View of apartment complexes in downtown Seoul from Seoul Sky, the observation deck of Lotte World Tower in Songpa-gu, Seoul. Photo by Yonhap News

View of apartment complexes in downtown Seoul from Seoul Sky, the observation deck of Lotte World Tower in Songpa-gu, Seoul. Photo by Yonhap News

[Asia Economy Reporter Ryu Tae-min] Although the decline in housing prices in Seoul and the metropolitan area has narrowed due to the real estate deregulation policy, housing prices in the 2nd phase new towns are still shaky. This appears to be due to the decline in jeonse prices caused by consecutive interest rate hikes, as well as accumulated fatigue from the rapid rise in housing prices, causing buying demand to slow down.

According to the weekly apartment price trend for the fifth week of last month (as of the 30th) announced by the Korea Real Estate Board on the 9th, the decline rate of apartment prices in Seoul was 0.25%. This is about one-third of the decline compared to the fourth week of December last year (-0.74%), which recorded the largest drop in 10 years. Similarly, the decline rate of apartment sale prices in the metropolitan area, which was -0.93% in the fourth week of December last year, decreased to -0.44% by the end of last month, falling to less than half.

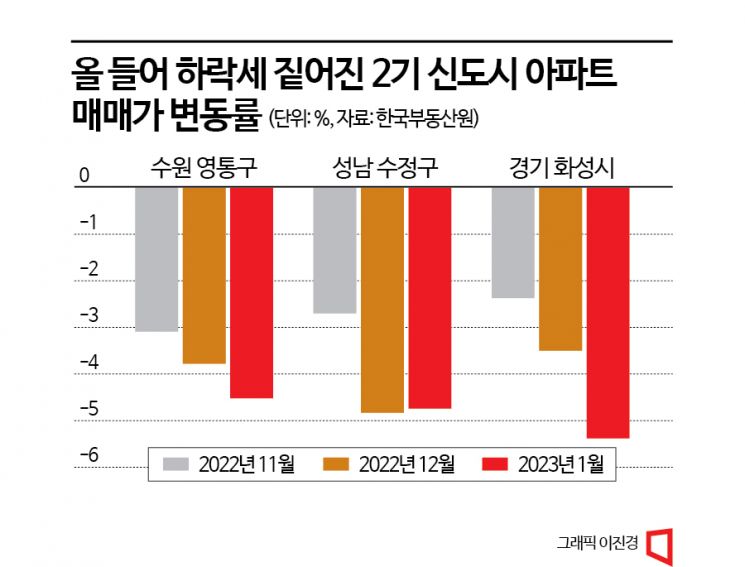

On the other hand, the weekly decline rate in areas including the 2nd phase new towns is increasing further. The apartment sale price decline rate in Hwaseong-si, Gyeonggi-do, where Dongtan New Town is located, recorded 1.01% at the end of last month, marking five consecutive weeks of over 1% decline. This trend is even more pronounced on a monthly basis. Last month, apartment sale prices in Hwaseong-si fell by 5.38%, deepening the decline compared to November (-2.37%) and December (-3.50%) of last year.

The decline is also increasing in other areas. In Yeongtong-gu, Suwon-si, Gyeonggi-do, where Gwanggyo New Town is located, the decline rate was -4.52% last month, deepening compared to November (-3.09%) and December (-3.78%) of last year. In Sujeong-gu, Seongnam-si, which includes part of Wirye New Town, the decline rates also increased, recording -2.70% in November, -4.83% in December, and -4.74% in January.

“If the price is the same, people buy in Seoul”…Jeonse price decline also a negative factor

This decline is analyzed to be due to weakened buying sentiment. A real estate expert explained, “The 2nd phase new towns such as Dongtan and Gwanggyo have abundant supply but limited demand,” adding, “Since the distance from Seoul is far, the proximity to workplaces is low, making them less attractive.” He added, “Although it has become easier to own a home through special mortgage loans like the Special Bogeumjari Loan, demand seems to be concentrated in Seoul if the price is the same.”

The decline in jeonse preference and the resulting fall in jeonse prices are also cited as major causes. Song Seung-hyun, CEO of City and Economy, said, “Previously, the 2nd phase new towns had abundant jeonse demand supporting prices,” adding, “Recently, due to consecutive interest rate hikes, the burden of financing has increased, leading to a decrease in jeonse prices and demand.”

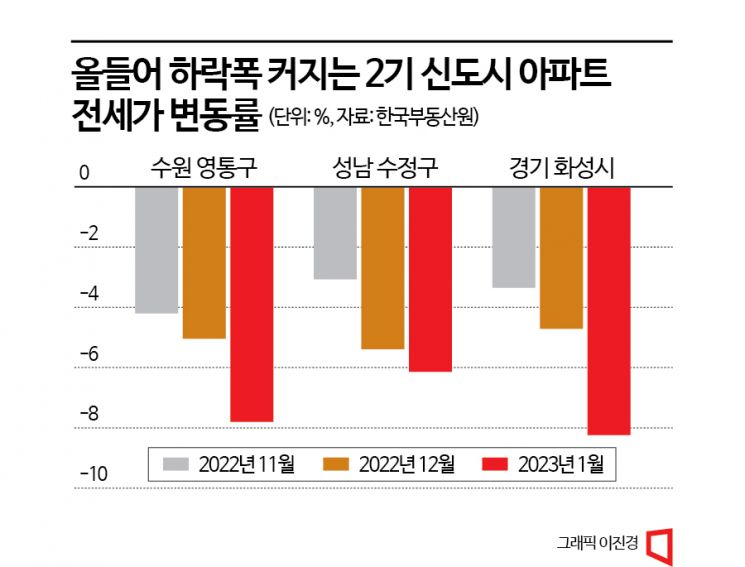

In fact, according to the Real Estate Board, the jeonse price decline rate in Hwaseong-si has been continuously increasing from -3.35% in November last year to -4.71% in December and -8.24% in January. In Yeongtong-gu, Suwon-si, the decline rates also increased from -4.20% in November to -5.04% in December and -7.80% in January. Sujeong-gu, Seongnam-si recorded -3.07%, -5.39%, and -6.14% during the same period, showing a continued plunge in jeonse prices.

Fatigue from rapid housing price rise remains…Observation continues amid gap between sellers and buyers

The gap between buyers' and sellers' price expectations also seems to be affecting the decline. The Korea Real Estate Board analyzed, “The gap between sellers' and buyers' desired prices has not narrowed, so the observation trend continues.” In fact, among homeowners, expectations that future interest rate hikes will be limited have formed, leading to more cases of holding onto high prices or withdrawing listings. On the other hand, buyers, burdened by increased financing costs due to interest rate hikes, try to buy at lower prices, resulting in transactions mainly focused on urgent sales.

Additionally, the reaction to the rapid rise in housing prices has also played a role. Song Seung-hyun, CEO of City and Economy, explained, “In new town areas such as Dongtan, Gwanggyo, and Wirye, housing prices have risen significantly, accumulating price fatigue among buyers,” adding, “Interest rate hikes and other factors are influencing the deepening decline in housing prices.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)