Impact of Increased Corporate Dividend Income

Avoiding Deficit Streak for Two Consecutive Months

Trade Balance Deficit for Three Consecutive Months

Last Year's Current Account Surplus of $29.83 Billion

Exceeds Bank of Korea's Forecast ($25 Billion)

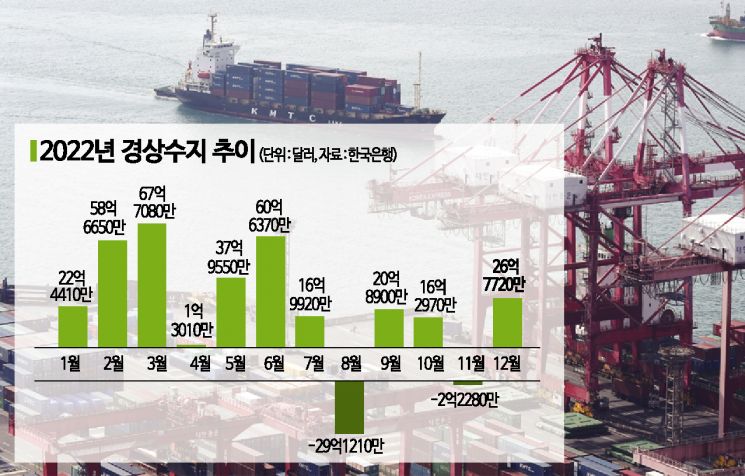

[Asia Economy Reporter Seo So-jeong] In December last year, the current account balance turned positive within a month, supported by an increase in dividend income from overseas local subsidiaries of domestic companies. Although the deficit streak for two consecutive months was narrowly avoided, the current account balance is showing an unstable trend as the goods balance decreased by as much as $4.91 billion compared to the same month last year due to a sharp decline in exports such as semiconductors amid the global economic slowdown, and the service balance also saw an expanded deficit.

According to the Bank of Korea's announcement on December's provisional international balance of payments on the 8th, the domestic current account recorded a surplus of $2.68 billion (approximately 3.3822 trillion KRW). This is $3.69 billion less than the $6.37 billion surplus recorded a year earlier. The goods balance shifted from a $4.43 billion surplus in the same month last year to a $480 million deficit.

The current account turned to a deficit in August last year (-$2.9121 billion), then recorded a surplus of $2.089 billion in September. It maintained a surplus for two consecutive months in October ($1.6297 billion), narrowly avoiding a deficit, but returned to a deficit in November (-$222.8 million) before turning positive again in December.

The cumulative current account surplus from January to December last year was $29.83 billion, narrowing the surplus by $55.4 billion compared to the same period the previous year.

By detailed items, the goods balance showed a deficit for three consecutive months, the first time since a 16-month deficit streak from January 1996. Exports amounted to $55.67 billion, down $6.47 billion (10.4%) from the same month last year. Exports declined for four consecutive months due to the global economic slowdown, mainly in semiconductors and steel products. In particular, semiconductors (customs basis -27.8%), steel products (-20.5%), and chemical products (-17.2%) underperformed. By region, exports to China (-27.1%), Southeast Asia (-23.7%), and Japan (-10.3%) contracted.

Imports ($56.15 billion) decreased by $1.56 billion (2.7%) compared to the same month last year. Imports declined for the first time in two years since December 2020, mainly due to reductions in capital goods and consumer goods. Raw material imports increased by 0.7% compared to the same month last year, while capital goods and consumer goods imports decreased by 6.4% and 4.9%, respectively. Among raw materials, the import amounts of gas and crude oil (customs basis) rose by 52.2% and 16.9%, respectively. Conversely, imports of petroleum products and chemical products decreased by 25.6% and 7.6%, respectively.

The service balance recorded a deficit of $1.39 billion as the surplus in transportation services shrank. The service balance deficit widened by $630 million compared to the same month last year. The transportation service surplus was $170 million, but the surplus shrank by $1.08 billion compared to a year earlier. This was influenced by the Shanghai Containerized Freight Index (SCFI) dropping 76.9% year-on-year in December last year. With the easing of COVID-19 restrictions, overseas travel surged, expanding the travel service deficit to $1.14 billion.

The primary income balance recorded a surplus of $4.79 billion, up $1.3 billion from December last year ($3.49 billion). Among the primary income balance, the dividend income surplus ($4.49 billion) increased by $1.7 billion over the year, reflecting increased dividend income received by domestic companies from overseas local subsidiaries.

The net financial account, which is assets minus liabilities, increased by $5.06 billion. In direct investment, domestic investors' overseas investment increased by $5.51 billion, and foreign investors' domestic investment increased by $2.48 billion. Domestic investors' overseas securities investment rose by $4.37 billion, marking an increase for two consecutive months following November last year. Overseas stock investments increased mainly in general government and other financial institutions (funds, etc.), and bond investments turned to an increase centered on the general government. Foreign investors' domestic securities investment decreased by $3.05 billion, marking a decline for the first time in six months since June last year. The increase in foreign investors' domestic stock investment narrowed due to concerns over continued tightening by major central banks, and bond investments decreased due to reduced arbitrage incentives.

Last year, the current account surplus recorded $29.83 billion, exceeding the Bank of Korea's forecast ($25 billion), but it was about one-third of the 2021 level ($85.23 billion). Kim Young-hwan, Deputy Director of the Economic Statistics Bureau at the Bank of Korea, said, "Last year, the rapid rise in raw material prices caused the import growth rate to exceed exports, sharply reducing the goods balance surplus and expanding the service balance deficit, significantly shrinking the current account surplus." He added, "However, considering the high level of energy prices, the slowdown in major countries' growth, and the contraction in the IT sector, the result is better than expected." Regarding future prospects, Deputy Director Kim emphasized, "Due to high uncertainty in external conditions such as energy import trends, major countries' economies, and IT industry recovery, it is difficult to predict monthly deficits or surpluses. Efforts to diversify export regions and items will be necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)