Prolia·Xgeva Ingredient 'Denosumab'

Patent Expiry in 2025... 7 Trillion KRW Annual Market

Developed Domestically by Epis, Celltrion, Huons, etc.

HK Innoen Acquires Overseas Biosimilar Rights

[Asia Economy Reporter Lee Chun-hee] As the patent for the active ingredient denosumab, a biopharmaceutical used for osteoporosis treatment, approaches expiration in 2025, domestic companies are continuing their efforts to dominate this market worth 7 trillion KRW through biosimilars (biopharmaceutical generics).

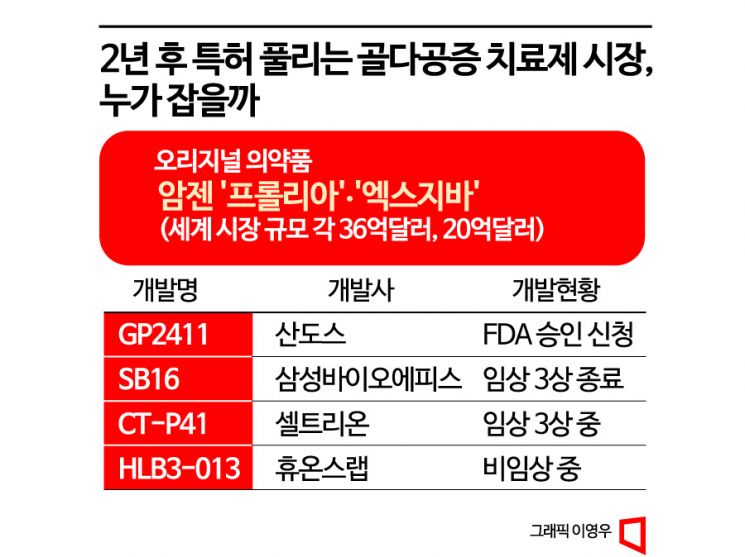

According to industry sources on the 8th, Huons Lab, a subsidiary of Huons Global, has targeted denosumab as its first biosimilar development candidate and is progressing with related development. Named 'HLB3-013' for this ingredient, it has confirmed equivalent efficacy to Prolia in preclinical animal efficacy tests. Experiments conducted on osteoporosis-induced model mice by an overseas clinical trial organization (CRO) confirmed equivalent osteoporosis inhibitory efficacy to Prolia across various factors.

Denosumab is a drug first developed by Amgen in 2010 that binds to the RANKL protein, which is essential for the survival and function of osteoclasts that destroy bone, thereby inhibiting the formation, function, and survival of osteoclasts to prevent bone destruction. Depending on the dosage, it is divided into 'Prolia' (60 mg), an osteoporosis treatment, and 'Xgeva' (120 mg), a treatment for preventing skeletal-related complications.

Last year, Prolia recorded sales of $3.628 billion (approximately 4.5785 trillion KRW), and Xgeva recorded $2.014 billion (approximately 2.5417 trillion KRW), creating a global market size of about 7 trillion KRW. In South Korea, since their launch in 2016, the combined annual market size of the two products has reached about 120 billion KRW. Pharmaceutical research firm Kotelis projected that the denosumab market will grow at an average annual rate of 5.6%, reaching a scale of 7.8 trillion KRW by next year.

Although it is a blockbuster drug, fierce development competition is underway as the global patent is set to expire in 2025. Moreover, since there are currently no denosumab biosimilars approved by regulatory agencies worldwide, the market is almost a no-man’s land, which further increases attention.

The frontrunner is Sandoz, the generics and biosimilars division separated from Novartis. Recently, after completing Phase 3 clinical trials of the biosimilar candidate 'GP2411' with the U.S. Food and Drug Administration (FDA), they submitted a Biologics License Application (BLA), making it highly likely to become the first approved biosimilar.

Domestically, Samsung Bioepis and Celltrion have also started development ahead of Huons Lab. Samsung Bioepis recently completed global Phase 3 clinical trials for 'SB16.' A Samsung Bioepis representative explained, "We have completed dosing for the last patient and are conducting final work to derive related results." Celltrion also received approval in 2021 for global Phase 3 clinical trials of 'CT-P41,' including in South Korea and Estonia, and is currently conducting related trials.

Some companies have quickly introduced overseas biosimilars under development. HK inno.N signed an exclusive domestic license agreement last month for two denosumab biosimilars under development by Spain’s Mapscience. Mapscience is also conducting Phase 3 clinical trials under the development name 'MB09.' Additionally, Alvotech is conducting Phase 3 clinical trials under the name 'AVT03,' indicating that the global competition to develop denosumab biosimilars is intensifying.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)