, "At a time when most citizens are struggling due to COVID-19 and complex economic crises, we will rigorously verify tax evasion suspicions of some celebrities, YouTubers, influencers, and local community-based business operators who enjoy stable high income while leading luxurious lifestyles. If tax evasion is confirmed, we will strictly handle the cases according to law and principles without exception, including filing charges under the Tax Crime Punishment Act."

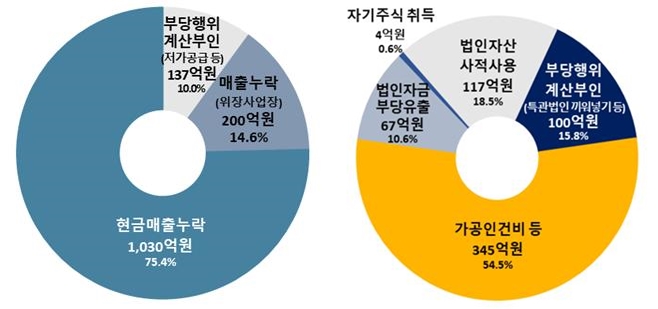

Previously, the NTS investigated 220 new boom business operators in one round in 2019 and three rounds in 2021, detecting unreported sales and other income amounting to 326.6 billion KRW through tax investigations and collecting 141.4 billion KRW in additional taxes. The types of income detection were cash sales omission of 103 billion KRW (75.4%), sales omission through disguised business places of 20 billion KRW (14.6%), and denial of unfair acts such as low-price supply of 13.7 billion KRW (10.0%) in order.

In terms of expenses, fabricated labor costs accounted for 34.5 billion KRW (54.5%), private use of corporate assets 11.7 billion KRW (18.5%), denial of unfair acts such as inserting special corporations 10 billion KRW (15.8%), and improper diversion of corporate funds 6.7 billion KRW (10.6%) in order. The investigated subjects formed assets totaling 800 billion KRW, including real estate worth 787.7 billion KRW and automobiles and membership rights worth 12.3 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.